Bitcoin has become an integral part of our financial landscape, and with it has come the emergence of sophisticated trading instruments like options. Options trading on Coinbase offers a unique opportunity to mitigate risk, enhance returns, and unlock the full potential of this digital asset. In this comprehensive guide, we’ll explore the world of bitcoin options trading on Coinbase, providing you with the essential knowledge and actionable insights to navigate this exciting market.

Image: cryptopotato.com

Understanding Bitcoin Options

Option contracts are financial instruments that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). In the case of bitcoin options trading on Coinbase, the underlying asset is bitcoin itself.

There are two main types of options: calls and puts. Call options give the buyer the right to buy bitcoin at the strike price on or before the expiration date. Put options, on the other hand, give the buyer the right to sell bitcoin at the strike price on or before the expiration date.

Bitcoin Options Trading on Coinbase

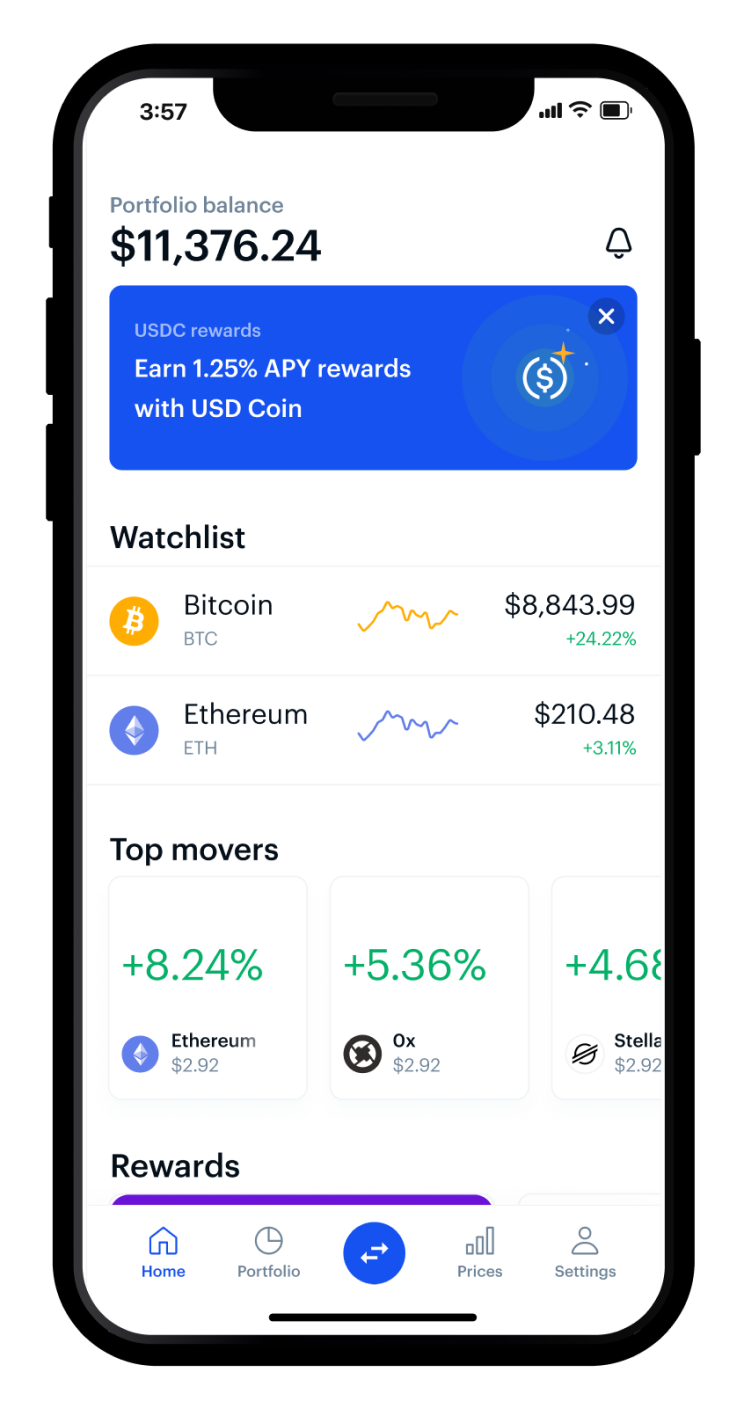

Coinbase, the leading cryptocurrency exchange in the United States, offers a convenient and secure platform for bitcoin options trading. Coinbase’s options platform is designed to cater to both beginners and experienced traders, providing a range of features to enhance the trading experience.

One of the key advantages of trading bitcoin options on Coinbase is its simplicity. The platform’s user-friendly interface makes it easy for both novice and seasoned traders to navigate the complex world of options trading. With Coinbase, you can quickly identify and trade the options that align with your trading goals and risk tolerance.

Exploring Trading Strategies

The realm of bitcoin options trading on Coinbase opens up a multitude of trading strategies, catering to various risk appetites and market conditions. For instance, if you anticipate a rise in bitcoin’s price, you could purchase a call option, allowing you to profit from such a market move. Alternatively, if you foresee a decline in bitcoin’s price, you could opt for a put option to protect your portfolio against potential losses.

A popular strategy among options traders is the “covered call.” This strategy involves selling (writing) call options on bitcoin that you already own. By selling the call option, you generate additional income while limiting your potential upside on the underlying bitcoin. In return, you receive a premium from the buyer of the option contract.

Image: www.coinbase.com

Expert Insights and Guidance

While bitcoin options trading on Coinbase offers immense potential, it’s crucial to approach this market with a solid understanding of the underlying concepts and risks involved. To help you navigate this complex landscape, it’s highly recommended to seek guidance from established experts in the industry.

The Coinbase learning hub is a rich resource for both beginner and advanced traders, featuring comprehensive articles, tutorials, and videos that delve into the intricacies of bitcoin options trading. Additionally, consider consulting with a qualified financial advisor to gain personalized insights tailored to your individual circumstances and risk tolerance.

Bitcoin Options Trading Coinbase

Image: thecryptocurrencyforums.com

Conclusion

Bitcoin options trading on Coinbase presents a powerful tool for both risk management and return enhancement in the cryptocurrency market. By understanding the basics of options trading, incorporating expert insights, and leveraging Coinbase’s user-friendly platform, you can unlock the full potential of this exciting trading vehicle. Remember, as with any financial instrument, the key to success in bitcoin options trading lies in thorough research, prudent risk management, and a deep understanding of the underlying market dynamics.