The pork industry is a bustling hub of global trade, and with its inherent volatility comes a wealth of opportunities for savvy investors and traders. Pork options, which grant the right but not the obligation to buy or sell pork at a predetermined price, have emerged as a fascinating tool for managing risk and potentially reaping profits in this dynamic market. By delving into the complexities of pork option trading, discerning individuals can harness its potential for financial success.

Image: porkcheckoff.org

A Gateway to Risk Mitigation and Profit-Seeking

Pork options offer investors a double-edged sword, providing a strategic shield against adverse market fluctuations while simultaneously presenting avenues for potential gains. With a depth of understanding and a keen eye, traders can navigate the ever-evolving pork landscape, mitigating risks associated with price fluctuations and exploiting market inefficiencies for profitable returns. However, it is imperative to recognize that option trading, like any investment endeavor, carries inherent risks and requires a comprehensive grasp of market dynamics and risk management strategies.

Unveiling the Anatomy of Pork Options

At the heart of pork option trading lies a meticulous understanding of its constituent parts. Each option contract represents a set quantity of pork, typically standardized at 40,000 pounds, tradable on designated exchanges. Options come in two primary flavors: calls, offering the right (but not the obligation) to purchase pork at a specified price, and puts, granting the right (but not the obligation) to sell pork at a specified price.

To fully grasp the mechanics of pork options trading, it is essential to comprehend the concepts of strike price and expiration date. The strike price, which could be either above or below the current market price, signifies the predetermined price at which the underlying pork can be bought (in case of call options) or sold (for put options). The expiration date, on the other hand, marks the specific date upon which the option contract expires, after which it becomes worthless.

Decoding Market Dynamics: Key Factors Influencing Pork Prices

The intricate web of factors that influence pork prices demands careful scrutiny for successful pork option trading. Supply and demand, driven by factors such as consumer preferences, export markets, and production costs, play a pivotal role in determining price movements. External forces, including weather conditions, disease outbreaks, and political events, can also exert significant influence on pork prices, amplifying the importance of staying abreast of market news and trends.

Image: comparebrokers.co

Unlocking the Power of Pork Option Strategies: A Trader’s Arsenal

The world of pork option trading encompasses a diverse array of strategies, each tailored to specific risk profiles and market conditions. Some popular strategies include long calls and long puts, suitable for bullish and bearish market outlooks respectively; covered calls, seeking to enhance returns on existing pork holdings; and protective puts, designed to safeguard against unexpected price declines. By harmonizing these strategies with a comprehensive understanding of market dynamics, traders can customize their approach to align with individual goals and risk tolerance.

Pricing Pork Options: A Symphony of Variables

Pricing pork options is an intricate art form, influenced by a symphony of variables. The underlying pork price, strike price, expiration date, and implied volatility all intricately intertwine to determine an option’s market value. Implied volatility, often considered the market’s expectation of future price fluctuations, plays a significant role in shaping option prices.

Hedging Strategies: Mitigating Market Risks with Surgical Precision

Hedging strategies stand as powerful tools in the arsenal of pork producers looking to safeguard against price fluctuations. By employing put options, producers can establish a guaranteed minimum price for their future production, shielding themselves from potential market downturns. Conversely, call options empower producers to lock in a maximum selling price, protecting against unforeseen market rallies.

Speculating on Pork Price Movements: Riding the Waves of Market Volatility

For those with a keen understanding of market dynamics and a thirst for potential returns, speculating on pork price movements using options can be a captivating endeavor. By making calculated bets on the direction of future prices, traders can potentially capitalize on market fluctuations. However, it is prudent to emphasize that speculation carries inherent risks, and venturing into such strategies demands a thorough grasp of market dynamics and risk management techniques.

Harvesting Profits and Managing Risks: Mastering the Exit

As with any investment, executing strategic exits is crucial in pork option trading. Monitoring market conditions, tracking option values, and understanding the performance of underlying pork prices are essential for maximizing returns while minimizing losses. Timely exits, whether through exercising, selling, or allowing the option to expire worthless, can significantly impact the overall outcome of any trading endeavor.

Embracing the Educational Journey: A Path to Knowledge and Empowerment

Navigating the complexities of pork option trading necessitates an unwavering commitment to education and continuous learning. Delving into industry reports, attending seminars, consulting financial advisors, and delving into online resources are all valuable avenues for expanding knowledge and enhancing trading acumen. Education is the key that unlocks the door to informed decision-making and empowers traders to make prudent choices in this dynamic market.

Trading Pork Options

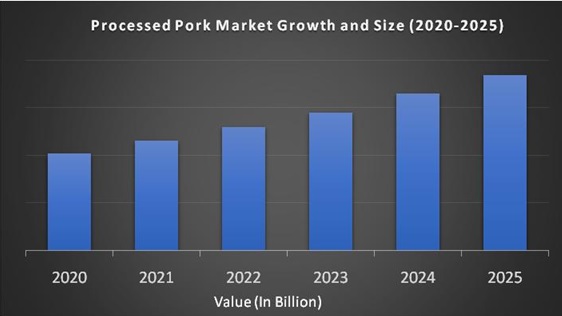

Image: www.marketdataforecast.com

Conclusion: A Gateway to Informed Decisions and Market Success

Pork option trading presents a fascinating opportunity for investors and traders to navigate the volatile pork market, mitigate risks, and potentially capture profits. By understanding the intricate details of pork options, deciphering market dynamics, and mastering strategic trading approaches, individuals can harness the power of this financial instrument for their own benefit. However, it is imperative to proceed with a measured approach, armed with a deep understanding of the risks involved and a commitment to continuous learning. Those who embrace education and tread cautiously can unlock the potential of pork option trading, emerging as informed and empowered market participants.