The bustling world of financial markets has always fascinated me. From the skyscrapers that house the behemoths that shape global economies to the humble beginnings of ambitious traders, it’s a captivating sphere that combines the thrill of the unknown with the promise of financial success. Among the vast array of investment opportunities that beckon, options trading has always held a particular allure for me, and the NDX (Nasdaq 100) index stands as a beacon of opportunity within this realm.

Image: ibkrcampus.com

Unlocking the Potential of NDX Options Trading

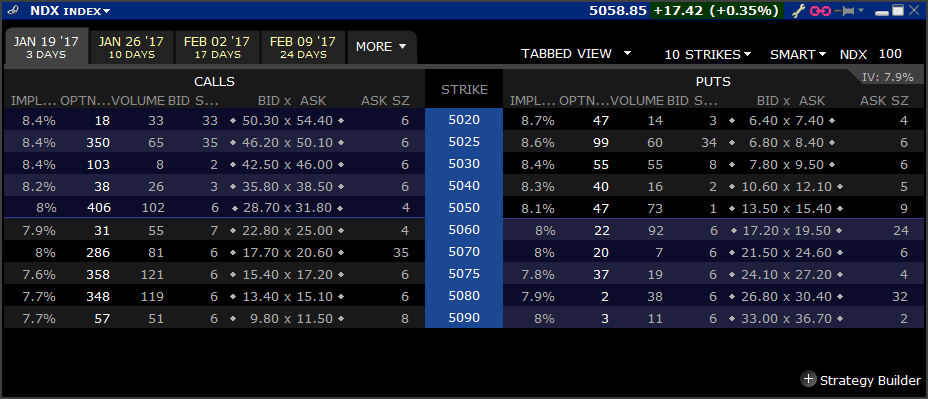

The NDX index, comprising 100 of the largest non-financial companies listed on the Nasdaq stock exchange, offers a gateway to the vibrant technology sector. The underlying companies that make up the index are at the forefront of innovation, driving breakthroughs in industries ranging from software and biotechnology to e-commerce and semiconductors. This inherent dynamism translates into immense potential for those who seek to harness the power of derivatives such as options to capitalize on market movements.

A Comprehensive Overview of NDX Options Trading

Options, in essence, are contracts that grant the holder the right but not the obligation to buy or sell an underlying asset at a specified price on or before a particular date. In the context of NDX options trading, the underlying asset is the NDX index itself. By engaging in options trading, investors can speculate on the future direction of the index, potentially profiting from both upward and downward movements.

Harnessing the Power of Options Strategy

The versatility of options trading extends beyond merely predicting the direction of the market. With options, traders can craft intricate strategies tailored to their risk tolerance and investment goals. From simple call and put options that provide direct exposure to the underlying asset to more complex strategies like spreads and straddles that offer nuanced risk-reward profiles, the options market caters to a wide spectrum of trading styles.

Understanding the intricacies of options trading is paramount for those who aspire to navigate this complex arena successfully. Proper due diligence, including thorough research and a firm grasp of market dynamics, is essential to make informed decisions. Furthermore, consulting with experienced professionals and leveraging educational resources can significantly enhance one’s trading acumen.

Image: www.optiontradingtips.com

Tips and Expert Advice for NDX Options Traders

As an avid trader who has traversed the labyrinthine corridors of the financial markets for years, I have garnered invaluable insights that can guide aspiring NDX options traders. Foremost among these is the importance of establishing clear trading goals and objectives. Whether you seek income generation, capital appreciation, or portfolio diversification, a well-defined roadmap will serve as an indispensable compass.

Furthermore, meticulous risk management should be the cornerstone of every trading strategy. Thoroughly assessing potential risks and implementing strategies to mitigate them is paramount to preserving capital and ensuring long-term success. This includes setting appropriate stop-loss orders, maintaining proper position sizing, and understanding the concept of delta hedging.

Common Questions and Concise Answers about NDX Options Trading

Q: What are the key advantages of NDX options trading?

A: NDX options trading offers the potential for high returns, leverage, and flexibility in implementing various trading strategies.

Q: What is the best strategy for beginners in NDX options trading?

A: For beginners, simple call and put options are suitable starting points, allowing for direct exposure to the underlying asset.

Q: How can I mitigate risks in NDX options trading?

A: Implement robust risk management strategies, including setting stop-loss orders, maintaining proper position sizing, and understanding delta hedging techniques.

Ndx Options Trading

Image: marketwiseasia.com

Conclusion: Unveiling the Path to Success in NDX Options Trading

The realm of NDX options trading presents a compelling opportunity for investors seeking to tap into the transformative power of the technology sector. By harnessing the versatility of options and adopting sound trading practices, traders can navigate the market’s complexities and potentially reap significant rewards. Whether you are a seasoned trader or just beginning to explore the world of options, embracing the principles outlined in this article will pave the way for a successful journey.

Are you ready to embark on the exciting adventure of NDX options trading? Let the journey begin!