Prepare for a high-stakes game of investing with options trading earnings calls. These pivotal events offer a unique opportunity to unravel the financial performance and future prospects of companies you hold or plan to invest in. Join us as we dissect the intricate world of options trading, empowering you with expert analysis and strategies to maximize your earning potential.

Image: optionstradingiq.com

Unveiling the Options Arena

Options trading, a sophisticated investment technique, empowers traders to speculate on the future price of an underlying asset, whether it’s a stock, currency, or commodity. Unlike buying a stock outright, options provide the flexibility to either purchase (call option) or sell (put option) the underlying asset at a predetermined strike price and expiration date. Options trading enables investors to enhance returns, hedge risk, and respond to market volatility.

Earnings Calls: A Window into Corporate Financials

Earnings calls are quarterly conferences where companies present their financial results and provide guidance on their future outlook. These calls serve as golden opportunities for investors to gauge a company’s financial health, business strategy, and growth prospects. Armed with this knowledge, traders can make informed decisions about whether to buy, sell, or hold their positions.

Navigating the Earnings Call Labyrinth

To make the most of earnings calls, it’s crucial to adopt a structured and informed approach. Firstly, identify the companies whose earnings calls hold significance for your portfolio or potential investments. Study their financial statements and industry trends to establish a solid understanding of their performance and competitive landscape.

During the call, pay close attention to key metrics such as revenue, earnings per share (EPS), profit margins, and guidance for future quarters. Management commentary on market conditions, growth initiatives, and competitive dynamics is also vital for assessing the company’s strategic direction.

Image: www.ig.com

Deciphering the Options Trading Impact

Earnings calls can significantly influence the price of options. If a company reports better-than-expected results and provides a positive outlook, the demand for call options typically increases, leading to a surge in premiums. Conversely, disappointing results and pessimistic guidance tend to drive down the value of call options and bolster the demand for put options.

Crafting Winning Options Trading Strategies

Strategic options trading during earnings calls requires precision and a deep understanding of market dynamics. Consider using call options for bullish expectations, buying them before the call to capitalize on potential share price appreciation. For bearish expectations, put options offer a cost-effective way to profit from declining stock prices.

However, options trading involves risk. Options can expire worthless if their strike price isn’t met by the expiration date. Careful risk management is paramount, including setting stop-loss orders and managing position size in line with your risk tolerance.

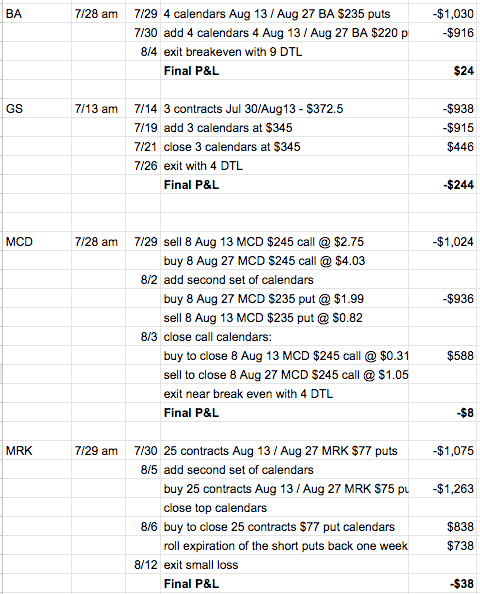

Insider Perspectives: Crunching the Numbers

Seek insights and perspectives from financial experts and analysts who follow the companies you’re interested in. They can provide valuable guidance, highlighting key data points and potential market reactions during earnings calls.

Combine this external expertise with your own thorough analysis to form a well-informed trading plan. Remember, the stock market is not without its uncertainties, so diversification and a balanced portfolio are crucial.

Options Trading Earnings Call

Image: ofosixijudu.web.fc2.com

Conclusion

Options trading earnings calls offer investors a powerful tool to capitalize on market volatility and enhance returns. By developing a sound understanding of the principles and complexities involved, traders can make informed decisions and unlock the potential of this dynamic investment arena. Embrace the challenge of earnings calls, navigate the intricacies, and elevate your investing game with expertise and strategy.