The world of options trading is an intricate and rapidly evolving landscape. One of the fundamental aspects that traders must understand is the concept of trading hours, as these determine the time frames during which options contracts can be bought and sold.

Image: www.analyticssteps.com

Understanding Option Market Trading Hours

Option market trading hours generally align with the underlying asset’s exchange trading hours. In the United States, for instance, most options contracts based on stocks trade during specific time frames:

- Regular trading hours: 9:30 AM – 4:00 PM ET (Eastern Time)

- Pre-market trading hours: 8:00 AM – 9:30 AM ET

- After-hours trading hours: 4:00 PM – 8:00 PM ET

It’s important to note that option market trading hours can vary depending on the specific exchange and the underlying asset. For example, options on futures contracts may have extended trading hours to accommodate global market activity.

Key Considerations for Trading Hours

Trading hours are crucial in option trading for several reasons:

- Order placement: Traders can only place orders to buy or sell options during the designated trading hours. Orders placed outside these hours will not be executed.

- Price discovery: Option prices are determined by the supply and demand forces within the trading hours. Trading outside these hours may result in less accurate pricing.

- Volatility: Trading hours can impact option volatility, as market activity tends to be more volatile during peak trading times.

Tips and Expert Advice on Trading During Market Hours

To maximize trading efficiency and minimize risk, traders should adhere to the following tips and expert advice:

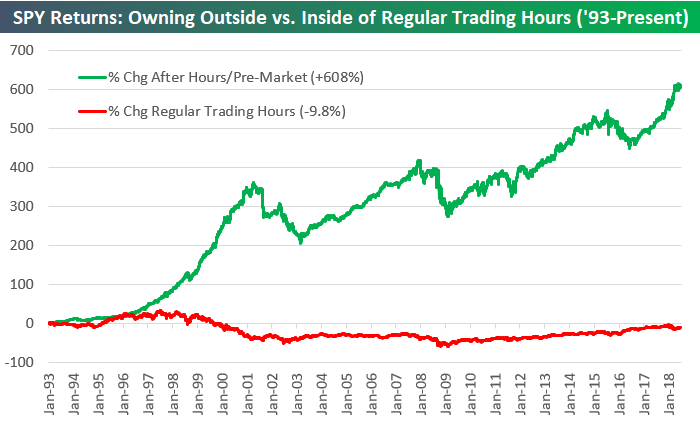

- Trading during peak hours: Trading during regular trading hours typically offers the highest liquidity and most favorable pricing.

- Being aware of pre-market and after-hours trading: These extended trading hours can provide opportunities to adjust positions or take advantage of price fluctuations.

- Managing risk: Trading outside regular trading hours carries higher risk due to reduced liquidity and potentially less reliable pricing.

- Using limit orders: Limit orders help traders control the execution price of their orders, especially outside regular trading hours.

By following these tips, traders can optimize their option trading strategies and improve their chances of success.

Image: seekingalpha.com

Frequently Asked Questions (FAQs) on Option Market Trading Hours

Q: Can I trade options 24 hours a day?

A: No, option market trading hours are typically limited to specific time frames, as described above.

Q: Why are trading hours important in option trading?

A: Trading hours determine when traders can place orders, affect price discovery, and influence volatility.

Q: What are the benefits of trading during regular trading hours?

A: Regular trading hours offer the highest liquidity, most favorable pricing, and lower risk compared to extended trading hours.

Q: How can I stay updated on changes to trading hours?

A: Monitor official announcements from the respective exchanges or stay informed through reputable financial news sources.

Option Market Trading Hours

:max_bytes(150000):strip_icc()/download12-5c6da12146e0fb000171982a.png)

Image: www.makeupera.com

Conclusion

Understanding option market trading hours is essential for successful trading. By adhering to the guidelines outlined above, traders can maximize their opportunities, minimize risk, and navigate the complexities of the options market with confidence.

Are you interested in further exploring the topic of option market trading hours? Join our online community or subscribe to our newsletter to stay informed about the latest updates and insights.