Introduction

Navigating the intricate world of options spread trading can be an arduous task without the proper tools. Enter options spread trading software—a game-changing innovation that has revolutionized the trading landscape. This cutting-edge technology empowers traders of all levels with sophisticated analytical and execution capabilities, enabling them to make informed decisions and maximize their trading potential.

Image: purrgramming.life

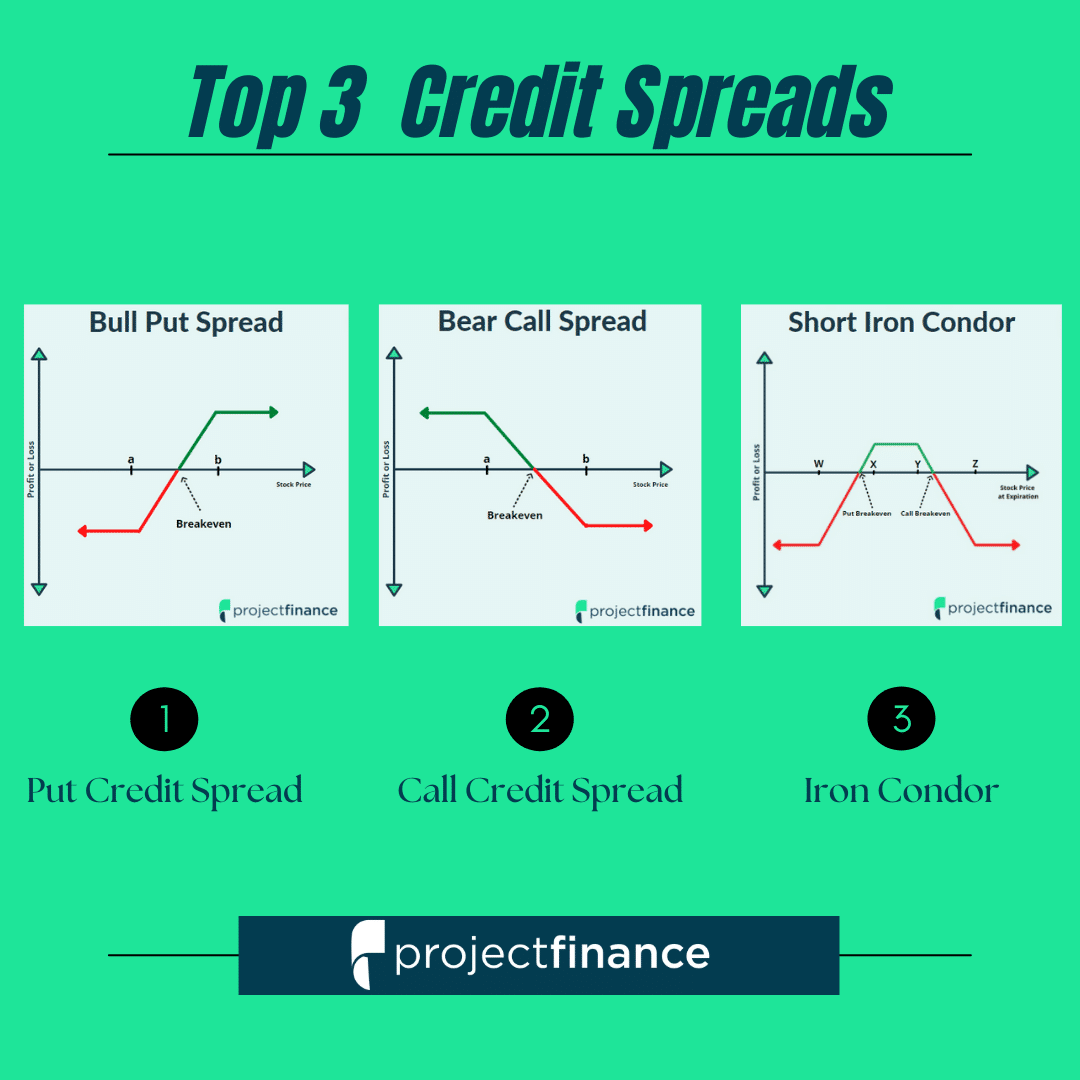

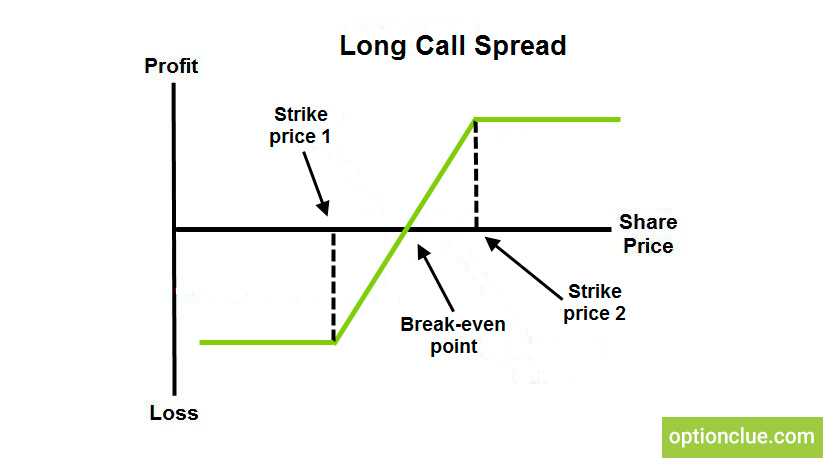

Options spread trading involves simultaneously buying and selling different strikes or expiration dates of the same option type, creating a combination known as a “spread.” This strategy allows traders to diversify their positions, manage risk, and potentially enhance their returns. However, the complexities associated with spread trading demand a robust software solution to facilitate seamless implementation and analysis.

Benefits of Options Spread Trading Software

Options spread trading software offers a myriad of advantages for traders:

- Real-time data analysis: Monitor market conditions, price movements, and volatility fluctuations in real time, ensuring informed decision-making.

- Spread builder and optimizer: Create and fine-tune complex spreads with ease. Optimize your strategies based on pre-defined criteria to maximize profitability.

- Risk management tools: Calculate and manage risk exposures, including Greeks and other key metrics, for comprehensive risk assessment.

- Strategy backtesting: Evaluate trading strategies historically using historical data, improving your understanding of market dynamics and refining your approach.

- Automated trade execution: Execute trades swiftly and efficiently with the ability to set alerts and stop-loss orders, leaving ample time for other trading activities.

How to Utilise Options Spread Trading Software

To leverage the full potential of options spread trading software, follow these steps:

- Identify a trading strategy: Determine your trading objectives and develop a well-defined spread trading strategy that aligns with your risk tolerance and investment goals.

- Choose a reputable software provider: Select a software solution that meets your specific trading needs and provides reliable data and robust functionality.

- Set up your account and configure settings: Install the software, create an account, and customize settings according to your preferences and trading strategy.

- Analyze market conditions: Monitor market data and identify trading opportunities. Use the software’s analytical tools to assess market sentiment, volatility, and other relevant factors.

- Build and execute your spread: Create your spread using the software’s intuitive builder. Once satisfied with your strategy, execute the trade with confidence, knowing that you have optimized your spread for maximum potential.

