Prelude: The Maze of Investing

Venturing into the realm of investing can be likened to navigating a labyrinth, teeming with myriad pathways and choices. Amidst this complexity, two primary avenues emerge: options contracts and purchasing 100 shares of a given stock. Both options offer distinct advantages and drawbacks, and understanding these nuances is paramount for achieving financial success.

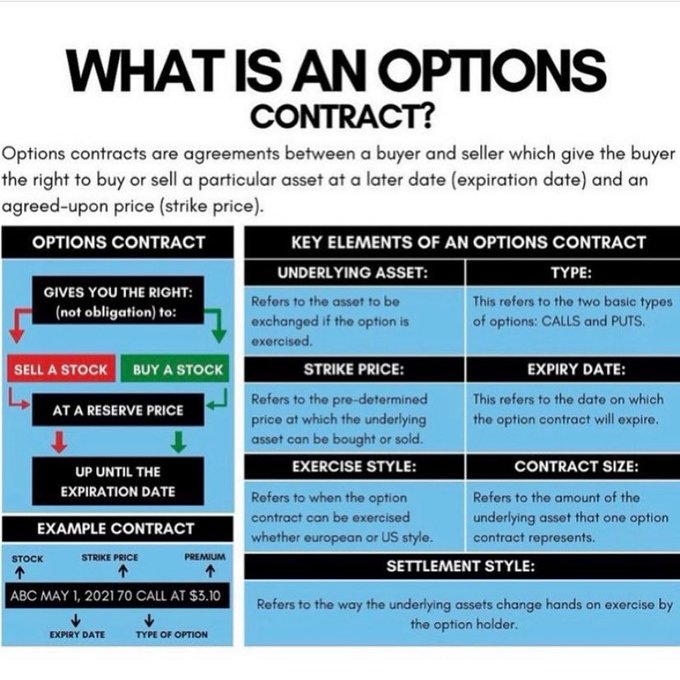

Image: en.rattibha.com

Before delving into the specifics, let’s establish some fundamental premises. Options contracts are derivative instruments that grant the holder the right, but not the obligation, to buy or sell an underlying asset (in this case, 100 shares) at a specified price on or before a designated date. On the other hand, buying 100 shares entails acquiring direct ownership of the underlying security.

Options Contracts: Navigating the Premiums

When it comes to options contracts, a crucial concept to grasp is the premium. This premium represents the price paid to the seller of the contract in exchange for the option to buy or sell the underlying asset at the agreed-upon price. The premium is influenced by several factors, including the underlying asset’s price, the time remaining until the contract’s expiration date, and the level of market volatility. By understanding these determinants and studying historical data, traders can strategize their options premium trading for optimal results.

Options contracts offer both potential rewards and risks. The ability to leverage relatively small amounts of capital to control much larger positions is one of the main advantages. This characteristic makes options premium trading accessible to investors with limited capital. Additionally, options provide flexibility in terms of the various strategies they can be utilized for, such as hedging, income generation, and speculation.

The Direct Approach: Buying 100 Shares

In contrast to options contracts, purchasing 100 shares of a stock represents direct ownership in the underlying company. As a shareholder, one is entitled to a proportionate share of any dividends issued by the company and holds voting rights that can influence corporate decisions. Furthermore, buying 100 shares provides the opportunity to benefit directly from the price appreciation of the underlying stock.

However, it is critical to recognize the inherent risks associated with purchasing 100 shares. Unlike options contracts, where losses are generally limited to the premium paid, buying shares exposes the investor to the full downside potential of the stock’s price decline. Therefore, a thorough understanding of the company’s fundamentals, industry dynamics, and market conditions is imperative before committing to a stock purchase.

Trading Options vs. Buying 100 Shares: A Comparative Analysis

To make an informed decision between trading options contracts and buying 100 shares, a comprehensive comparison of the two strategies is essential. While both approaches present opportunities for financial gain, the underlying mechanisms, risk profiles, and potential rewards are quite distinct.

- Risk Profile: Options contracts offer begrenzte liability, with the maximum loss capped at the premium paid. In contrast, buying 100 shares exposes the investor to unlimited downside risk.

- Capital Requirements: Options contracts generally require less capital than buying 100 shares, making them accessible to investors with limited funds.

- Flexibility: Options contracts provide greater flexibility through the wide range of strategies they can be employed for, including hedging and income generation.

- Potential Returns: While both options contracts and buying 100 shares have the potential for substantial returns, options contracts offer the possibility of achieving higher returns with less capital.

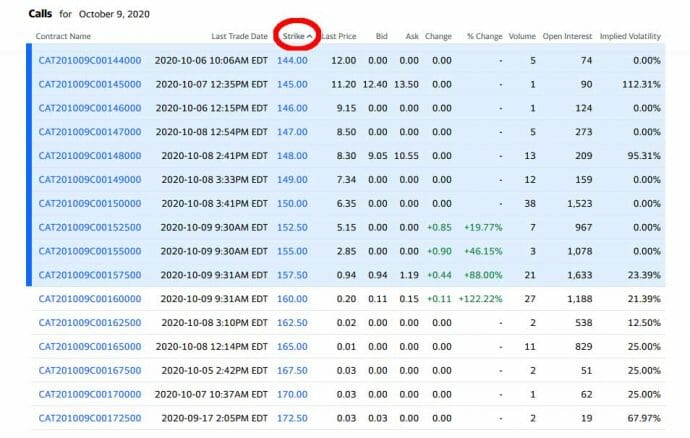

Image: theministerofcapitalism.com

FAQs

To further elucidate the concepts discussed, I’ve compiled a series of frequently asked questions that provide clear and concise answers.

Q: What is the difference between an option and a stock?

A: An option is a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset (100 shares in this case) at a specified price on or before a designated date. A stock, on the other hand, represents direct ownership in the underlying company.

Q: Are options contracts less risky than stocks?

A: While options contracts offer limited liability, they are not necessarily less risky than stocks. Buying shares exposes the investor to the full downside potential of the stock’s price decline, while options contracts limit losses to the premium paid. However, options are more complex and require a deeper understanding of market dynamics.

Q: Is it better to trade options or buy shares?

A: The choice between trading options or buying shares depends on individual circumstances, risk tolerance, and investment goals. Options offer greater potential returns with less capital but also carry higher risks. Stocks provide direct ownership and voting rights but expose the investor to unlimited downside risk.

Options Contracts Premium Trading Vs Buying The 100 Shares

Image: blog.quantinsti.com

Pearl of Weisheit

Navigating the financial markets can be likened to a game of chess – understanding the myriad of pieces and their strategic potential is key to formulating a winning strategy. By comprehending the intricacies of options contracts, including their premiums and risk-reward profile, in comparison to buying 100 shares, investors can equip themselves with the knowledge necessary to make informed decisions and cultivate long-term financial success.

Tell me, dear reader, have the tides of this article sparked a quench for further exploration? Are you eager to delve deeper into the realm of options contract trading or the enigmatic world of stock ownership? Let your curiosity be your guide, for the journey of financial literacy is a lifelong endeavor.