Introduction

For those who seek financial freedom and flexibility, options trading offers an unparalleled avenue of wealth creation. My first encounter with this dynamic world, back in 2011 during the infamous financial crisis, ignited a fire within me—a profound appreciation for the power of options to mitigate risk and multiply profits. Through a rigorous journey of exploration, I have delved into the intricacies of this multifaceted strategy, honing my skills and unlocking its enormous potential. Join me as I guide you through the labyrinth of options trading, unraveling the art of turning volatility into an ally.

Image: o3schools.com

Understanding Options Contracts: The Foundation

Options, in their essence, are derivative financial instruments that bestow upon their owners the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specified date. This fundamental principle unlocks myriad opportunities, empowering traders to tailor strategies that align seamlessly with their financial objectives and risk tolerance.

The building blocks of an option contract encompass the following key attributes:

- Underlying Asset: The underlying asset refers to the security or instrument upon which the option is based, such as a stock, index, commodity, or currency.

- Strike Price: The strike price represents the predetermined price at which an option holder can buy (in the case of a call option) or sell (in the case of a put option) the underlying asset.

- Expiration Date: The expiration date marks the final day on which an option can be exercised. Options can expire weekly, monthly, or quarterly, providing traders with a range of time frames to execute their strategies.

Options Types: Call and Put Options

The landscape of options trading encompasses two primary types of contracts:

- Call Options: Call options grant holders the right to buy the underlying asset at the strike price on or before the expiration date. For a call option to be considered “in-the-money,” the underlying asset’s price must be higher than the strike price.

- Put Options: Put options, on the other hand, bestow upon holders the right to sell the underlying asset at the strike price on or before the expiration date. A put option is said to be “in-the-money” when the underlying asset’s price falls below the strike price.

The Allure of Options Trading: Opportunity and Flexibility

For seasoned investors and novice traders alike, options trading offers an enticing array of benefits:

- Leverage: Options provide substantial leverage, allowing traders to control large positions with limited capital.

- Risk Management: Options enable precise risk management by allowing traders to hedge against potential losses and limit downside exposure.

- Income Generation: Options offer versatile strategies for generating income, such as selling premium through option writing and profiting from the decay of time value.

- Flexibility: Options provide unparalleled flexibility, empowering traders to customize strategies based on their market outlook, time horizon, and risk tolerance.

Image: o3schools.com

Mastering Options Trading: Tips and Expert Advice

To navigate the options market with confidence, consider the following tips:

- Thoroughly Research and Understand the Underlying Asset: Gain deep knowledge of the underlying asset’s price behavior, market trends, and industry dynamics.

- Set Realistic Trading Goals and Objectives: Determine your financial goals, risk tolerance, and time horizon before entering trades.

- Utilize Technical and Fundamental Analysis: Employ a comprehensive approach to market analysis, leveraging technical indicators alongside fundamental data.

- Risk Management is Paramount: Always prioritize risk management by setting stop-loss orders and position sizing appropriately.

- Seek Educational Resources and Mentorship: Engage in ongoing learning through books, online courses, and the guidance of experienced mentors.

