In the fast-paced and adrenaline-fueled world of day trading, the allure of high returns beckons. But venturing into this realm demands a deep understanding of the risks involved, particularly when leveraging margin call options.

Image: ronoxivipyr.web.fc2.com

What are Day Trading Margin Call Options?

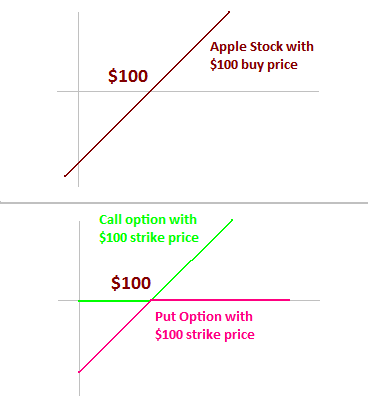

Margin call options are essentially loans from a brokerage firm that allow traders to amplify their buying power. By borrowing against the value of their existing holdings, they can trade with a larger amount of capital than they otherwise could. While this strategy offers the potential for substantial gains, it also magnifies potential losses.

When a Margin Call Occurs

When a trader’s account balance dips below a certain threshold set by the brokerage firm, a margin call is triggered. This means the trader must either deposit additional funds or liquidate some of their positions to meet the required equity ratio. Failure to do so can result in forced liquidation of the trader’s entire portfolio.

Risks and Rewards of Margin Call Options

While margin call options can enhance profitability, they also amplify the risks associated with day trading:

- Increased Volatility: Using margin amplifies both gains and losses, so even small market fluctuations can have a significant impact on your account balance.

- High Pressure: The threat of a margin call can create immense psychological pressure, leading to poor decision-making.

- Forced Liquidation: Non-compliance with margin calls can result in forced liquidation, potentially wiping out your entire investment.

Expert Insights on Managing Risk

To navigate the intricacies of day trading with margin call options, experienced traders emphasize the following strategies:

- Adequate Capitalization: Start with a sufficient amount of capital to absorb potential losses and avoid triggering margin calls.

- Conservative Leverage: Begin with a modest amount of leverage and gradually increase it as you gain experience and confidence.

- Stop-Loss Orders: Implement stop-loss orders to mitigate losses by automatically selling positions when they fall below a predefined threshold.

- Emotional Discipline: Control your emotions and avoid making impulsive decisions under stress.

A Cautionary Tale

The tale of the infamous “Black Monday” in October 1987 serves as a cautionary reminder of the potential dangers of margin trading. Overleveraged traders found themselves trapped in a downward spiral of margin calls, leading to a devastating market crash.

Conclusion

Day trading with margin call options can be a double-edged sword. While it offers the chance for higher rewards, it also amplifies the risks involved. By thoroughly understanding the risks, implementing sound trading strategies, and practicing emotional discipline, traders can navigate this volatile market and potentially reap its benefits without succumbing to its pitfalls.

Image: fxaccess.com

Day Trading Margin Call Options

Image: www.berotak.com