Unleashing the Power of Options for Stable Market Conditions

The world of options trading offers a broad spectrum of strategies, each tailored to specific market conditions. One such strategy, particularly apt for periods of low implied volatility, centers around trading **low implied volatility (IV) options++. When IV retreats to subdued levels, options premiums tend to shrink, presenting an opportunity to capitalize on calculated price movements. This article delves into the intricacies of low IV options trading, exploring its нюансы and offering expert advice to enhance your trading acumen.

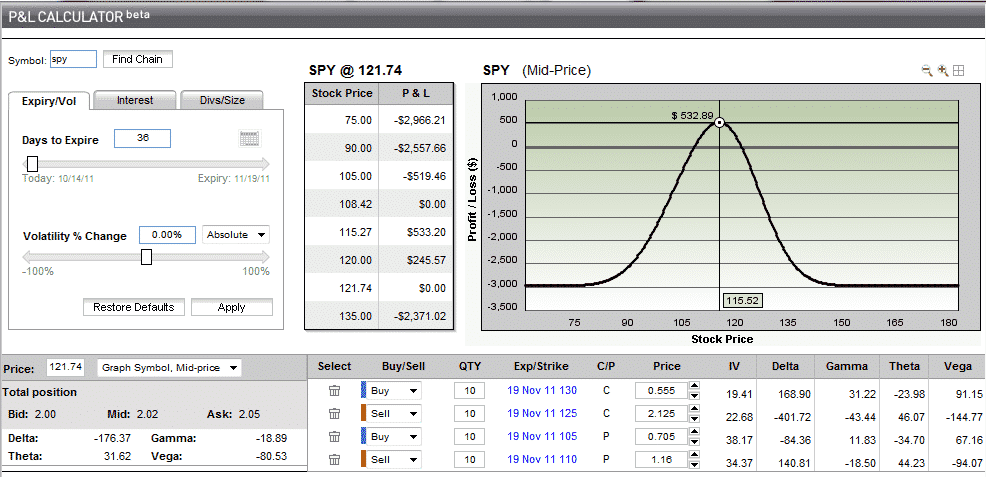

Image: www.myoptionsedge.com

Catching the Tailwind of Low Implied Volatility

The implied volatility of an option, a crucial metric, gauges market sentiment and expectations regarding future price fluctuations. When IV dips, it suggests that the market anticipates a period of relative stability, with smaller-than-average price swings. This creates an ideal backdrop for trading low-premium options as the likelihood of significant price deviations from the strike price diminishes.

Low IV conditions favor options strategies that capitalize on time decay or premium contraction. Selling premium-rich options with a high probability of expiring worthless can yield consistent returns over time. For instance, selling cash-secured put options on stable stocks or selling covered calls on slightly overvalued stocks can generate income while maintaining downside protection.

Mastering the Low IV Options Trading Landscape

Trading low IV options demands a comprehensive understanding of market dynamics, option pricing models, and risk management principles. Begin by pinpointing assets experiencing low IV. Historical data and options chains can provide valuable insights into IV trends. Consider the time to expiration; options with longer durations tend to exhibit higher IV compared to their short-dated counterparts.

Choosing the appropriate options strategy hinges on the market outlook. Neutral or slightly bullish markets favor selling premium, capturing time decay and potential price appreciation. Bearish sentiments may call for protective strategies, such as buying out-of-the-money puts or employing vertical spreads to mitigate risk while positioning for downward price moves.

Expert Tips for Success

Seasoned options traders emphasize several key principles for successful low IV trading:

- Exercise Patience: Low IV conditions do not arise frequently. Patience is paramount to identifying optimal trading opportunities. Avoid hasty trades during periods of high IV.

- Manage Risk: Options trading magnifies risk. Implement sound risk management strategies, such as proper position sizing and stop-loss orders, to safeguard your capital.

- Seek Knowledge: Continuously expand your understanding of options trading concepts, market dynamics, and analytical tools. Education empowers informed decision-making.

:max_bytes(150000):strip_icc()/volatilitysmile-5c64696846e0fb00011066e4.jpg)

Image: fity.club

Frequently Asked Questions

Q: What is implied volatility?

A: Implied volatility is the market’s estimate of an option’s future volatility. It reflects market sentiment and expectations of price movements.

Q: How can I determine if implied volatility is low?

A: Compare current IV levels to historical data and identify periods when IV has retreated to subdued levels. Consider option chains and other market indicators.

Q: What are the risks of trading low IV options?

A: Options trading involves risk. While low IV conditions reduce the likelihood of significant price swings, unforeseen market events can still result in losses.

Trading Low Implied Volatility Options Strategy

Image: optionstradingiq.com

Conclusion

Trading low implied volatility options requires a keen eye for market conditions, an understanding of options strategies, and unwavering risk management. By embracing the principles outlined in this article and seeking continuous knowledge, you can harness the potential of low IV trading and navigate market challenges with confidence. Remember, the financial markets are constantly evolving, so stay informed and adapt your approach accordingly.