Image: pubfasr154.weebly.com

Introduction

In the dynamic world of financial markets, options trading has emerged as a powerful tool for investors seeking to harness volatility and potentially enhance their portfolios. As a leading brokerage platform, Fidelity offers a robust platform for option trading, catering to both experienced traders and those taking their first steps into this complex arena. This comprehensive guide will delve into the nuances of option trading work on Fidelity, empowering you with the knowledge and strategies to navigate this fascinating realm.

Understanding Options Trading

At its core, option trading involves the exchange of contracts that give the buyer the “option” to buy or sell an underlying asset, such as a stock, at a predetermined price (strike price) within a specified period (expiration date). The defining feature of options is that they confer this right but do not obligate the exercise of that right.

Benefits of Option Trading

The allure of option trading stems from its ability to unlock unique investment opportunities. Options can serve as:

- Risk management tools: Hedging against portfolio fluctuations by offsetting potential losses.

- Income generators: Generating premiums through option sales or leveraging price differentials.

- Leverage amplifiers: Magnifying potential profits with limited capital outlay compared to stock ownership.

Fidelity’s Option Trading Platform

Fidelity offers a state-of-the-art option trading platform that empowers traders with:

- Advanced charting tools: Visualizing market patterns, identifying trends, and making informed decisions.

- Real-time market data: Accessing up-to-date quotes and tracking market movements relentlessly.

- Educational resources: An extensive library of articles, videos, and webinars covering option trading basics and advanced strategies.

Approaching Option Trading Work

Embarking on option trading on Fidelity requires a methodical approach. Here are crucial steps to consider:

- Understand your risk tolerance: Determine the amount of loss you are comfortable with, as options trading carries inherent risks.

- Educate yourself: Familiarize yourself with the fundamentals of options, different types of options, and trading strategies.

- Start small: Begin with smaller trades, gradually increasing your exposure as you gain confidence and experience.

- Use the available tools: Leverage Fidelity’s platform capabilities for market analysis, strategy testing, and risk management.

Expert Insights

“Option trading on Fidelity allows investors to tap into market opportunities and customize strategies tailored to their risk profile,” advises Emily Carter, an expert options trader.

“Key to success lies in understanding the Greek measures and applying them to strategize trades,” adds Robert Adams, a financial analyst.

Actionable Tips

- Prioritize researching the underlying asset and understanding its price behavior before trading options.

- Utilize stop-loss orders to limit potential losses and protect your capital.

- Consider using limit orders to execute trades at specific price levels, ensuring optimal pricing.

- Monitor market conditions, especially news and economic events, as they can significantly impact option prices.

Conclusion

Option trading work on Fidelity empowers investors with the tools and opportunities to harness market volatility and craft tailored investment strategies. By embracing a mindful and strategic approach, leveraging Fidelity’s platform, and seeking guidance from experts, individuals can navigate this dynamic realm effectively and potentially enhance their investment portfolios. Whether seeking to manage risk, generate income, or amplify leverage, Fidelity offers a robust platform and invaluable resources for option trading success.

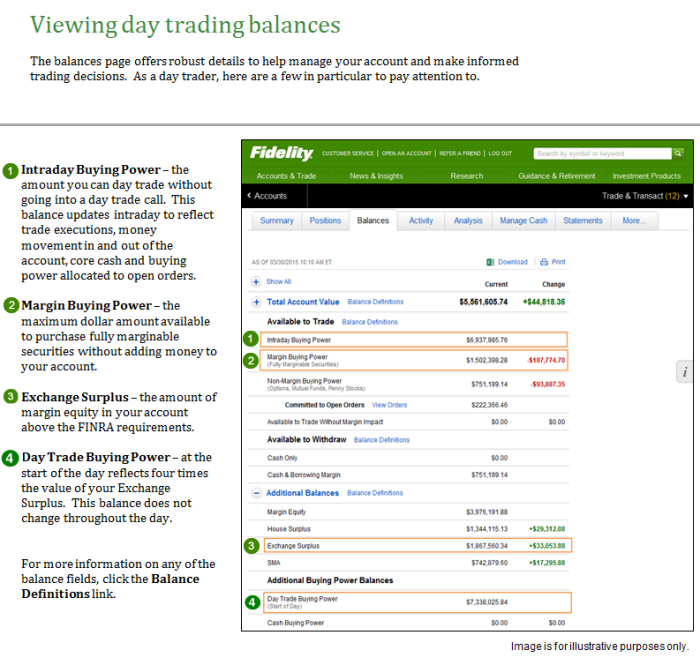

Image: www.calibrateindia.com

Option Trading Work On Fidelity

Image: ywepubuy.web.fc2.com