Options trading, an alluring yet complex realm in the crypto sphere, offers a lucrative opportunity for savvy investors seeking to maximize their gains. Much like the roller coaster of emotions experienced when trading cryptocurrencies, options trading adds another dimension of excitement, expanding the possibilities for both rewards and risks.

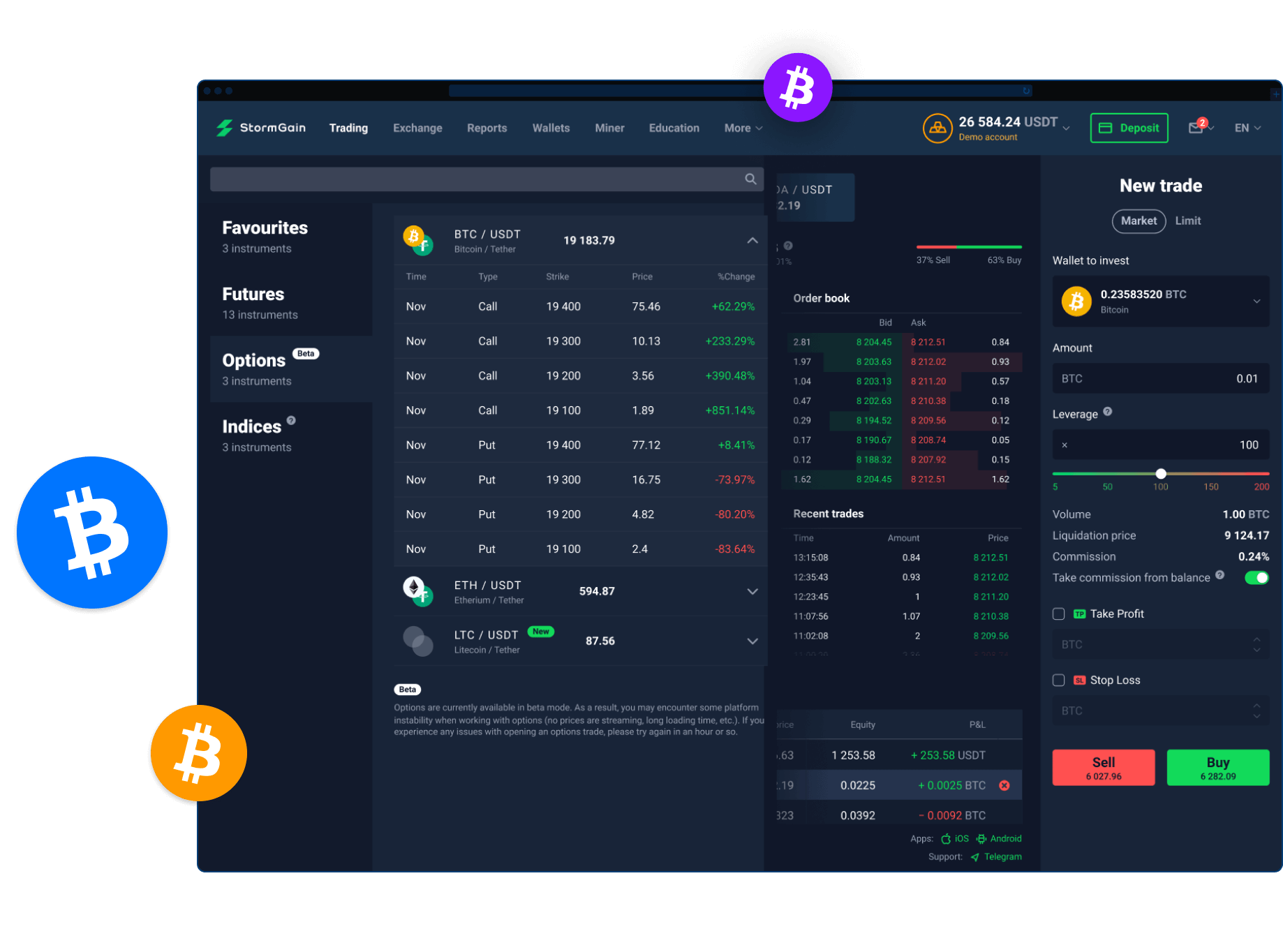

Image: stormgain.com

Conceptualizing Options Trading in Crypto:

Options trading involves a contract that grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) until a specific expiration date. Crypto options allow traders to speculate on the future price movement of cryptocurrencies like Bitcoin or Ethereum, enabling them to profit from price fluctuations without direct ownership of the underlying asset.

Unveiling the Benefits and Risks:

Embarking on options trading on crypto presents traders with a myriad of benefits. Enhanced leverage with limited upfront capital investment, amplified profit potential, and the ability to mitigate risks through hedging strategies allure traders seeking financial gain. However, the substantial risks inherent in cryptocurrency markets, coupled with the complex nature of options contracts, demand a high level of understanding and risk tolerance. Careful consideration of market dynamics, risk management techniques, and trading strategies is paramount to navigate this volatile landscape successfully.

Mastering the Mechanics:

Understanding the intricacies of options trading is the cornerstone of successful participation. A call option grants the buyer the right to purchase the underlying crypto asset at the strike price before its expiration. Conversely, a put option grants the right to sell the asset at the strike price. The premium paid by the buyer to the seller represents the cost of this option contract. Executing profitable trades hinges on a comprehensive understanding of options pricing, influenced by various factors such as volatility, time to expiration, and the underlying asset’s price.

Navigating the Legal Maze:

Venturing into options trading on crypto necessitates an understanding of the regulatory landscape surrounding crypto assets. The classification of cryptocurrencies as securities or commodities varies across jurisdictions, resulting in diverse regulatory frameworks. Traders must be mindful of applicable laws, reporting requirements, and any restrictions imposed by their local jurisdiction to avoid legal pitfalls.

Finding a Trustworthy Exchange:

Selecting a reputable crypto exchange that offers options trading is crucial for secure and reliable transactions. Thorough research, examining factors such as exchange fees, trading volume, security measures, and customer support, ensures traders choose a platform that aligns with their trading needs and preferences.

Embracing Education and Practice:

Exceeding in options trading on crypto demands an ongoing pursuit of knowledge. Exploring educational resources, engaging in practice trading through demo accounts, and seeking guidance from experienced traders pave the way for building a solid foundation. The ever-changing nature of crypto markets necessitates continuous learning and adaptation to evolving conditions.

Understanding Trading Strategies:

Options trading encompasses a wide array of trading strategies, each tailored to specific market conditions and risk-reward profiles. By devising a trading plan and employing appropriate risk management techniques, traders can position themselves to capitalize on favorable market conditions and minimize potential losses. Leverage conservative strategies, stay abreast of market trends, and stay disciplined in trade execution to increase the probability of successful outcomes.

Conclusion:

The adrenaline-pumping world of options trading on crypto unveils a spectrum of possibilities for those seeking to amplify their financial gains. While the intricacies of options contracts and the inherent volatility of crypto markets pose challenges, the potential rewards are substantial. Traders equipped with a deep understanding of trading mechanisms, risk management, and market analysis can harness the power of options to navigate the crypto landscape like seasoned navigators. Remember, options trading is not for the faint of heart, and careful consideration of risks and rewards is paramount. With knowledge as your compass and strategy as your guide, embark on this adventure and explore the thrilling realms of options trading in the crypto universe.

Image: www.peerthroughmedia.com

Options Trading On Crypto

Image: blog.bit.com