Introduction:

Image: disneyartdrawingseasycoloringpages.blogspot.com

In the pulsating world of financial markets, where fortunes are made and lost in a matter of hours, thrill seekers and risk-tolerant traders embark on a captivating journey called swing trading weekly options. This exhilarating strategy, where opportunities dance in the twilight zone between short-term scalping and long-term investing, presents a unique blend of potential rewards and challenges that has fascinated traders for decades.

Swing traders, armed with a keen eye for price trends and a versatile understanding of derivatives, patiently hunt for market inflections and capitalize on them with deftly placed trades held for several days to weeks. They exploit the inherent volatility of weekly options, a type of financial contract that conveys the right (but not the obligation) to buy or sell an underlying asset at a predetermined price within a specific time frame. By artfully combining technical analysis and options theory, these traders navigate the ebb and flow of market sentiment, seeking to profit from both bull and bear market swings.

Harnessing the Swing Trading Edge:

While the allure of swing trading is undeniable, the path to success is paved with both opportunities and pitfalls. Embarking on this trading adventure requires a thorough understanding of the intricacies involved, a disciplined mindset, and a steadfast commitment to risk management.

To excel as a swing trader of weekly options, individuals must master a myriad of skills, including:

-

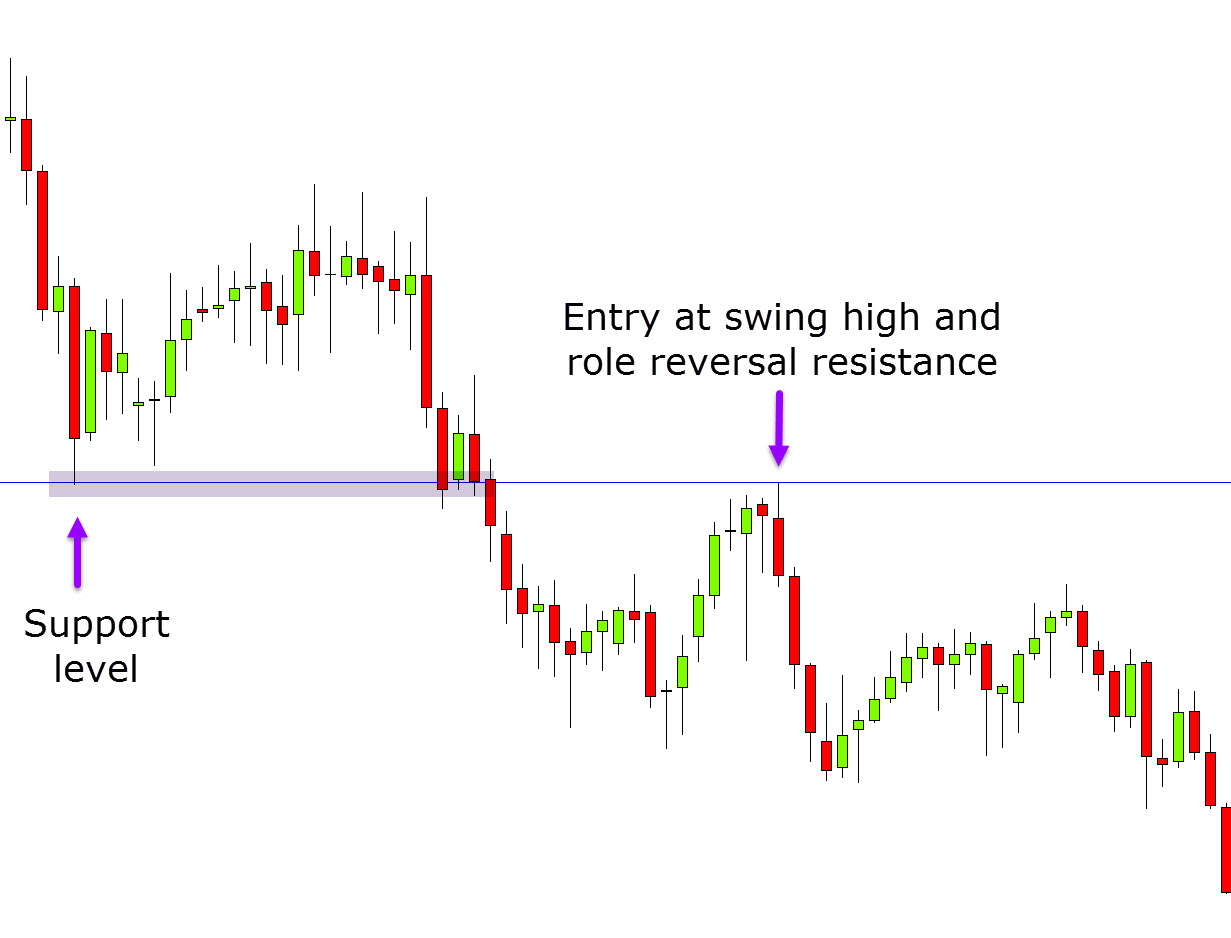

Technical Analysis: Interpreting chart patterns, recognizing indicators, and discerning support and resistance levels empower traders to identify potential trend changes and actionable trading signals.

-

Options Strategy Selection: Navigating the diverse landscape of option strategies, from bullish calls to bearish puts, and comprehending their respective risk and reward profiles are crucial for optimizing trades.

-

Position Sizing and Risk Management: Calculating optimal trade sizes, meticulously placing stop-loss orders, and maintaining prudent leverage levels are essential safeguards that protect capital and prevent catastrophic losses.

Why Swing Trading Weekly Options Stands Out:

Despite the inherent risks inherent in options trading, swing trading weekly options offers several compelling advantages that distinguish it as a sought-after strategy:

-

Time Advantage: The abbreviated duration of weekly options compared to traditional monthly contracts allows traders to capture short-term market swings, potentially reducing exposure to unforeseen macroeconomic events or unexpected news announcements.

-

Enhanced Leverage: The leverage embedded within options contracts amplifies both the potential profits and potential losses. This leverage can magnify trading outcomes, enabling traders to control larger positions with a relatively modest outlay.

-

Flexibility and Adaptability: Swing trading weekly options offers remarkable flexibility, allowing traders to capitalize on both rising and falling markets. By alternating between long (buy) and short (sell) positions, traders can adeptly weather market volatility and seek consistent gains.

Conclusion:

Swing trading weekly options is an enthralling and potentially lucrative trading strategy, but it demands a deep understanding of financial markets, a mastery of options concepts, and an unwavering commitment to sound risk management practices. For traders who possess these qualities, the allure of swing trading beckons, promising both the thrill of risk and the satisfaction of unlocking market opportunities.

Image: www.pinterest.com

Swing Trading Weekly Options