Expert Tips and Advice

Enhance your options spread trading journey with these expert tips:

- Stay informed: Keep abreast of market news and updates to stay attuned to emerging trends and market movements.

- Manage risk effectively: Utilize the software’s risk management tools to monitor your positions closely and mitigate potential losses.

- Practice discipline: Adhere to your trading plan and avoid emotional decision-making. Discipline is crucial for long-term trading success.

- Seek continuous education: Learn from experienced traders, attend webinars, and read financial literature to expand your knowledge and refine your strategies.

- Choose quality over cost: Invest in a software solution that aligns with your trading needs and provides superior data quality and functionality.

Image: www.commodityresearchgroup.com

FAQ

Here are answers to some common questions about options spread trading software:

- Q: What is the best options spread trading software?

A: The optimal software depends on your trading needs. Consider factors such as functionality, reliability, user interface, and cost before making a decision. - Q: Is it necessary to use options spread trading software?

A: While not mandatory, options spread trading software significantly enhances your trading experience. It provides valuable tools for analysis, execution, and risk management. - Q: Can I use options spread trading software with my existing trading platform?

A: Compatibility with your trading platform varies depending on the software you choose. Check with your platform provider or the software vendor for specific compatibility details. - Q: How do I learn to use options spread trading software effectively?

A: Consult the software’s documentation, attend online tutorials, or consider seeking professional guidance from an experienced trader. - Q: What are the benefits of using options spread trading software?

A: Benefits include real-time data analysis, spread builder and optimizer, risk management tools, strategy backtesting, and automated trade execution.

Options Spread Trading Software

Image: optionclue.com

Conclusion

Options spread trading software has emerged as an indispensable tool for savvy traders seeking to navigate the complex world of options spread trading. Its ability to provide real-time data analysis, optimize spread strategies, and manage risk effectively empowers traders to make informed decisions and enhance their trading potential. Embrace options spread trading software today and unlock the potential for greater trading success.

Are you eager to delve deeper into the world of options spread trading and explore the benefits that software can offer? Let us know your thoughts and questions, and we’ll be glad to assist you on this exciting trading journey.