Unveiling the Secrets of Options Trading: A Paradigm Shift in Financial Markets

In the dynamic realm of finance, options trading has emerged as a lucrative avenue, enabling investors to capitalize on market fluctuations and navigate financial complexities. In 2014, F.D. Scott, a renowned financial expert, authored a groundbreaking book titled “Options Trading for Beginners.” This seminal work unravels the intricacies of options trading, empowering novice investors with the knowledge to venture into this sophisticated market.

Image: www.youtube.com

Options trading involves contracts that grant the right, but not the obligation, to buy or sell an underlying asset at a predetermined price. Unlike traditional stock trading, options provide investors with the flexibility to speculate on market movements without purchasing the underlying asset outright. This unique characteristic opens up a wide array of strategies, allowing investors to tailor their investments to their specific risk appetites and financial goals.

Understanding the Mechanics of Options Trading

To fully grasp options trading, it is essential to delve into its foundational concepts. Options contracts comprise two primary components: the underlying asset and the expiration date. The underlying asset can be a stock, bond, commodity, or index, while the expiration date specifies the timeframe within which the option holder can exercise their right to buy or sell the asset.

There are two main types of options: calls and puts. A call option grants the buyer the right to purchase the underlying asset at the agreed-upon price (strike price), while a put option gives the buyer the right to sell the underlying asset at the strike price. These contracts provide distinct opportunities for profit: call options allow investors to profit from rising prices, whereas put options offer the potential to profit from falling prices.

The Evolution of Options Trading: From Inception to Present

The history of options trading dates back to the 16th century, with its origins in agricultural markets. Farmers would purchase contracts guaranteeing the right to sell their crops at a predetermined price, regardless of market conditions. This practice evolved over time, finding application in various asset classes and financial instruments.

The advent of standardized options contracts in the 20th century revolutionized options trading, making it more accessible and efficient. Today, options are traded on regulated exchanges worldwide, offering investors diverse opportunities to manage risk and capitalize on market fluctuations.

Expert Insights and Practical Strategies for Options Trading

Tips for Options Trading Success

- Define clear objectives: Identify your investment goals and risk tolerance before entering an options trade.

- Research thoroughly: Gain a comprehensive understanding of the underlying asset and market conditions before making any decisions.

- Choose appropriate option type: Select call or put options based on your market outlook and profit strategy.

- Manage your risk: Implement risk management techniques, such as stop-loss orders, to protect your investments against potential losses.

- Seek professional guidance: Consider consulting with a financial advisor for personalized advice and guidance.

Explanation of Expert Tips

Following these expert tips is crucial for successful options trading. Defining clear objectives helps guide your investment decisions, while thorough research provides a solid foundation for understanding market dynamics. Choosing an appropriate option type ensures that your trades align with your investment strategy. Implementing risk management techniques safeguards your investments, and seeking professional guidance can enhance your trading decisions and overall profitability.

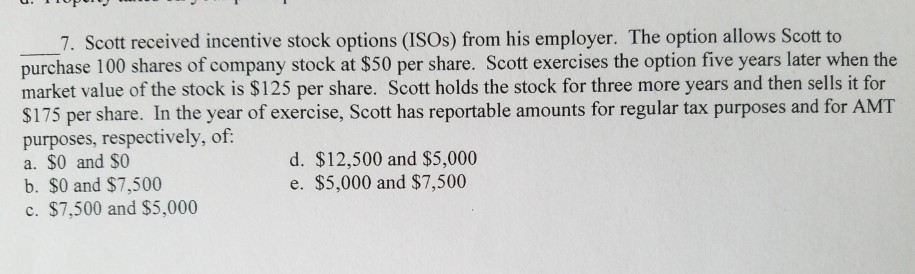

Image: www.chegg.com

Frequently Asked Questions on Options Trading

Q: What are the benefits of options trading?

Options trading offers numerous benefits, including leverage, flexibility, and limited risk exposure. It allows investors to speculate on market movements without owning the underlying asset and provides the potential for substantial profits.

Q: What are the potential risks involved in options trading?

Options trading involves inherent risks, including the possibility of losing your entire investment or more if you hold an uncovered option position. It is crucial to carefully consider your risk tolerance and manage your positions accordingly.

Options Trading Fo J D Scott 2014

Image: www.advisorsmagazine.com

Conclusion: Embark on the Journey of Options Trading

Options trading offers a unique blend of risk and reward, empowering investors with the tools to potentially profit from market fluctuations. F.D. Scott’s “Options Trading for Beginners” provides a comprehensive guide to this dynamic asset class, equipping investors with the knowledge and strategies to navigate the complexities of options trading. By embracing the concepts and insights presented in this article, you can venture into the realm of options trading with greater confidence and the potential to enhance your financial future.

Are you ready to unlock the hidden potential of options trading? If so, embark on this journey of financial empowerment today.