Introduction

Image: www.ifcm.co.uk

In the enigmatic realm of finance, where fortunes are won and lost, there exists a formidable tool that grants investors the power to amplify their potential returns: options trading CFDs. These contracts have captivated the attention of both seasoned and aspiring traders alike, promising the allure of substantial profits. However, navigating their complexities can be a daunting task, requiring a blend of knowledge, strategy, and a touch of audacity.

In this comprehensive guide, we will venture into the labyrinthine corridors of options trading CFDs, unraveling their intricacies and empowering you with the insights necessary to make informed decisions. From understanding their fundamental concepts to mastering their practical applications, we will illuminate your path towards financial literacy and self-confidence.

Diving into the World of Options Trading CFDs

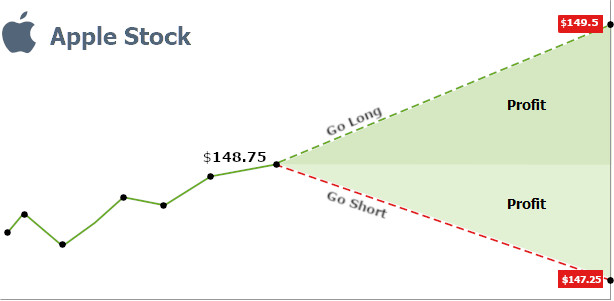

Options trading CFDs, or contracts for difference, represent an ingenious financial instrument that allows traders to speculate on the future price movements of an underlying asset without needing to own it outright. These instruments derive their name from the contractual agreement between the buyer and seller, whereby the buyer (option holder) pays a premium to acquire the “right” (not an obligation) to exercise the option at a predetermined price (strike price) before or at its expiration date.

The versatility of options trading CFDs extends beyond their mere access to a broader range of financial markets. They empower traders to tailor their contracts to suit their investment objectives. Whether seeking leverage to magnify potential gains, hedging against risk, or generating income through premium collection, options offer a myriad of strategies to satisfy diverse trading styles.

Unveiling the Key Concepts of Options Trading

-

Option Types: The primary distinction within the realm of options trading lies in the two fundamental types: calls and puts. A call option confers upon the buyer the right to purchase the underlying asset at the strike price, while a put option grants the holder the right to sell.

-

Expiration Date: Every options trading CFD carries a predetermined expiration date, which serves as the pivotal moment when the contract matures. At this juncture, the option holder must decide whether to exercise their right to buy or sell the underlying asset or let the contract expire worthless.

-

Strike Price: This pivotal element represents the price at which the option holder may exercise their right to buy or sell the underlying asset once the contract reaches maturity.

-

Premium: The cost of acquiring an option, known as its premium, plays a pivotal role in the economics of options trading. The premium reflects the market’s valuation of the likelihood that the underlying asset will reach or exceed the strike price before expiration.

Delving into the Benefits and Risks of Options Trading CFDs

Benefits:

-

Leveraged Exposure: Options provide investors with access to substantial leverage, allowing them to multiply potential profits. However, it is crucial to remember that leverage amplifies not only potential profits but also potential losses.

-

Hedging against Risk: Options serve as potent tools for hedging against potential losses on other investments. Their inherent flexibility empowers investors to tailor strategies that offset unfavorable market movements.

-

Diversification: Options offer a versatile avenue for portfolio diversification, providing exposure to various asset classes and trading strategies.

Risks:

-

Loss of Principal: Unlike stocks and bonds, where the potential loss is limited to the invested capital, options trading involves the risk of losing the entire premium paid for the contract.

-

Time Decay: The relentless march of time can be an adversary to options traders, especially for those holding short-term contracts. As expiration nears, the time value component of the premium diminishes, potentially eroding the option’s intrinsic value.

Harnessing the Power of Expert Insights

Emily Jones, a seasoned options trader with two decades of experience, emphasizes the importance of understanding the interplay between market dynamics and option pricing. She cautions, “Successful options trading demands a keen eye for market trends, volatility patterns, and the art of reading charts effectively.”

“Risk management should be the cornerstone of every options trader’s strategy,” advises David Smith, a leading industry analyst. “Emphasize position sizing, diversification, and never risking more than you can afford to lose.”

Transformative Tips for Navigating Options Trading

-

Education is Paramount: Arm yourself with a comprehensive understanding of options terminology, concepts, and strategies. Knowledge is your most potent weapon in this enigmatic arena.

-

Practice with Virtual Trading: Before venturing into live trading, simulate real-world experiences through virtual trading platforms. This invaluable sandbox empowers you to refine your skills and test strategies without risking capital.

-

Monitor Market Conditions: Keep a pulse on the markets you’re engaged in. Stay attuned to economic data, news events, and geopolitical influences that can impact asset prices.

-

Seek Mentorship: Find an experienced trader who can guide you through the intricacies of options trading. Their knowledge and wisdom can prove invaluable.

Conclusion

Options trading CFDs present an alluring path towards financial empowerment, but they are not without their risks. By embracing knowledge, practicing prudent risk management, and leveraging the insights of experts, you can unravel the complexities of this remarkable financial tool. Remember, the journey of options trading is a perpetual quest for knowledge and adaptation. So, trade with confidence, embrace the potential for exceptional returns, and may your every trade be profitable.

Image: www.pinterest.com

Options Trading Cfd

Image: uk.finecobank.com