Unveiling the Dynamic World of Options Trading

In the ever-evolving sphere of financial markets, options trading has emerged as a compelling tool for both investors and traders seeking to navigate risk and enhance returns. India, with its vibrant economy and growing financial literacy, has witnessed a significant surge in the size and scope of its options trading market. In this article, we delve into the anatomy of this burgeoning market, exploring its history, key players, and the immense opportunities it presents to participants.

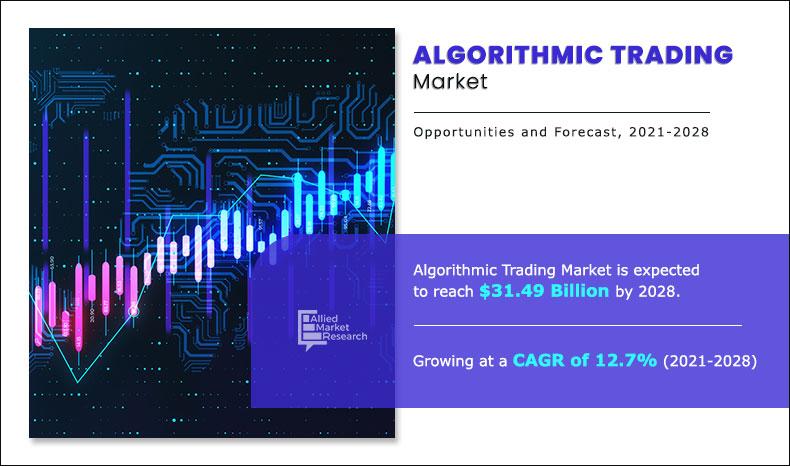

Image: www.alliedmarketresearch.com

A Historical Perspective: From Origins to the Present

Options trading in India can be traced back to the mid-1990s when the National Stock Exchange (NSE) introduced index options in 1995. Initially, trading was limited to a select group of large institutions, but over time, it has expanded to include a vast base of retail investors and individual traders. The introduction of exchange-traded funds (ETFs) and other derivative instruments has further fueled the growth of the options market in India.

Market Size and Key Players: A Comprehensive Overview

As of March 2023, the total notional value of options contracts traded on Indian exchanges stood at a staggering $1.3 trillion. This represents a substantial increase from just $0.5 trillion in 2018. Key players in the options trading market include large domestic brokerages such as Zerodha, Upstox, and Angel Broking, as well as international investment banks like Goldman Sachs and Morgan Stanley. These firms provide a range of options trading products and services, empowering traders and investors to implement various strategies.

Unraveling the Mechanics of Options Trading

Options contracts are derivative instruments that offer investors the right, but not the obligation, to buy (call options) or sell (put options) an underlying asset at a predetermined price on or before a specific date. This flexibility allows traders to tailor positions based on their market outlook and risk appetite. Options trading involves speculating on the future price movements of underlying assets, such as stocks, indices, and commodities.

Image: www.statista.com

The Benefits and Risks: Understanding the Dual Nature

Options trading offers several key advantages. Firstly, it provides a cost-effective way to gain exposure to various assets. Secondly, it enables traders to hedge their positions, reducing risk while still benefiting from price movements. Thirdly, options trading allows for the generation of income through premium collection and strategic trading techniques.

However, it is crucial to acknowledge the inherent risks associated with options trading. Market movements can be unpredictable, and losses can exceed the initial investment. Volatility, time decay, and liquidity risks are additional factors that traders must be cognizant of when engaging in options trading.

Essential Tips for Options Trading Success

To enhance the likelihood of success in options trading, consider the following expert insights:

- Thorough Research: Conduct in-depth research on the underlying asset, market trends, and historical data to make informed trading decisions.

- Risk Management: Implement sound risk management practices by setting well-defined stop-loss levels and carefully managing position sizing.

- Diversification: Spread your trades across multiple underlying assets to minimize the impact of adverse price movements in any single market.

- Understanding Options Pricing: Familiarize yourself with the factors influencing options pricing, such as volatility, time to expiration, and strike prices.

- Emotional Discipline: Control emotional biases by establishing trading rules and sticking to them. Avoid making impulsive or fear-driven decisions.

Options Trading Market Size India

Image: www.educba.com

Conclusion: Embracing the Opportunities with Caution

The options trading market in India offers a wealth of opportunities for traders and investors alike. Understanding the mechanics, key benefits, and potential risks is the cornerstone of successful involvement in this dynamic market. By adhering to disciplined trading principles, leveraging expert guidance, and controlling emotional biases, participants can harness the power of options trading while navigating the inherent risks associated with it. As the market continues to evolve, embracing a continuous learning mindset is pivotal to adapting to changing market conditions and maximizing opportunities in the options trading landscape of India.