Introduction

The exhilarating world of financial markets has become a magnet for aspiring traders, with two trading modalities taking center stage: option trading and scalping. Skillfully maneuvering through the complex landscapes of these approaches presents immense opportunities, yet also requires an astute understanding of their distinct nuances. This comprehensive guide will delve into the intricate realms of option trading and scalping, unraveling their unique strategies, revealing their pros and cons, and guiding you towards an informed decision based on your individual circumstances, goals, and risk tolerance.

Image: www.trality.com

Option Trading: A Calculated Gamble

Option trading empowers traders with the ability to speculate on the future price movements of underlying assets, juggling two main types of options: calls and puts. Calls bestow upon traders the right to purchase an asset at a predetermined price (the strike price) on or before a specified expiration date. On the other hand, puts grant traders the right to sell an asset at the strike price by the expiration date. The price of an option, known as its premium, fluctuates dynamically based on several factors, including the asset’s volatility, time remaining until expiration, and market sentiment.

Therein lies the allure of option trading: the potential for exponential gains. However, this tantalizing prospect comes hand in hand with substantial risk. Option trading is a realm where fortunes can be amassed or wiped out, often in a matter of hours. Seasoned traders leverage option trading strategies to manage risk, generate income, and capitalize on market movements. While intricate, option trading can be a formidable tool for those who approach it with an informed mindset and a robust tolerance for risk.

Scalping: A Finesse for Speed

In the bustling markets, scalpers emerge as nimble traders, pouncing on momentary fluctuations rather than lingering market trends. They meticulously analyze price action, aiming to extract tiny profits from rapid-fire trades executed within seconds or minutes. Often employing sophisticated algorithms and lightning-fast execution platforms, scalpers navigate the labyrinthine market landscapes with precision and discipline.

Unlike option traders who strategize around future price movements, scalpers focus on the immediate present, exploiting minor price discrepancies or technical indicators to uncover fleeting opportunities. This demanding approach necessitates an acute understanding of market dynamics, a keen eye for identifying patterns, and impeccable risk management skills. Scalping may be particularly suitable for traders who thrive under pressure, possess quick decision-making abilities, and seek instant gratification in their trading endeavors.

Weighing the Pros and Cons: A Balanced Perspective

Navigating the tumultuous waters of option trading and scalping requires a clear-eyed examination of their merits and drawbacks. Let’s dissect these strategies layer by layer:

Image: fxssi.dev

Option Trading: Pros and Cons

Pros:

- Limit potential losses through calculated risk management techniques

- Abundant trading opportunities

- Income generation through premium collection

Cons:

- Premiums can erode over time, potentially leading to losses

- Unpredictable market dynamics may lead to significant losses

- Requires a deep understanding of options and risk management

Scalping: Pros and Cons

Pros:

- Immediate profit potential

- Fast-paced and exhilarating trading style

- Minimal impact from wider market trends

Cons:

- Requires intense focus and stamina

- High frequency of trades can amplify losses

- Execution latency can hinder profitability

Expert Insights and Actionable Tips

To capture the crux of option trading and scalping, we consulted with seasoned traders who shared their insights and provided invaluable advice for aspiring market mavericks.

“Option trading is not about predicting the future; it’s about managing probabilities and risk.” – John Carter, renowned trader and author

“Scalping is a demanding discipline, but with rigorous training and emotional fortitude, it can be a lucrative pursuit.” – Kathy Lien, renowned forex trader and analyst

Actionable tips:

- Seek guidance from reputable trading mentors or educational resources

- Practice trading with virtual funds or simulation accounts

- Thoroughly research and analyze the assets or markets you intend to trade

- Develop and adhere to a robust risk management strategy

- Maintain discipline, patience, and a clear mind during trading sessions

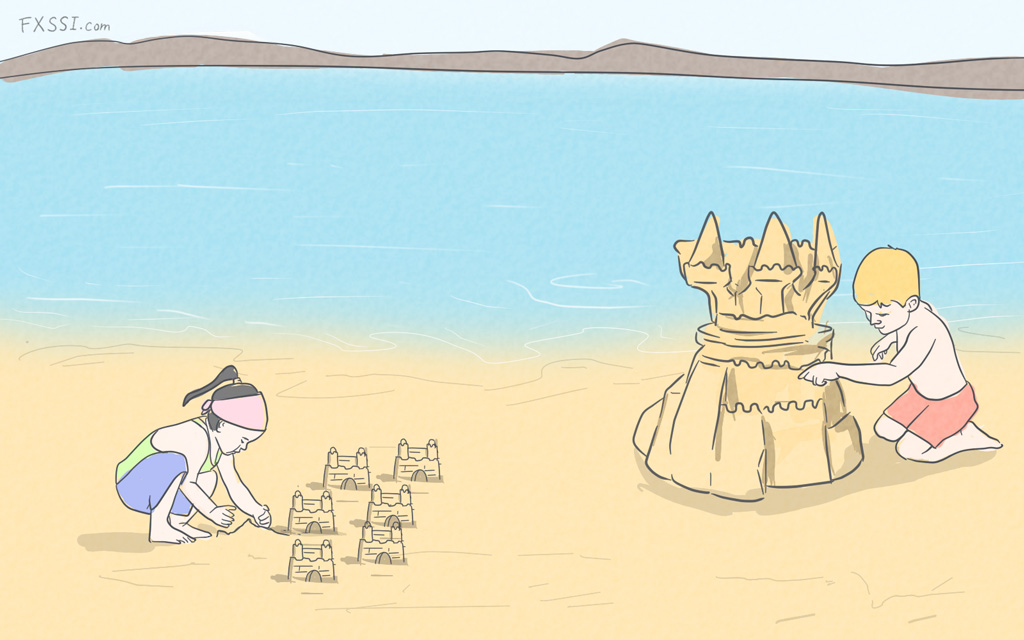

Option Trading Vs Scalping

Conclusion

Embarking on the trading journey is an endeavor fraught with both potential rewards and inherent risks. Option trading and scalping, while distinct in their approaches, can lead to financial success if executed with discipline, knowledge, and emotional resilience. By carefully considering your trading style, risk appetite, and time horizon, you can choose the strategy that aligns with your unique circumstances and aspirations. Remember, the markets are an ever-evolving landscape, and continuous learning, adaptability, and risk management are essential for long-term success.