Introduction

Image: thecryptocurrencyforums.com

Options, often shrouded in complexity, offer a fascinating realm of possibilities for savvy investors. Coinbase, the trusted cryptocurrency exchange, has embraced this powerful tool, allowing traders to unlock a spectrum of strategies and enhance their cryptocurrency experiences. In this comprehensive guide, we embark on a journey to unravel the intricacies of options trading on Coinbase, unraveling its concepts, mechanics, and potential benefits. Whether you’re a seasoned trader or a curious novice, prepare to immerse yourself in the world of options and elevate your cryptocurrency endeavors.

Chapter 1: Understanding Options Trading

At the heart of options trading lies the idea of speculating on the future movement of an underlying asset, such as a cryptocurrency. These contracts grant traders the right, but not the obligation, to buy or sell an asset at a predetermined price on a specified date. By mastering the art of options trading, investors can enhance their returns, manage risk, and unlock a world of strategic possibilities.

Chapter 2: Basic Concepts of Options

To navigate the realm of options, let’s first establish some foundational concepts:

- Call Option: A call option gives the buyer the right to purchase an asset at a certain price before the contract’s expiration date.

- Put Option: A put option grants the buyer the privilege to sell an asset at a designated price before its expiration.

- Strike Price: The predetermined price at which the option can be exercised (bought or sold).

- Expiration Date: The date on which the option contract expires, nullifying any unexercised rights.

Chapter 3: Options Trading on Coinbase

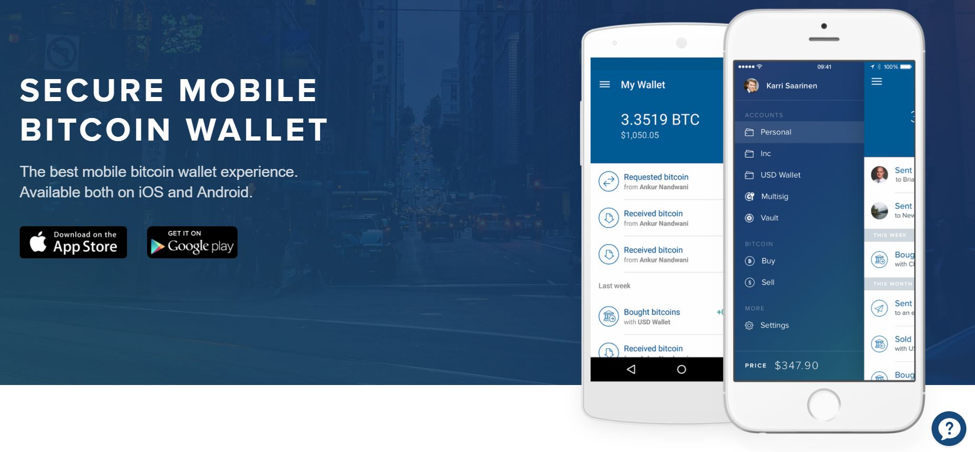

Coinbase, renowned for its user-friendly platform and robust security, has extended its offerings to encompass options trading. By leveraging this platform, traders can seamlessly access options markets, execute trades with confidence, and track their strategies in real-time.

Chapter 4: Benefits of Options Trading

The allure of options trading stems from its multifaceted benefits:

- Enhanced Profit Potential: Options offer the potential for magnified returns compared to traditional spot trading.

- Risk Management: By employing options, traders can hedge against potential losses and mitigate the volatility inherent in cryptocurrencies.

- Strategic Flexibility: Options empower traders with a toolkit of strategies, enabling them to adapt to various market conditions and pursue customized investment goals.

Chapter 5: Types of Options Strategies

The world of options trading is vast, encompassing a myriad of strategies catered to different risk appetites and investment objectives. Let’s delve into some popular options strategies:

- Covered Call: A strategy that involves selling or writing a call option against an underlying asset already owned, generating income while limiting potential upside.

- Protective Put: A strategy that involves buying a put option to protect against a potential decline in the value of the underlying asset.

- Long Call: A bullish strategy involving the purchase of a call option, anticipating a future price surge in the underlying asset.

Chapter 6: Execution and Monitoring

Executing options trades on Coinbase requires meticulous attention to detail:

- Selecting the Asset: Choose the cryptocurrency you intend to speculate on, whether it’s Bitcoin, Ethereum, or another supported asset.

- Choosing the Contract: Determine the expiration date and strike price that align with your strategy and market outlook.

- Executing the Trade: Specify the quantity of contracts you wish to buy or sell and place your order.

- Monitoring the Contract: Regularly track the performance of your options contract as the market evolves, adjusting your strategy as needed.

Chapter 7: Managing Risk

Options trading, while potent, is not devoid of risks. Prudent risk management is paramount to preserving capital and achieving long-term success.

- Understand Underlying Volatility: Cryptocurrency markets are inherently volatile; comprehend the risks associated with the underlying asset’s price fluctuations.

- Set Defined Stop-Loss Points: Establish pre-determined levels at which your options contracts will be automatically sold to limit potential losses.

- Proper Position Sizing: Allocate funds wisely, avoiding overexposure to any single trade or strategy.

Chapter 8: Conclusion

Options trading on Coinbase presents a sophisticated arena for cryptocurrency investors. By harnessing the power of options, traders can elevate their returns, mitigate risk, and craft tailored strategies that align with their investment objectives. Remember, understanding the intricacies of options trading requires a proactive approach, ongoing education, and a commitment to prudent risk management. As you venture into this dynamic realm, may this comprehensive guide serve as your compass, empowering you to navigate the world of options with confidence and reap its rewarding potential.

Image: thecryptocurrencyforums.com

Options Trading Coinbase

Image: www.trading101.com