Introduction

Image: riset.guru

Options trading is a powerful financial tool that allows investors to speculate on the future price movements of assets. It’s a complex yet rewarding strategy that can potentially generate substantial returns. The Interactive Brokers (IB) platform is one of the most popular and comprehensive platforms for options trading, offering a wide range of features and tools to help traders make informed decisions. In this article, we’ll provide a comprehensive guide to options trading on the IB platform, covering the basics, advanced concepts, and practical strategies.

Understanding Options

An option is a financial contract that gives the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock, futures contract, or currency, at a specific price (strike price) on or before a certain date (expiration date). Options trading involves speculating on whether the underlying asset’s price will rise or fall in the future. The potential for profit or loss in options trading is limited to the premium paid for the option, making it a relatively low-risk, high-reward strategy.

Getting Started on the IB Platform

To start options trading on the IB platform, you’ll need to create an account and fund it with sufficient capital. Once your account is set up, you can access the IB Trading Workstation, a comprehensive software platform that provides a full range of trading tools and resources. The platform’s intuitive interface makes it easy for both beginners and experienced traders to navigate and execute trades.

Basic Concepts

Understanding the key concepts of options trading is crucial for successful trading. These include strike price, expiration date, premium, intrinsic value, and time value. The strike price is the price at which the option can be exercised. The expiration date is the last date the option can be exercised. The premium is the price of the option contract. Intrinsic value is the amount of profit an option holder would receive if they exercised it immediately. Time value is the premium an option holder pays for the right to hold the option until the expiration date.

Types of Options Strategies

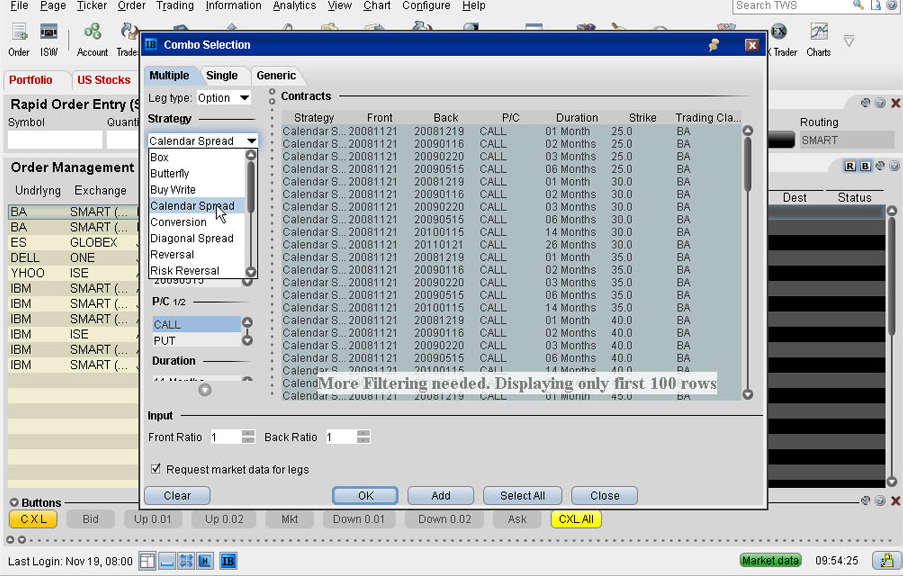

The IB platform supports a wide variety of options strategies, each with its unique risk and reward profile. Common strategies include buying calls or puts, selling calls or puts, bull spreads, bear spreads, and straddles. The choice of strategy depends on the trader’s market outlook and risk tolerance.

Advanced Concepts

For advanced traders, the IB platform offers advanced concepts such as implied volatility, Greeks, and option delta. Implied volatility measures the expected price volatility of the underlying asset and is used to price options. Greeks are mathematical measures of the sensitivity of an option’s price to changes in factors such as the underlying asset’s price, time to expiration, and volatility. Option delta measures the change in an option’s price for a one-dollar change in the underlying asset’s price.

Practical Strategies

The IB platform provides traders with a wealth of tools and resources to implement practical options strategies. These include streaming quotes and charts, real-time price alerts, option chains, and customizable watchlists. Traders can also use the platform’s strategy backtester to test and analyze the performance of different options strategies under various market conditions.

Conclusion

Options trading on the IB platform is a powerful tool that can enhance portfolio performance and generate substantial returns. Whether you’re a beginner or an experienced trader, the IB platform provides a comprehensive suite of tools and resources to meet your trading needs. By understanding the basics, advanced concepts, and practical strategies, you can unlock the potential of options trading and navigate the markets with confidence.

Image: www.trading-attitude.com

Options Trading In Ib Platform

Image: www.sooperarticles.com