The financial landscape has evolved with the advent of options trading, introducing unparalleled opportunities for individuals seeking exceptional returns and mitigating potential risks. Options, as derivatives of underlying assets, empower investors with immense flexibility and the ability to tailor their positions to specific market conditions. Understanding this robust trading mechanism unlocks the gateway to informed decision-making and the pursuit of financial prosperity.

Image: tradingplatforms.com

Delving into the Essence of Options

Options trading entails the exchange of contracts that provide buyers and sellers with the option, but not the obligation, to execute a transaction involving an underlying asset at a predetermined price on or before a specified date. This unique characteristic distinguishes options from futures contracts, which mandate the execution of the transaction. The underlying assets subject to options trading encompass a vast array of financial instruments, including stocks, bonds, commodities, and indices, catering to diverse investment objectives.

Embracing the Dual Roles of Options: Speculation and Hedging

Options trading presents a versatile tool, effectively serving both speculative and hedging purposes. Speculators leverage options to capitalize on their market forecasts, seeking substantial profits through predicting price movements. In contrast, hedgers utilize options as a protective measure, safeguarding their portfolios from potential downturns and minimizing financial exposure to fluctuations in the underlying asset’s value.

Navigating the Options Terminology

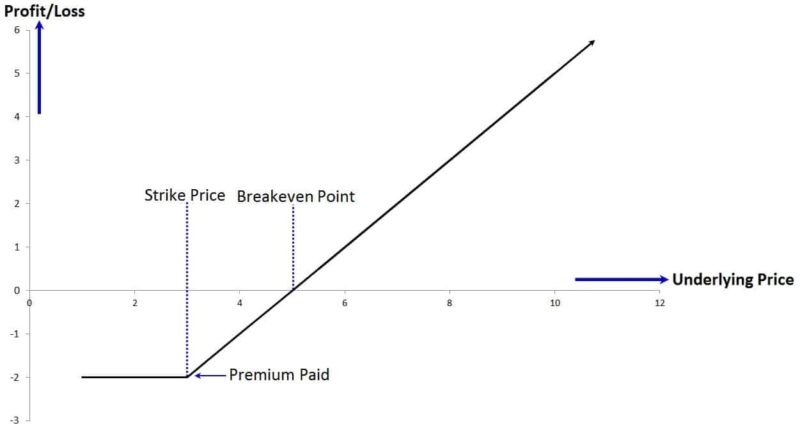

To venture into the realm of options trading, a firm grasp of essential terminology is paramount. A “call option” grants the buyer the right to purchase the underlying asset at the predetermined “strike price” before or on the “expiration date.” Conversely, a “put option” bestows upon the buyer the right to sell the underlying asset at the strike price. Understanding these fundamental concepts forms the cornerstone for successful options trading endeavors.

Image: www.tradethetechnicals.com

Market Mechanics: Understanding the Dynamics of Options Trading

The value of options is intricately linked to the underlying asset’s price, the time remaining until expiration, the volatility of the asset, and the prevailing interest rates. Options premiums, representing the amount paid by the buyer to acquire the option contract, fluctuate based on these variables. Comprehending the factors influencing option prices is pivotal for informed decision-making and optimizing trading strategies.

Strategies for Success: Uncovering Options Trading Techniques

Options trading encompasses a myriad of strategies, each tailored to specific market conditions and risk profiles. The “covered call” strategy, as an illustration, entails selling a call option while owning the underlying asset. This approach is often employed to generate income through option premiums while retaining the potential for upside appreciation in the underlying asset. Conversely, the “protective put” strategy involves buying a put option to safeguard against a potential decline in the value of the underlying asset.

The Allure of Options: Unleashing the Advantages

The allure of options trading lies in its inherent leverage, enabling investors to control a substantial amount of the underlying asset with a relatively small investment. Additionally, options offer exceptional flexibility, empowering traders to tailor their positions to align with their unique risk tolerance and market outlook. The potential for both substantial profits and effective risk management further contribute to the enduring appeal of options trading.

Charting the Course: Analyzing Options Trading Charts

Technical analysis plays a pivotal role in options trading, providing valuable insights into price patterns and potential market trends. By interpreting price charts and identifying technical indicators, traders can enhance their decision-making process and optimize their trading strategies. Understanding chart patterns, such as moving averages and support and resistance levels, empowers traders with a deeper comprehension of market dynamics and the ability to anticipate price movements.

Embracing the Risks: Navigating Options Trading Pitfalls

While options trading presents immense opportunities, it is imperative to acknowledge the inherent risks involved. Unforeseen market movements can result in substantial losses, particularly for inexperienced traders. Options trading requires a thorough understanding of the underlying asset, market dynamics, and the potential risks associated with each strategy. It is prudent for aspiring traders to seek professional guidance and gain experience through paper trading or simulated environments before venturing into live markets.

The Path to Options Trading Mastery: Unlocking Education and Experience

Mastering the art of options trading hinges upon continuous education and practical experience. Delving into reputable books, attending workshops, and engaging in online courses provides a solid foundation for knowledge acquisition. Simultaneously, honing one’s skills through simulated trading environments or under the mentorship of seasoned traders accelerates the learning process. It is through this concerted effort of theoretical understanding and practical application that traders refine their strategies and cultivate the acumen to navigate the complexities of options trading with confidence.

Options Trading Nedir

Image: www.asktraders.com

Conclusion: Options Trading – A Gateway to Financial Empowerment

Options trading, with its inherent leverage, flexibility, and potential for both substantial profits and effective risk management, has become an indispensable tool in the financial arsenal of astute investors. By embracing a thorough understanding of options terminology, market mechanics, and trading strategies, individuals can unlock the power of this versatile instrument. Embracing the transformative potential of options trading empowers investors to transcend the limitations of traditional investment approaches and embark on a journey towards financial empowerment.