Delving into Options: Unlocking Potential Profits

In the dynamic world of finance, options trading presents an exciting avenue for investors seeking to leverage market fluctuations and potentially maximize returns. An option contract, simply put, grants the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price known as the strike price. This versatile instrument offers a myriad of strategies, enabling traders to tailor their investments to align with their risk tolerance and financial objectives.

Image: thestockmarketwatch.com

Essential Concepts: Demystifying Options Terminology

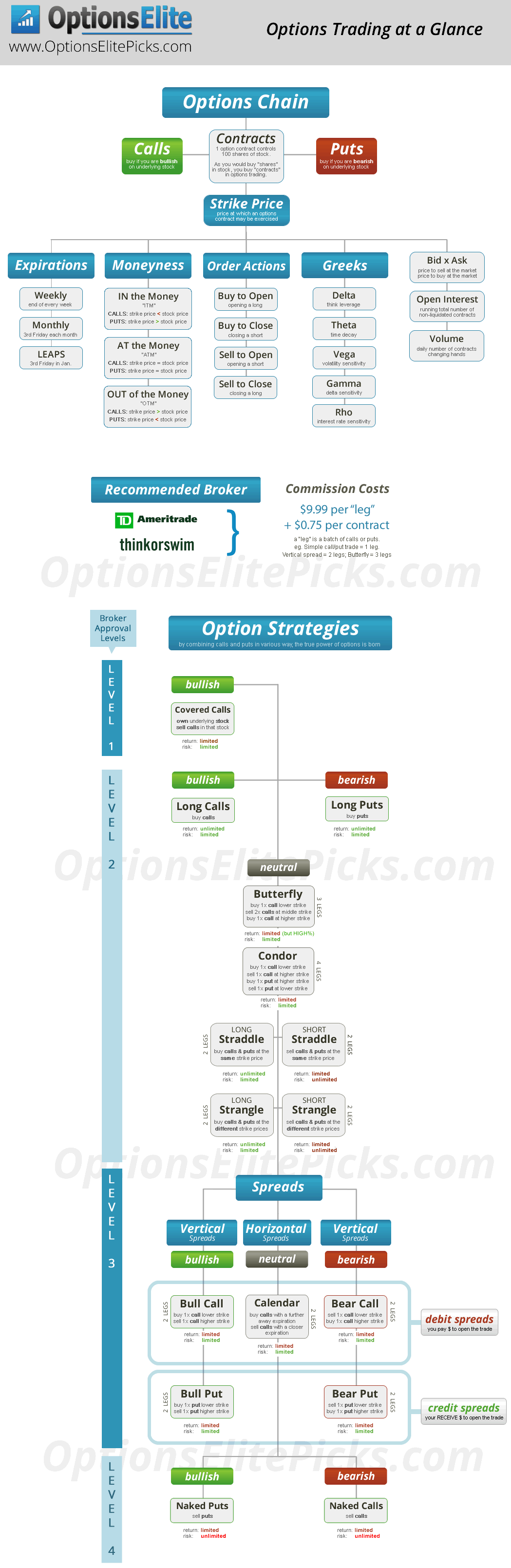

To navigate the options market effectively, it’s crucial to gain a firm grasp of the fundamental concepts and terminology. Calls and puts are the two primary types of options contracts. Call options confer upon the holder the right to purchase the underlying asset at the strike price on or before a specified expiration date. Conversely, put options grant the right to sell the underlying asset at the strike price. The premium, payable by the option buyer to the seller, represents the cost of acquiring the right embedded in the contract.

Decoding Market Dynamics: Understanding Key Drivers

The value of an options contract is influenced by a complex interplay of factors, each contributing to its intricate price movements. Intrinsic value, the difference between the strike price and the current market price of the underlying asset, forms the foundation of option pricing. Time value reflects the remaining lifespan of the contract, as options closer to expiration tend to command higher premiums. Volatility, a measure of the underlying asset’s price fluctuations, also exerts a significant impact on options pricing.

Image: www.barnesandnoble.com

Options Trading Learn

Image: margintradeab.blogspot.com

Crafting Strategies: Harnessing Options for Diverse Objectives

The versatility of options trading lies in the wide array of strategies available to investors. Covered calls involve selling calls against an underlying asset that the investor already owns, generating income from the premium while maintaining exposure to potential price appreciation. Buying puts provides downside protection against potential losses in the underlying asset, acting as a form of insurance. Straddles and strangles capital