Embarking on the captivating realm of options trading demands a thorough understanding of market dynamics and trading hours. Fidelity Investments, a trusted brokerage powerhouse, provides a robust platform for investors seeking opportunities in the options market. This comprehensive guide will delve into the intricacies of Fidelity options trading hours, empowering you with the knowledge to navigate the markets strategically.

Image: www.warriortrading.com

Options, versatile financial instruments that bestow the right to buy or sell an underlying asset at a predetermined price, are subject to specific trading hours. Fidelity options trading hours closely mirror the underlying asset’s trading hours, allowing for efficient and timely execution of trades. Understanding these trading windows is crucial to maximizing trading opportunities and mitigating risks.

Navigating Fidelity Options Trading Hours

Fidelity options trading hours align with the operating hours of the underlying asset’s exchange. For instance, options on stocks listed on the Nasdaq or New York Stock Exchange trade during the regular market hours of 9:30 AM to 4:00 PM EST. Options on futures contracts follow the trading hours of the respective futures exchange.

However, it’s noteworthy that Fidelity extends its options trading hours for certain indices and ETFs, offering traders greater flexibility. For instance, options on the S&P 500 Index (SPX) and Nasdaq 100 Index (NDX) are available for trading from 8:30 AM to 9:00 AM EST, known as the pre-market session, and from 4:00 PM to 5:00 PM EST, known as the post-market session.

Understanding Pre-Market and Post-Market Trading

Pre-market and post-market trading sessions provide opportunities to execute trades before or after the regular market hours, offering several advantages. These extended hours allow traders to react to overnight news and events that may impact the underlying asset’s price, enabling them to adjust their positions accordingly.

While these extended trading sessions offer flexibility, it’s important to note that liquidity may be lower during these periods, potentially affecting the execution price and speed of trades. Traders should carefully consider the potential risks and benefits before engaging in pre-market or post-market trading.

Leveraging Fidelity’s Option Trading Features

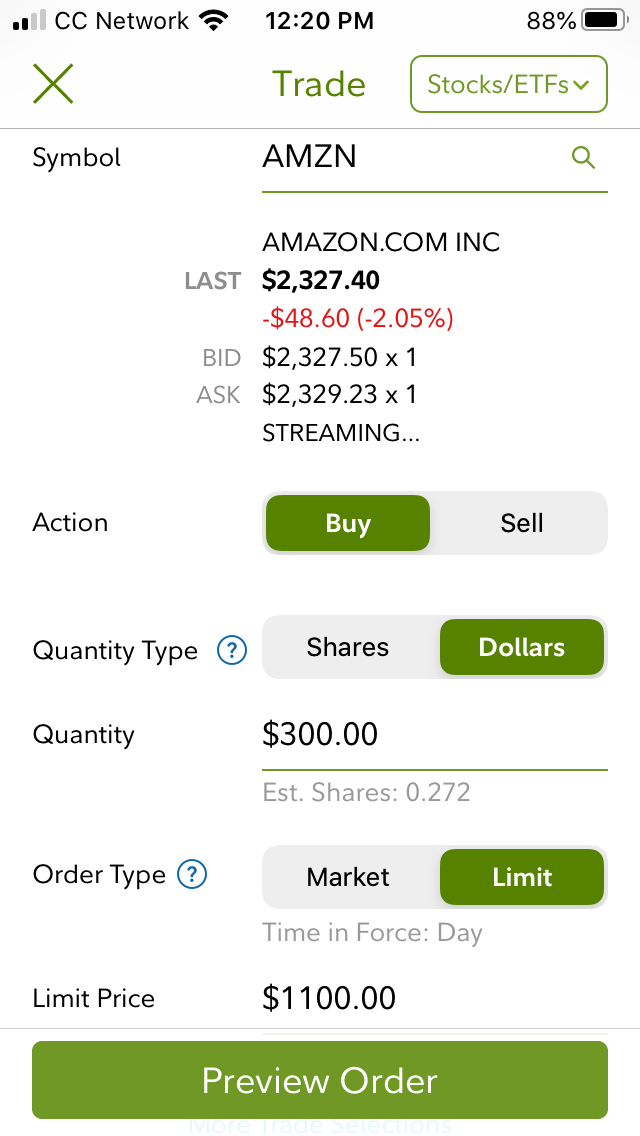

Fidelity’s robust trading platform empowers options traders with a suite of advanced features designed to enhance the trading experience. Traders can access real-time quotes, analyze historical data, and develop sophisticated trading strategies using Fidelity’s user-friendly interface.

Fidelity’s Research & Insights center provides valuable market commentary, in-depth analysis, and expert opinions, equipping traders with the knowledge they need to make informed decisions. The platform also offers educational resources, such as webinars and articles, to help traders refine their skills and expand their understanding of options trading.

Image: www.warriortrading.com

Fidelity Options Trading Hours

Conclusion

Mastering Fidelity options trading hours is fundamental to maximizing trading opportunities and minimizing risks in the volatile options market. By adhering to these trading windows and leveraging Fidelity’s exceptional platform, traders can navigate the markets with confidence. Remember to continuously stay informed about market dynamics and adjust your trading strategies accordingly to navigate the ever-evolving world of options trading.