Embarking on the exhilarating journey of options trading can be a daunting experience, especially for those navigating the ever-changing landscape of financial markets. In this comprehensive guide, we delve into the depths of options trading, unearthing its intricacies and empowering you with the knowledge to navigate its complexities effectively. With a particular focus on LJM, a renowned figure in the industry, this article unveils the nuances of this captivating financial strategy.

Image: traderstat.com

Delving into the realm of options trading, it is imperative to unravel its essence and origins. Options, in the context of finance, refer to contracts that bestow upon the buyer the right, but not the obligation, to purchase or sell a specified asset at a predetermined price within a predefined time frame. This unique characteristic distinguishes options from stocks and bonds, where ownership or debt is prevalent. The allure of options lies in their inherent flexibility, enabling investors to tailor their strategies to suit their risk appetite and investment objectives.

Unveiling the Significance of LJM in Options Trading

Amidst the myriad of options trading strategies, LJM stands out as a prominent figure who has revolutionized the landscape of this dynamic financial realm. LJM, an acronym for Larry Jersey Mike, is a seasoned options trader and educator who has dedicated decades to mastering the art of options trading. Through his extensive experience and in-depth knowledge, LJM has developed a suite of innovative strategies that consistently outperform market benchmarks.

LJM’s approach to options trading emphasizes the judicious utilization of technical analysis and risk management principles. By meticulously scrutinizing market data and leveraging sophisticated trading tools, he identifies high-probability trading opportunities while simultaneously implementing robust risk management strategies to mitigate potential losses.

Decoding the Mechanisms of Options Trading

To fully grasp the intricacies of options trading, it is imperative to comprehend its fundamental mechanics. Imagine yourself as the proud owner of an “option contract,” akin to a valuable key that grants you the privilege of executing certain actions at your discretion. With a call option in your possession, you secure the right to purchase an underlying asset at a specified strike price before a predetermined expiration date. Conversely, a put option empowers you to sell the underlying asset at the designated strike price.

The strike price, a pivotal element in options trading, represents the price at which you can exercise your right to buy or sell the underlying asset. The premium, on the other hand, is the price you pay to acquire the option contract, reflecting the market’s assessment of the likelihood that the option will be exercised profitably.

Exploring the Nuances of Options Trading Strategies

Options trading encompasses a diverse array of strategies, each meticulously crafted to capitalize on unique market conditions and trader preferences. Scalping, a popular strategy among short-term traders, involves capturing quick profits from minuscule price fluctuations within a single trading session. In contrast, day trading, as its name suggests, entails executing trades within a single trading day, seeking to profit from intraday price movements.

Option spreads, a more complex but potentially lucrative strategy, involve the simultaneous purchase and sale of multiple options contracts with varying strike prices and expiration dates. This intricate strategy enables traders to fine-tune their risk and reward profiles, tailoring their positions to specific market scenarios.

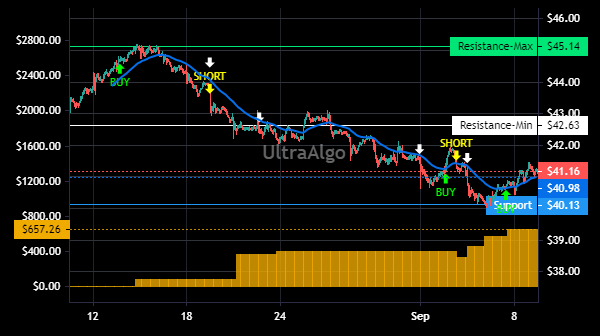

Image: www.mql5.com

Unlocking the Latest Trends in Options Trading

The realm of options trading is constantly evolving, with new trends and developments emerging on a regular basis. Options on futures contracts, for example, have gained prominence in recent years, offering traders a versatile tool to manage risk and speculate on future market movements. Additionally, the advent of exchange-traded funds (ETFs) that track options has further expanded the accessibility and liquidity of options trading.

Social media platforms and online forums have also emerged as vibrant hubs for options traders to connect, exchange ideas, and stay abreast of the latest market developments. These online communities provide a wealth of knowledge and insights, empowering traders to refine their strategies and adapt to the ever-changing market landscape.

Empowering Traders with Expert Advice and Tips

Mastering options trading requires not only theoretical knowledge but also practical wisdom. Seasoned traders have generously shared their insights and advice, providing invaluable guidance for aspiring and experienced traders alike.

One of the most fundamental tips involves the prudent management of risk. Options trading, while potentially lucrative, carries inherent risks that must be carefully navigated. Implementing robust risk management strategies, such as position sizing and stop-loss orders, is paramount for safeguarding your capital.

Addressing Frequently Asked Questions about Options Trading

To further clarify any lingering uncertainties, let us delve into a series of frequently asked questions about options trading:

- Q: What is the difference between options and futures?

- A: While both options and futures are derivatives, they differ in their contractual obligations. Options provide the right, but not the obligation, to buy or sell an underlying asset, while futures contracts obligate the buyer to purchase or the seller to deliver the underlying asset on a specified future date.

- Q: Can options be traded on any asset?

- A: Options can be traded on a wide range of underlying assets, including stocks, bonds, currencies, commodities, and even indices like the S&P 500.

- Q: What is the best way to learn about options trading?

- A: There are numerous resources available for learning about options trading, including books, online courses, and educational websites. It is also beneficial to seek mentorship from experienced traders and participate in online communities.

Options Trading Ljm

Image: www.ultraalgo.com

Conclusion

Options trading, with its inherent versatility and potential for substantial returns, offers an alluring opportunity for both novice and seasoned investors. Embracing the guidance and expertise of industry leaders like LJM can significantly enhance your chances of success in this dynamic financial arena. Whether you are an experienced trader seeking to refine your strategies or a newcomer eager to embark on this exciting journey, the insights and knowledge imparted in this comprehensive guide will serve as an invaluable compass, guiding you towards informed decision-making and empowering you to navigate the ever-changing landscape of options trading with confidence.

Are you intrigued by the captivating world of options trading? Embark on a transformative learning experience today and unlock the boundless possibilities that await you. Your financial journey awaits, and with the right tools and knowledge, you can seize the day and chart your path to trading success.