Navigating the Unpredictable: A Trader’s Guide to ATR

In the realm of options trading, volatility is an ever-present force, shaping market behavior and testing traders’ skills. Average true range (ATR) emerges as an indispensable tool in this volatile landscape, providing traders with a valuable metric to gauge price fluctuations and craft informed decisions. This comprehensive guide delves into the intricacies of ATR options trading, empowering traders to harness the power of volatility and navigate the markets with confidence.

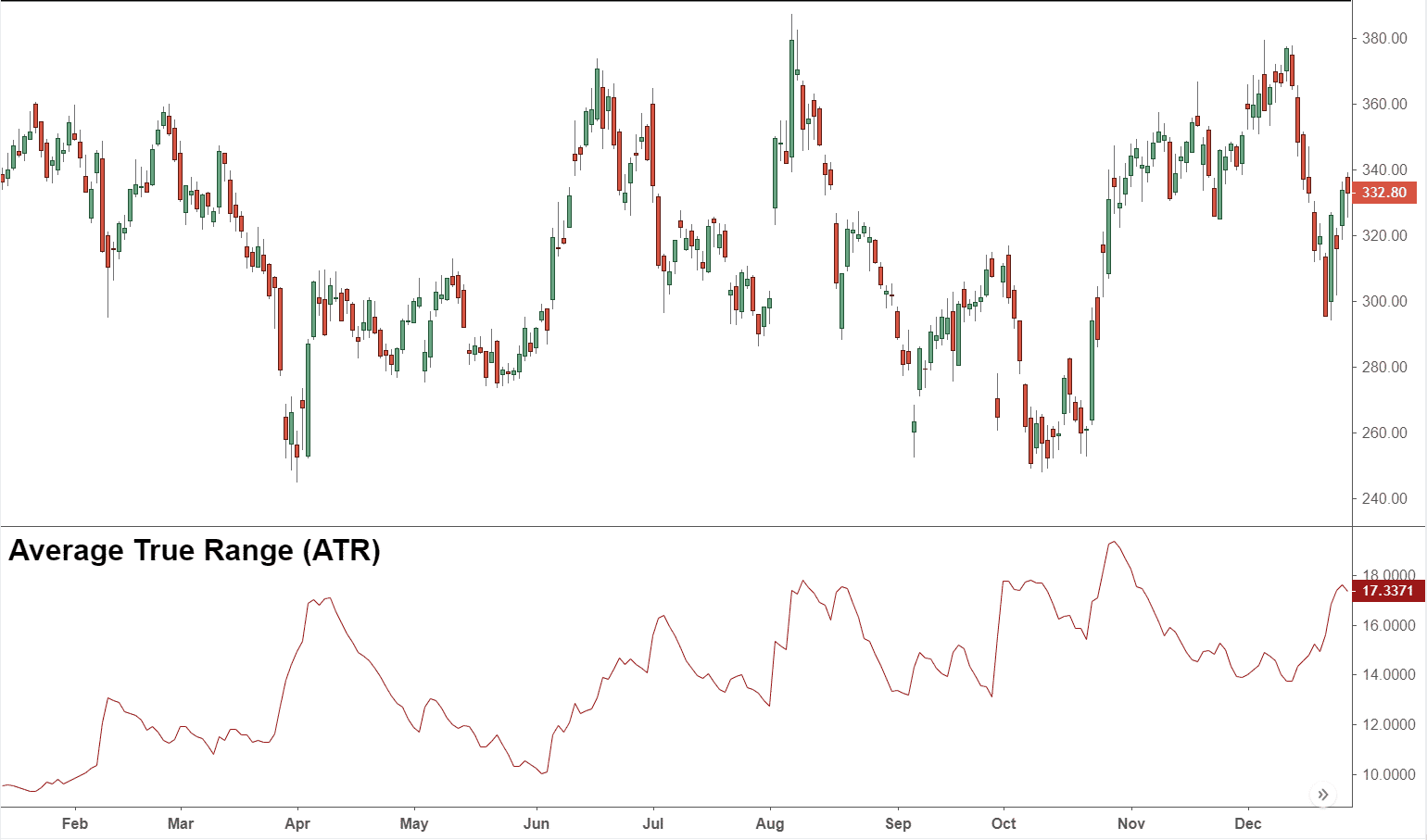

Image: www.dolphintrader.com

Defining Average True Range

Average true range, abbreviated as ATR, measures the degree of price volatility in a financial instrument over a specified period, typically 14 days. It encapsulates both the entire price range (the difference between the high and low prices) and the previous close, offering a more comprehensive volatility assessment than basic price range. ATR is expressed in absolute terms, such as points or percentage, depending on the underlying asset.

The Significance of ATR in Options Trading

Volatility is a pivotal factor affecting option prices and trading strategies. When volatility rises, options premiums tend to increase, as the perceived risk associated with the underlying asset’s price movements intensifies. By utilizing ATR, traders can gauge the expected volatility and make informed decisions about option pricing, position sizing, and risk management.

Applying ATR in Practice

Incorporating ATR into options trading strategies involves understanding various concepts and applications:

Image: forexrobotexpert.com

Calculating Option Premiums:

ATR provides insights into the fair value of options premiums. Higher ATR values imply greater volatility, leading to higher premiums. Conversely, lower ATR values indicate lower volatility, resulting in lower premiums. Traders can use ATR to evaluate whether option prices are reasonably priced or over/undervalued.

Determining Position Size:

ATR helps determine the appropriate position size for options trades. Higher ATR values warrant smaller position sizes, as the potential for significant price swings increases. Conversely, lower ATR values allow for larger position sizes due to the reduced likelihood of extreme price movements.

Managing Risk:

ATR plays a crucial role in risk management for options traders. By assessing the ATR of the underlying asset, traders can establish stop-loss levels at appropriate distances from the entry price. This calculated approach helps minimize potential losses and protect trading capital.

Advanced ATR Options Trading Techniques

Traders seeking to delve deeper into ATR options trading can explore advanced techniques to enhance their understanding and improve their trading strategies:

ATR Channels:

ATR values plotted on a price chart create ATR channels that provide visual guidance for identifying potential support and resistance levels. These channels can aid in making entry and exit decisions, as well as identifying potential trading ranges.

ATR Oscillators:

ATR oscillators combine ATR with other indicators to measure momentum and overbought/oversold conditions. These oscillators help traders gauge the strength of price trends and identify potential turning points in the market.

ATR Volatility Bands:

ATR volatility bands, similar to Bollinger Bands, use ATR to create dynamic bands around the price chart. These bands can assist in identifying potential price breakouts and trend reversals.

Average True Range Options Trading

Conclusion

Embracing ATR options trading unravels a world of opportunities for traders who seek to master the art of volatility. By understanding the nuances of ATR and applying it in their trading strategies, traders can gain an edge in the ever-changing markets and maximize their potential for success. From calculating option premiums to managing risk effectively, ATR proves to be an indispensable tool in the arsenal of any options trader. Delving into advanced ATR techniques further elevates traders’ abilities, empowering them to navigate market volatility with greater confidence and precision.