Introduction:

In the vibrant tapestry of financial markets, option trading market makers stand as astute and pivotal figures. As conductors of this dynamic symphony, they orchestrate the delicate balance between supply and demand, ensuring seamless execution and liquidity in the complex realm of options. They wield the power to shape market prices, manage risk, and ultimately facilitate the transfer of wealth between buyers and sellers. Embarking on this deep dive, we unravel the intricacies of option trading market makers, deciphering their role, strategies, and impact on the financial landscape.

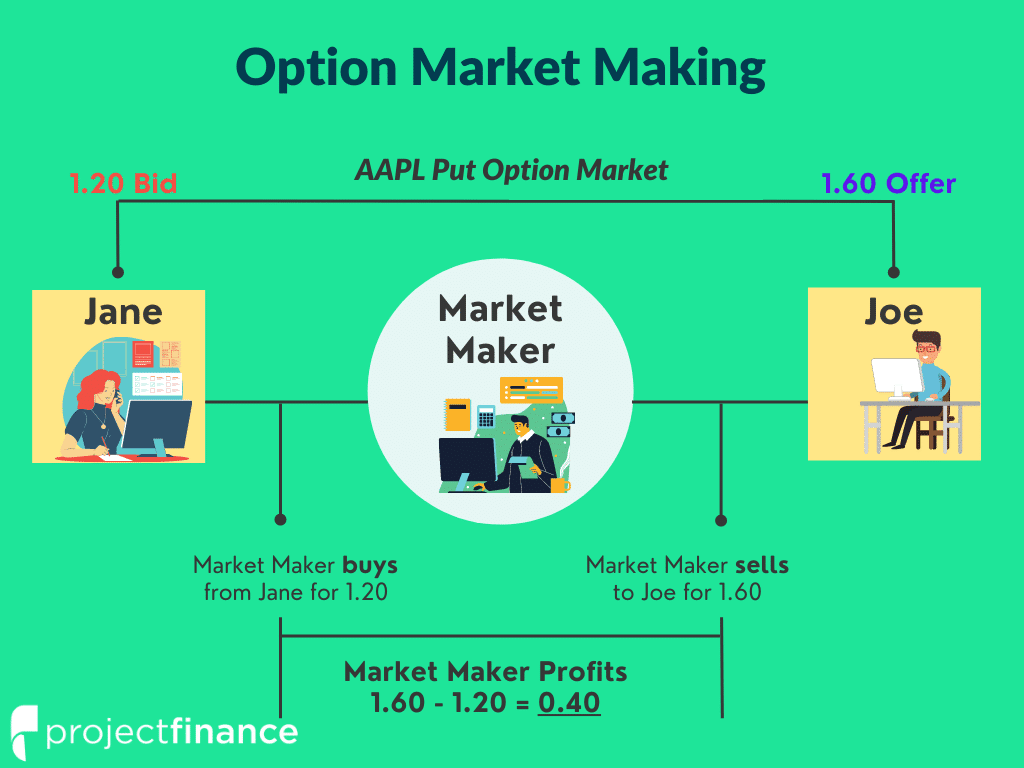

Image: www.projectfinance.com

Understanding Option Trading Market Makers:

