Introduction

Image: criptotrader.pro

In today’s rapidly evolving financial landscape, options trading has emerged as a captivating realm where savvy investors seek to amplify their returns while managing risk. The rise of user-friendly platforms like Public App has made this sophisticated investment strategy accessible to a broader audience. This article will delve into the intricacies of options trading on Public App, equipping you with the knowledge and confidence to navigate this exciting financial arena.

Options, financial instruments derived from underlying assets, offer investors the flexibility to leverage market movements in both directions. Whether you’re anticipating a stock’s rise or decline, options provide an avenue to capitalize on your predictions. However, with increased potential rewards come heightened risks, making it paramount to approach options trading with a thorough understanding of its mechanics.

Understanding the Basics of Options

An option contract grants the buyer the right, not the obligation, to buy (in the case of “call” options) or sell (with “put” options) a specific number of shares of an underlying asset at a predetermined price (the “strike price”) on or before a certain date (the “expiration date”). The underlying asset can be a stock, index, commodity, or other financial instrument.

Options are classified into two main categories: “in the money” and “out of the money.” An option is deemed “in the money” when it has intrinsic value, meaning its exercise price is below the underlying asset’s current market price for call options or above it for put options. Conversely, options with no intrinsic value are considered “out of the money.”

Option contracts are priced based on a combination of factors, including the asset’s volatility, strike price, time to expiration, and dividend yields. The price of an option represents the “premium” that the buyer agrees to pay to acquire the right to exercise the option.

Options Trading on Public App

Public App offers a streamlined and intuitive interface for options trading. The platform’s mobile-first design simplifies the option selection and order placement process, making it accessible to investors of all experience levels.

To initiate an options trade on Public, navigate to the “Trade” section of the app and select “Options.” From there, you can choose the underlying asset, option type (call or put), strike price, and expiration date. The app will display the option premium and provide real-time updates on the contract’s performance.

One key feature of Public App is its “theme investing” approach, which allows investors to create customizable portfolios based on various market themes or trends. This enables users to diversify their options investments and potentially mitigate risk.

Strategies for Options Trading

Options trading strategies can be tailored to align with an investor’s risk tolerance and financial goals. Some common strategies include:

- Long Call: Buying a call option in anticipation of the underlying asset’s price rising above the strike price before expiration.

- Long Put: Purchasing a put option when the investor believes the underlying asset’s price will decline below the strike price by the expiration date.

- Covered Call: Selling (writing) a call option against an existing position in the underlying asset to generate additional income while limiting potential upside.

- Short Put: Selling a put option when the investor expects the underlying asset’s price to remain above the strike price or rise, potentially resulting in a profit if the price stays above the strike price at expiration.

Risks and Considerations

While options trading offers the potential for significant returns, it also comes with inherent risks that investors must carefully consider before initiating any trades:

- Time Decay: Options gradually lose their value as the expiration date approaches, regardless of whether the underlying asset’s price moves favorably or not.

- Volatility Risk: Options prices are highly sensitive to changes in the underlying asset’s volatility, which can lead to substantial gains or losses depending on market conditions.

- Assignment Risk: Selling (writing) options can potentially obligate the investor to buy or sell the underlying asset at the strike price, regardless of the market conditions.

Conclusion

Options trading on Public App can be an effective way to enhance returns and manage risk, but it requires a thorough understanding of the mechanics involved and a clear assessment of the associated risks. By approaching options trading with knowledge, caution, and a well-defined strategy, investors can harness the potential of this sophisticated investment tool.

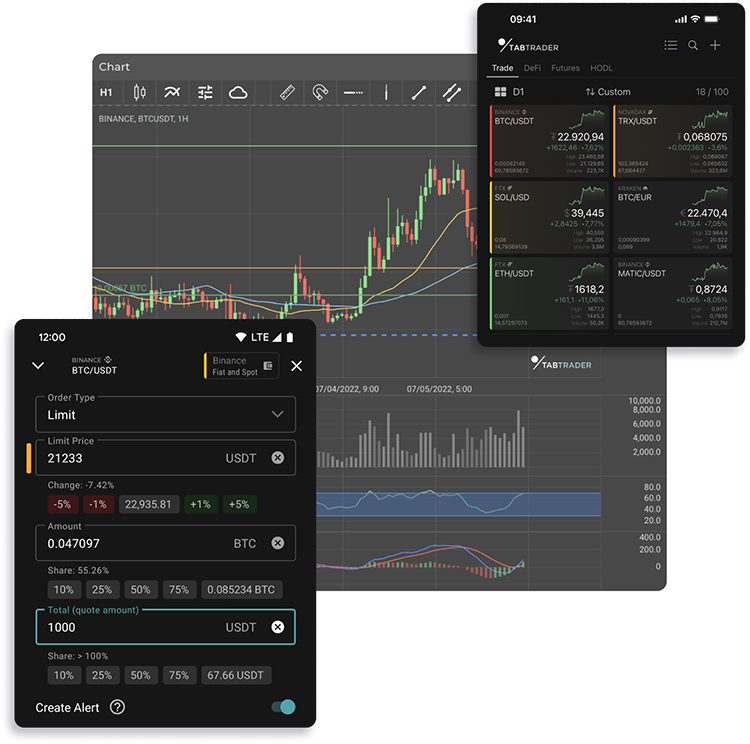

Image: tabtrader.com

Options Trading On Public App

Image: theonlinejobs.in