Frequently Asked Questions (FAQs) on Options Trading

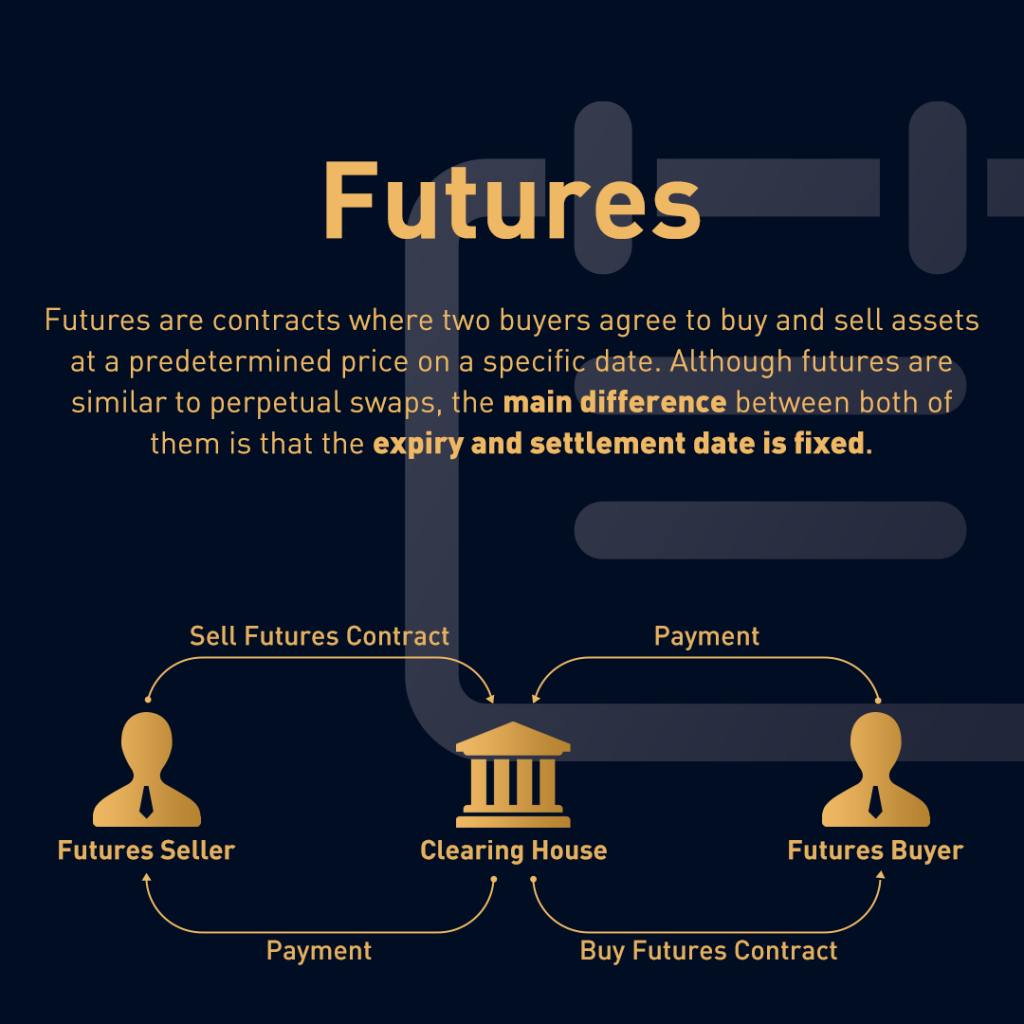

Q1: What is the difference between an option and a future?

A1: Options provide the right but not the obligation to buy or sell an asset, while futures contracts obligate the holder to buy or sell the underlying asset at a future date.

Q2: Which type of option is suitable for a bullish market outlook?

A2: In a bullish market, call options are favored as they allow holders to profit from price appreciation in the underlying asset.

Q3: Can options be traded for a short period?

A3: Yes, options can be traded for short periods, such as day trading, enabling traders to capitalize on intraday price fluctuations.

Q4: How can I minimize risk in options trading?

A4: Employing risk management strategies such as setting stop-loss orders, diversifying your portfolio, and understanding the Greeks can mitigate risk.

Q5: What is the “Greeks” in options trading?

A5: The Greeks are a set of metrics that measure the risk and sensitivity of options contracts to various factors.

Options Trading Options Contracts

Image: invatatiafaceri.ro

Conclusion: Embracing the World of Options Trading

As you delve into the fascinating world of options trading, remember that knowledge, discipline, and a dedication to continuous learning will serve as your compass. Whether you seek financial empowerment or the thrill of outwitting markets, the vast landscape of options trading beckons you to explore its boundless possibilities.

Consider the potential that lies within this dynamic realm and ask yourself: Are you ready to harness the power of options and sculpt your financial future?