Unlock the Opportunities of After-Hours Options Trading with Fidelity

Options trading has become increasingly popular among investors seeking to enhance their financial portfolio. Fidelity, a leading financial services company, offers investors the opportunity to trade options even after traditional market hours. This guide delves into the world of Fidelity options trading after hours, empowering you to make informed decisions and seize the potential benefits of extended-hours trading.

![[Fidelity Mobile App] How to Trade Stocks Pre-Market and After Hours ...](https://i.ytimg.com/vi/KrGGtemkZkE/maxresdefault.jpg)

Image: www.youtube.com

Benefits of Fidelity Options Trading After Hours

- Extended Trading Hours: Fidelity’s after-hours trading service extends trading hours beyond the traditional 9:30 AM to 4:00 PM ET, allowing you to execute trades until 8:00 PM ET. This extended window provides you with additional flexibility to adjust your positions, manage your portfolio, and capitalize on market fluctuations that may occur outside of regular trading hours.

- Enhanced Market Access: After-hours trading grants you access to the broader market, enabling you to stay ahead of the curve and react to market news and events in a timely manner. This agility can be particularly beneficial when volatility arises during extended trading sessions, allowing you to make quick and decisive decisions.

- Risk Management: After-hours trading offers an avenue for risk management. You can utilize options strategies, such as spreads or covered calls, to mitigate potential losses incurred during regular trading hours. By utilizing these strategies after hours, you can potentially limit downside risk and protect your portfolio.

Understanding Fidelity’s After-Hours Trading Platform

Fidelity’s trading platform provides state-of-the-art tools and resources to facilitate after-hours options trading. Key features include:

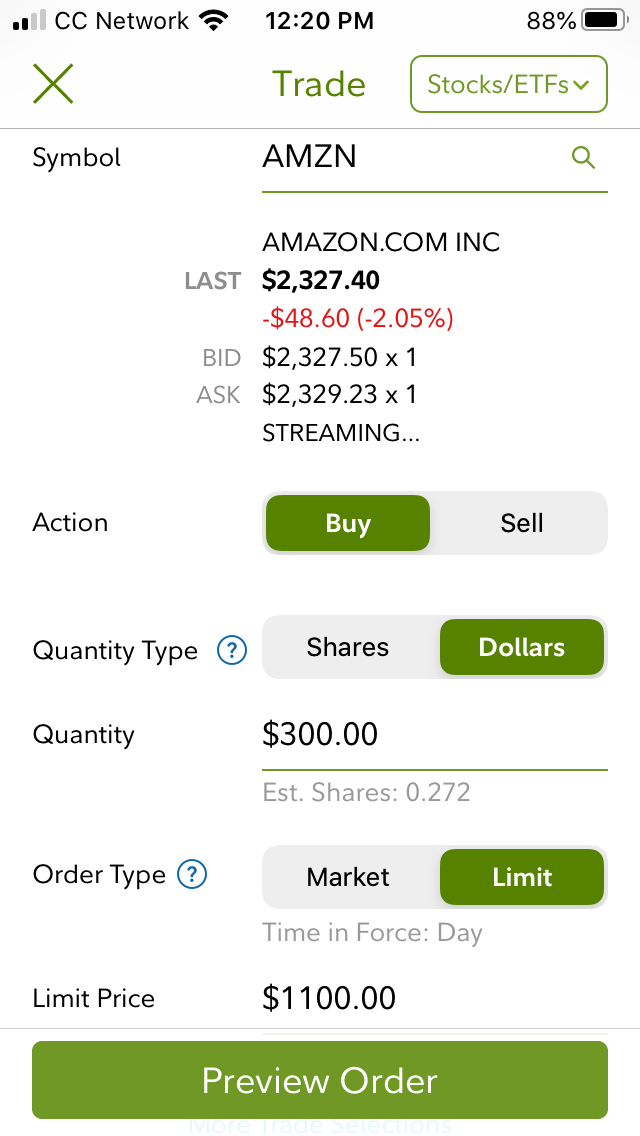

- Streamlined Interface: The platform’s user-friendly interface simplifies after-hours trading. You can seamlessly navigate the platform, execute trades, and monitor your positions with ease.

- Advanced Order Types: Fidelity offers a range of order types, including limit orders, stop orders, and trailing stops, empowering you to tailor your trading strategies to specific market conditions.

- Real-Time Data and Charts: Access real-time market data and charting tools to analyze market trends, identify trading opportunities, and make informed decisions.

- Comprehensive Market Reports: Stay updated with comprehensive market reports and news, ensuring you have the latest insights and information at your fingertips.

Strategies for After-Hours Options Trading

- Spread Trading: By combining multiple options contracts with different expiration dates and strike prices, you can employ spread trading strategies to reduce risk and potentially enhance returns.

- Covered Calls: Generate additional income by selling (writing) covered calls against stocks you own. This strategy allows you to collect premiums while limiting your potential for profit on the underlying shares.

- Iron Condor: An iron condor involves buying and selling both puts and calls at different strike prices. It’s a neutral strategy that aims to profit from a narrow price range while limiting potential losses.

Image: www.warriortrading.com

Fidelity Options Trading After Hours

Image: www.warriortrading.com

Conclusion

Fidelity options trading after hours offers a unique opportunity for investors to extend their reach into the markets and potentially enhance their financial strategies. With its extended trading hours, enhanced market access, and risk management tools, Fidelity empowers you to navigate the complexities of after-hours trading. By understanding the benefits, utilizing the platform’s capabilities, and implementing appropriate strategies, you can position yourself to capitalize on the potential rewards of extended-hours options trading.