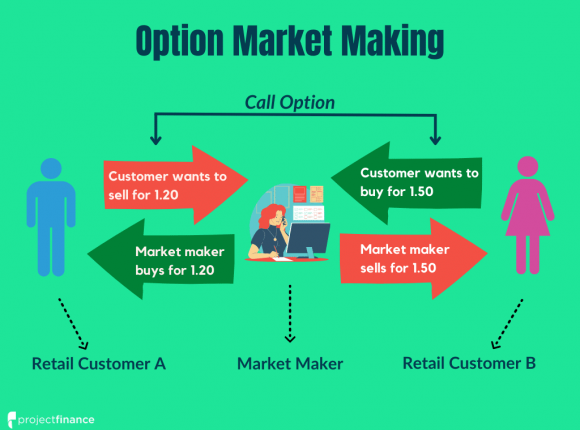

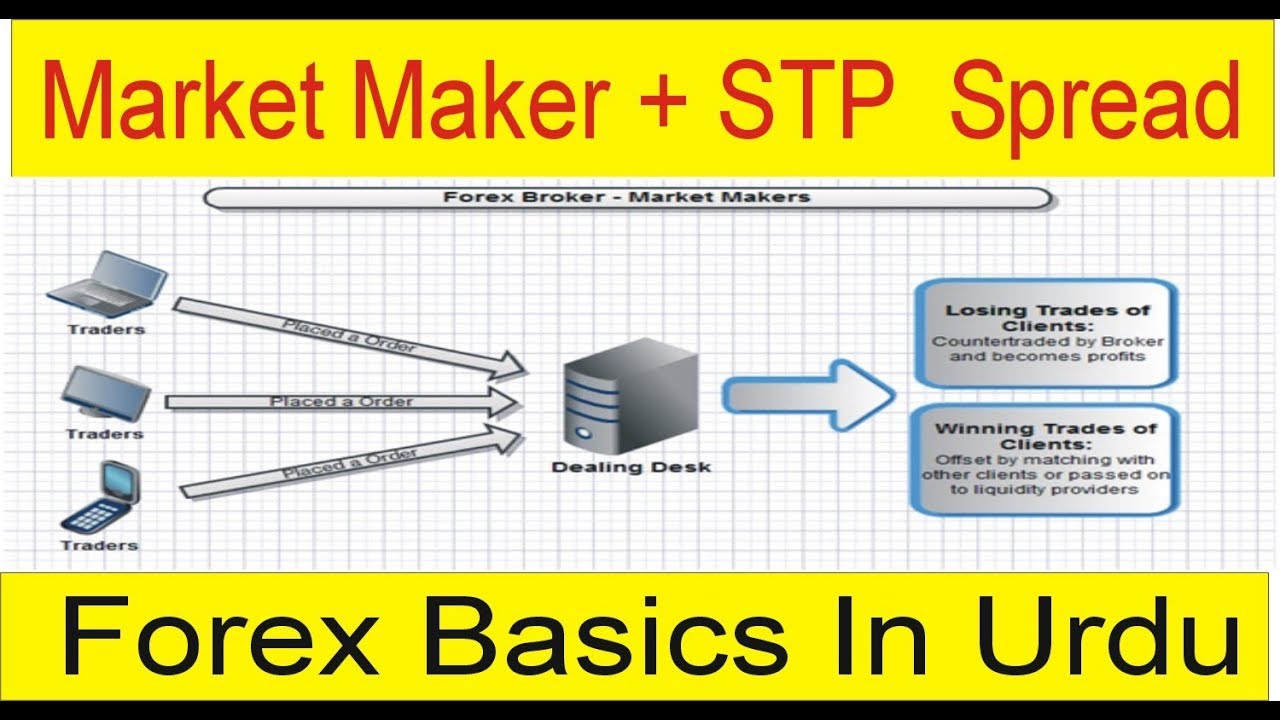

Option trading market makers are specialized firms or individuals who continuously quote both buy and sell prices for options contracts, thereby creating a liquid and efficient market for these derivatives. Unlike traditional brokers who act as intermediaries between buyers and sellers, market makers actively trade on their own account, assuming both the risks and rewards of the underlying asset. By providing continuous liquidity, they enable investors to swiftly buy or sell options without the need for a matching counterparty.

Historical Roots and Evolution:

The origins of option trading market making can be traced back to the bustling trading floors of the past, where traders manually matched buy and sell orders. As financial markets evolved, so too did the role of market makers. Technological advancements and electronic trading platforms propelled the industry forward, empowering market makers with sophisticated algorithms and real-time data analysis capabilities. Today, they operate primarily in the digital realm, leveraging cutting-edge technology to quote prices and manage risk.

Foundational Concepts:

To grasp the essence of option trading market making, it’s essential to comprehend the underlying concepts. Options are financial contracts that bestow upon the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. Market makers quote prices for both call options, which confer the right to buy, and put options, which provide the right to sell. These quotes are influenced by various factors, including the underlying asset’s price, volatility, time to expiration, and interest rates.

Image: www.projectfinance.com

Unveiling Market Making Strategies:

Option trading market makers employ a diverse array of strategies to generate profits and manage risk. Among the most common approaches are:

1. Delta Neutral Trading:

This strategy involves the simultaneous purchase and sale of options with offsetting deltas. By structuring positions in this manner, market makers reduce their exposure to price movements in the underlying asset, aiming to capture the premium decay as options approach expiration.

2. Volatility Trading:

Market makers may capitalize on market volatility by trading options with short durations and high implied volatility. They endeavor to buy (sell) options when implied volatility is low (high) and sell (buy) when implied volatility rises (falls).

3. Basis Trading:

This strategy exploits the difference between the implied volatility of an option and the realized volatility of the underlying asset. Market makers purchase (sell) options with low (high) implied volatility relative to realized volatility and vice versa.

The Impact of Market Makers:

Option trading market makers have a profound impact on the health and efficiency of financial markets. They provide liquidity, which enables investors to enter and exit positions quickly and efficiently, reducing transaction costs and enhancing overall market stability. Furthermore, market makers play a crucial role in price discovery, ensuring that option prices accurately reflect the market’s assessment of risk and reward.

The Benefits and Challenges:

Market makers reap the rewards of the trading profits they generate, while simultaneously assuming substantial risks. They must carefully navigate a myriad of potential pitfalls, including adverse price movements in the underlying asset, volatility spikes, and trading restrictions. To succeed in this competitive landscape, they require a deep understanding of options pricing models, risk management techniques, and market dynamics.

Expert Insights:

Gaining insights from industry experts can illuminate the path to successful option trading market making. They emphasize the importance of:

1. Risk Management:

Market makers must prioritize risk management to safeguard their capital. This entails employing robust position-sizing strategies, implementing stop-loss orders, and utilizing sophisticated risk-monitoring systems.

2. Market Understanding:

A comprehensive understanding of the market is paramount for market makers. They must constantly monitor economic indicators, analyze the underlying assets, and anticipate potential market movements.

3. Technological Prowess:

Harnessing the power of technology is crucial for market makers. Advanced trading platforms, historical data analysis tools, and real-time pricing feeds are indispensable for effective market making.

Actionable Tips:

For those aspiring to become option trading market makers, these tips can serve as a valuable guide:

1. Education and Training:

Acquire a solid foundation in financial theory, options pricing models, and risk management principles. Consider formal training programs or industry certifications.

2. Practical Experience:

Seek opportunities to gain hands-on experience in option trading and market making. Simulator accounts and internships can provide a valuable training ground.

3. Networking and Collaboration:

Establish connections with experienced market makers and industry professionals. Attend industry events and participate in online forums to expand your knowledge and build partnerships.

Option Trading Market Maker

Image: forexfundamentalstrategiespdf.blogspot.com

Conclusion:

Option trading market makers stand as indispensable figures in the financial markets, orchestrating the seamless flow of option contracts and providing liquidity to investors. Their astute strategies and expert navigation of risk empower them to profit from market imbalances while contributing to the stability and efficiency of the broader market ecosystem. As we venture into the future, technological advancements and evolving market dynamics promise to shape the landscape of option trading market making, presenting both challenges and opportunities for those agile enough to adapt and innovate. By understanding their role, strategies, and impact, we gain deeper insights into the intricate tapestry of financial markets.