In the realm of investing, the allure of options trading has captivated the hearts and minds of countless traders seeking the potential to amplify profits. As one who has embarked on this fascinating journey, I cannot overstate the profound impact that Thinkorswim, a cutting-edge trading platform, has had on my trajectory.

Image: www.youtube.com

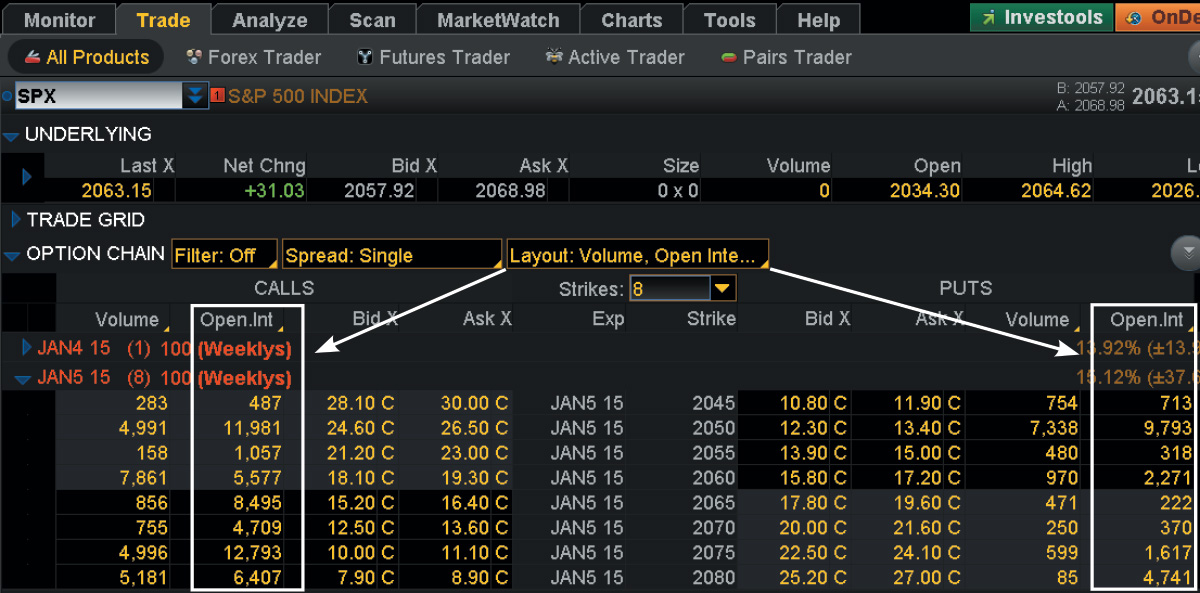

Through its intuitive interface, robust research tools, and seamless execution capabilities, Thinkorswim empowers traders of all skill levels to navigate the complexities of options markets with confidence. Delving into the depths of this remarkable platform, we shall explore its myriad features and delve into the intricacies of options trading, unveiling the secrets that lie within.

Thinkorswim: A Gateway to Options Mastery

Developed by TD Ameritrade, Thinkorswim has established itself as a formidable force in the options trading arena. Its comprehensive suite of tools, coupled with its user-centric design, has earned it accolades from seasoned traders and industry experts alike.

At the heart of Thinkorswim lies its intuitive platform, meticulously crafted to streamline the trading process. From customizable charting functionalities to real-time market data, every aspect of the platform is designed to enhance decision-making and optimize trading outcomes. Moreover, Thinkorswim offers a wealth of educational resources, empowering traders to delve deeper into the intricacies of options trading and refine their strategies.

Options Trading Demystified

Options, enigmatic financial instruments, grant traders the privilege to either buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). This flexibility opens up a world of possibilities, enabling traders to tailor their investment strategies to their risk tolerance and market outlook.

Understanding the nuances of options trading requires a firm grasp of key concepts such as time decay, volatility, and Greeks (measures of option sensitivity). By leveraging Thinkorswim’s powerful analytics, traders can delve into these intricacies, gaining a deeper understanding of how options behave and harnessing that knowledge to make informed trading decisions.

Navigating the Options Trading Landscape

The options trading landscape is a dynamic and ever-evolving realm, constantly shaped by market forces and economic events. Keeping abreast of the latest trends and developments is crucial for traders seeking to stay ahead of the curve.

Thinkorswim provides traders with access to a comprehensive array of research tools, market news, and industry insights. By tapping into this wealth of information, traders can stay attuned to market sentiment, identify emerging opportunities, and refine their trading strategies accordingly. Moreover, Thinkorswim’s robust community forums and social media presence offer invaluable platforms for traders to connect, share ideas, and learn from the collective wisdom of their peers.

Image: treewallpaperkeren.blogspot.com

Options Trading With Thinkorswim

Image: tickertape.tdameritrade.com

Expert Advice: Unlocking the Power of Options Trading

Embarking on an options trading journey requires a blend of knowledge, skill, and strategic planning. Drawing upon insights gained from seasoned traders and industry experts, here are some invaluable tips to enhance your trading approach:

- Define your risk tolerance: Before venturing into the options market, it is imperative to establish your risk tolerance. This will guide your trading decisions and help you manage potential losses.

- Master the art of due diligence: Thoroughly research both the underlying asset and the specific options contract you intend to trade. Understanding the factors that influence their value is crucial for making informed choices.

- Leverage technology to your advantage: Options trading platforms like Thinkorswim offer a plethora of tools