In the realm of financial markets, where volatility reigns, options emerge as versatile instruments offering both potential rewards and risks. Option trading calls, specifically, empower traders to speculate on the future price trajectory of an underlying asset, granting them the flexibility to profit from both rising and falling markets. To navigate this complex arena successfully, traders must possess an analytical mindset and a keen understanding of option trading calls analysis.

Image: www.optiontradingtips.com

Decoding Option Trading Calls: A Foundation

An option contract embodies a legal agreement between two parties: the buyer and the seller. Upon purchasing an option, the buyer acquires the “right but not the obligation” to execute a trade (either buying or selling) on a specified underlying asset at a predetermined price (strike price) by a specific expiration date. Option trading calls refer to the strategy of buying an option with the expectation that its value will increase over time.

Dissecting the Anatomy of an Option Trade

To analyze option trading calls effectively, traders must first grasp the fundamental elements that shape the value of an option contract:

- Underlying Asset: The asset whose price fluctuations impact the option’s value (e.g., stocks, commodities, indices)

- Strike Price: The predetermined price at which the underlying asset can be bought (call option) or sold (put option)

- Expiration Date: The date by which the option contract expires and loses its validity

- Premium: The price paid by the option buyer to acquire the contract

Factors Influencing Option Call Premiums

The premium of an option call is not static; it fluctuates based on a confluence of factors:

- Intrinsic Value: The difference between the strike price and the current price of the underlying asset

- Time Value: The value of the option’s remaining time until expiration

- Volatility: The expected price fluctuations of the underlying asset

- Interest Rates: The prevailing interest rate environment

Image: www.youtube.com

Analyzing Option Calls: Technical and Fundamental Approaches

Option trading calls analysis involves employing both technical and fundamental approaches:

- Technical Analysis: Examines historical price patterns and market indicators to identify potential price trends and trading opportunities. Traders use charts, technical indicators, and statistical models to forecast future price movements.

- Fundamental Analysis: Focuses on company-specific factors, industry trends, and macroeconomic conditions that can impact the value of the underlying asset. Analysts assess factors like earnings reports, economic data, and geopolitical events.

Managing Option Calls: Risk and Reward

Option trading calls entail both potential rewards and risks. Traders must carefully assess the following considerations:

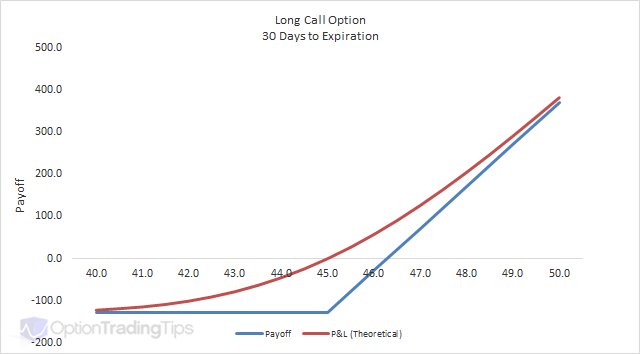

- Maximal Profit Potential: The maximum gain on a call option is the difference between the strike price and the premium paid when the underlying asset price rises significantly.

- Maximal Loss Potential: The maximum loss is limited to the premium paid.

- Volatility Risk: Since options respond sensitively to price fluctuations, high volatility can amplify both gains and losses.

- Time Decay: As an option approaches its expiration date, its time value diminishes, potentially leading to losses if the underlying asset price does not rise sufficiently.

Option Trading Calls Analysis

Image: www.pinterest.com

Conclusion: Unveiling Market Insights through Option Trading Call Analysis

Option trading calls analysis is an art and a science that empowers traders to harness market opportunities. By delving into the intricacies of options, traders can enhance their ability to make informed trading decisions, optimize risk management, and potentially achieve superior financial returns. Whether embarking on technical or fundamental analysis, it is essential to approach this realm with a keen mind and a comprehensive understanding of the dynamics at play. So, embrace the challenge, embrace the journey, and let the enigmatic world of option trading calls unfold its secrets to you.