In the realm of options trading, navigating credit hits is a crucial aspect for traders to comprehend. A credit hit occurs when an options trade results in a loss that exceeds the initial premium received, leading to a negative balance in the trading account. Navigating this scenario demand a well-informed approach and strategic risk management techniques to mitigate its potential impact.

Image: www.pinterest.com

Decoding Credit Hits in Options Trading

Options trading involves the purchase and sale of contracts granting the right, not the obligation, to buy or sell an underlying asset at a particular price on a specific date. When a trader sells an option, they receive a premium from the buyer in exchange for taking on the obligation to fulfill the contract if exercised. However, if the market moves against the trader’s position, the loss on the trade can surpass the initial premium received, resulting in a credit hit.

Tips and Expert Advice for Navigating Credit Hits

To effectively navigate credit hits, it is imperative to adopt a proactive approach and implement prudent risk management strategies. Here are some essential tips and expert advice:

- Preemptive Risk Management: Establish clear risk parameters and adhere to a disciplined trading plan. Determine the maximum acceptable loss for each trade and never risk more than you can afford to lose.

- Monitor Market Conditions Closely: Stay informed about market developments and economic indicators that may influence the underlying asset’s price. Utilize real-time market data to make informed decisions and identify potential risks.

- Diversify your Portfolio: Avoid concentrating your investments in a narrow range of options. Spread your risk across different underlying assets, expiration dates, and strike prices to mitigate the impact of a single adverse market movement.

- Utilize Stop-Loss Orders: Implement stop-loss orders to automatically exit a trade if it reaches a predetermined loss threshold. This strategy helps limit potential losses and prevents catastrophic damage to your trading account.

- Consider Hedging Strategies: Explore hedging techniques to reduce the risk associated with specific options trades. Implement offsetting positions in other options contracts or underlying assets to mitigate exposure to market fluctuations.

By implementing these risk management strategies, traders can minimize the impact of credit hits and enhance their overall trading performance. It is important to note that there is no guaranteed method to eliminate the risk entirely. Therefore, it is crucial to approach options trading with a prudent mindset and a thorough understanding of the potential risks involved.

FAQs on Options Trading Credit Hits

Q: How can I determine the potential impact of a credit hit?

A: Assess the current market value of the underlying asset, your strike price, and the time remaining until expiration. Calculate the potential loss if the market continues to move against your position.

Q: What steps should I take if I experience a credit hit?

A: Reassess your trading strategy, review your risk management measures, and consider seeking professional guidance from an experienced options trader or financial advisor.

Q: Can I recover from a credit hit?

A: It is possible to recover from a credit hit with careful planning and disciplined trading. Reevaluate your trading strategy, consider alternative investment opportunities, and seek professional guidance if necessary.

Q: How can I prevent credit hits in the future?

A: Implement proactive risk management techniques, monitor market conditions closely, diversify your portfolio, utilize stop-loss orders, and consider hedging strategies to mitigate potential losses.

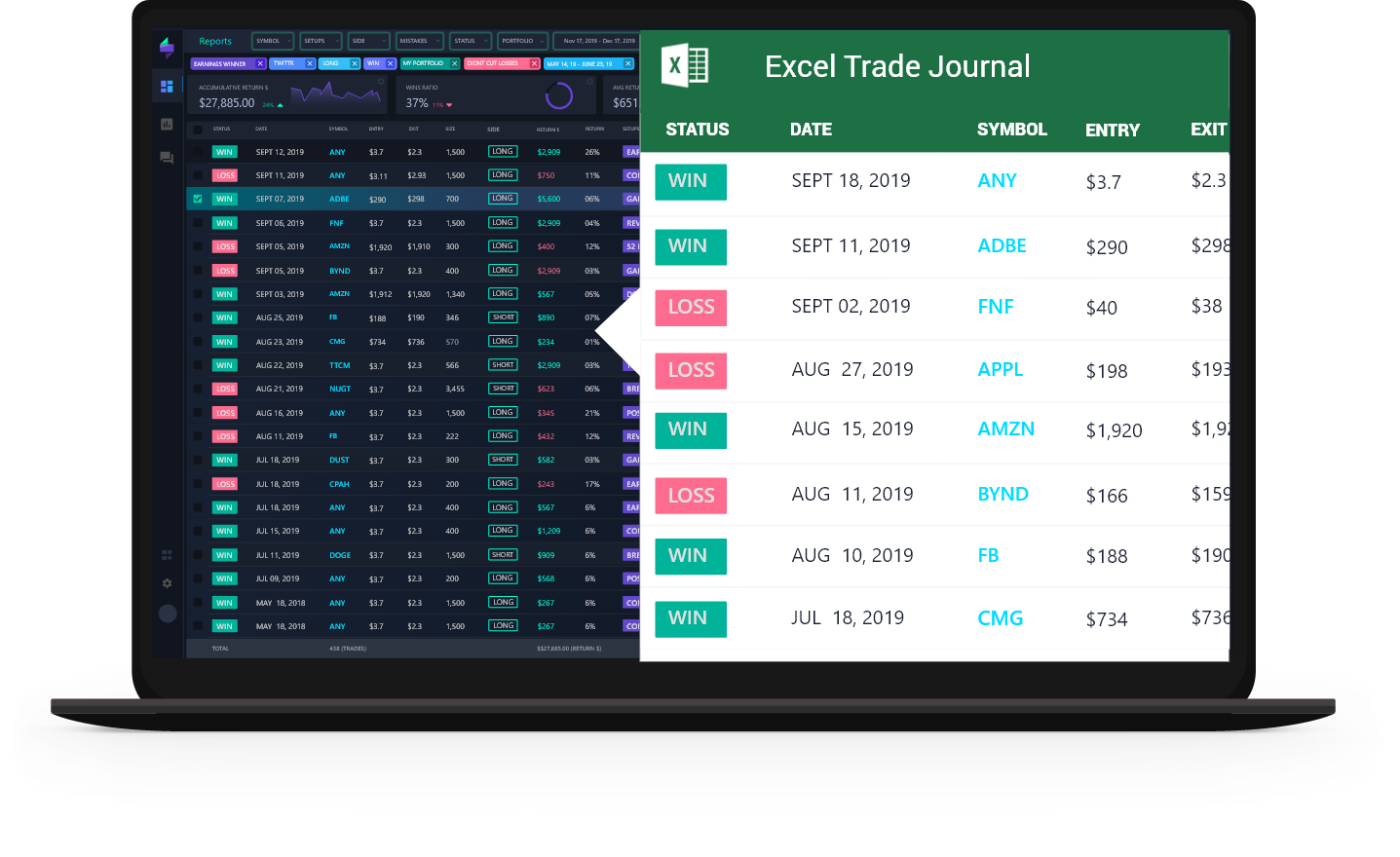

Image: tradersync.com

Options Trading Credit Hit

Image: www.youtube.com

Conclusion

Understanding options trading credit hits is essential for traders of all experience levels. By adopting prudent risk management strategies, implementing recommended tips, and seeking expert advice when needed, traders can minimize the impact of credit hits and enhance their overall trading performance. Whether you are navigating your first options trade or seeking to refine your existing strategy, a comprehensive understanding of credit hits is crucial for success in the dynamic world of options trading.

Do you have any questions or insights regarding options trading credit hits? Feel free to share your thoughts and experiences in the comments section below. Your contributions can help enrich the understanding of this topic and benefit fellow traders.