Introduction

In the ever-evolving landscape of cryptocurrency trading, Coinbase stands out as a prominent platform offering a diverse range of options to traders and investors. With the growing popularity of digital assets and the constant introduction of innovative trading strategies, understanding the intricacies of Coinbase trading options has become paramount for anyone seeking to navigate the market successfully. This article aims to provide a comprehensive guide to Coinbase trading options, catering to both beginners and experienced traders alike.

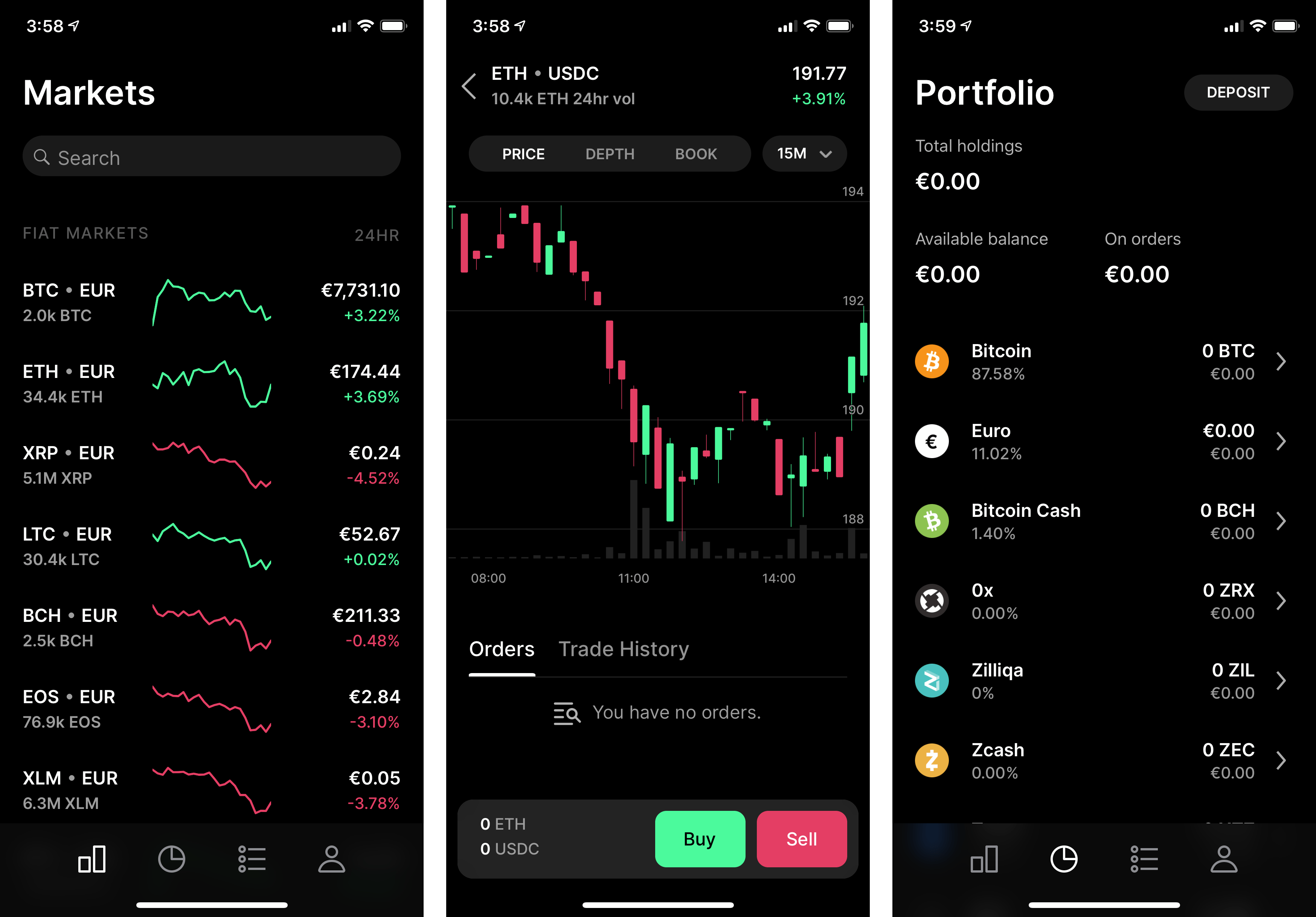

Image: www.cryptonewsz.com

What Are Coinbase Trading Options?

Coinbase trading options are financial contracts that grant traders the right, but not the obligation, to buy or sell a specified cryptocurrency at a predetermined price within a specific timeframe. These options provide traders with greater flexibility and risk management tools compared to traditional spot trading. The buyer of an option pays a premium to the seller in exchange for this right. Coinbase offers various types of options, including call options, put options, and more advanced strategies like spreads and combinations.

Types of Coinbase Trading Options

1. Call Options

Call options give the buyer the right to purchase a cryptocurrency at the strike price on or before the expiration date. If the market price of the cryptocurrency rises above the strike price, the buyer can exercise the option and purchase the cryptocurrency at a profit.

2. Put Options

Put options provide the buyer the right to sell a cryptocurrency at the strike price on or before the expiration date. If the market price of the cryptocurrency falls below the strike price, the buyer can exercise the option and sell the cryptocurrency at a profit.

3. Spreads

Spreads involve combining multiple options contracts to create a customized trading strategy. Traders can buy and sell combinations of call and put options with different strike prices or expiration dates to create complex trading scenarios.

4. Combinations

Combinations are advanced strategies that involve combining multiple options contracts, such as a bull call spread or a bear put spread. These strategies offer more complex risk-reward profiles and are typically employed by experienced traders.

Benefits of Coinbase Trading Options

1. Flexibility and Risk Management

Options provide traders with flexibility and risk management tools not available in spot trading. Traders can limit their risk by controlling their potential losses and leveraging strategies like hedging to offset market fluctuations.

2. Potential for Outsized Returns

Options trading offers the potential for outsized returns, especially when market conditions are highly volatile or a specific market direction is anticipated. However, it’s important to note that options trading also carries risks of loss, and traders should manage their positions carefully.

3. Diversification

Trading options can diversify a portfolio and provide additional income streams. By incorporating options strategies, traders can potentially offset losses from other investments and generate returns in both rising and falling markets.

Considerations for Coinbase Trading Options

1. Premium Costs

The premium paid for an option contract represents the cost of the option. This cost varies depending on factors such as market volatility, time to expiration, and the strike price. Traders should consider the premium cost when calculating potential returns and risk management strategies.

2. Expiration Dates

Each option contract has a specific expiration date. Options become worthless if not exercised or sold before the expiration date. Traders need to be aware of the expiration dates and manage their positions accordingly.

3. Market Volatility

Market volatility plays a crucial role in the pricing and profitability of options contracts. Traders should understand how to analyze market volatility and how it can impact their options trading strategies.

Conclusion

Coinbase trading options offer a flexible and powerful tool for traders seeking to navigate the cryptocurrency market effectively. By understanding the types, benefits, and considerations of Coinbase trading options, traders can enhance their trading strategies, manage risk, and potentially generate outsized returns. It’s essential to conduct thorough research, practice prudent risk management, and stay informed about market dynamics to maximize the potential benefits of Coinbase trading options while minimizing risks.

Image: techcrunch.com

Coinbase Trading Options

https://youtube.com/watch?v=n7BCH4fAYuY