Imagine yourself as an intrepid stock trader, seeking new frontiers and lucrative opportunities. Today, we embark on an exciting expedition into the realm of index options trading, unlocking the secrets that can elevate your financial prowess.

Image: tradingstrategyguides.com

Introduction to Index Options Trading

Index options are financial instruments that derive their value from the performance of a specific market index, such as the S&P 500 or NASDAQ-100. Unlike stock options, which are tied to the performance of an individual company, index options provide exposure to broader market movements.

These versatile financial tools empower traders to speculate on the future direction of the underlying index, allowing for both hedging strategies and speculative plays. With index options, you can gain access to sizeable market exposure, leverage your capital, and hedge against potential losses.

5 Essential Index Options Trading Tips

Mastering the art of index options trading requires a multifaceted approach, incorporating both technical analysis and strategic decision-making. Here are five invaluable tips to guide you on this path:

- Choose Liquid Options: Opt for options contracts with high trading volume, ensuring sufficient liquidity for smooth execution and tight bid-ask spreads.

- Manage Risk with Precision: Calculate your position size meticulously, considering your risk tolerance and account balance. Utilize stop-loss orders to mitigate potential losses.

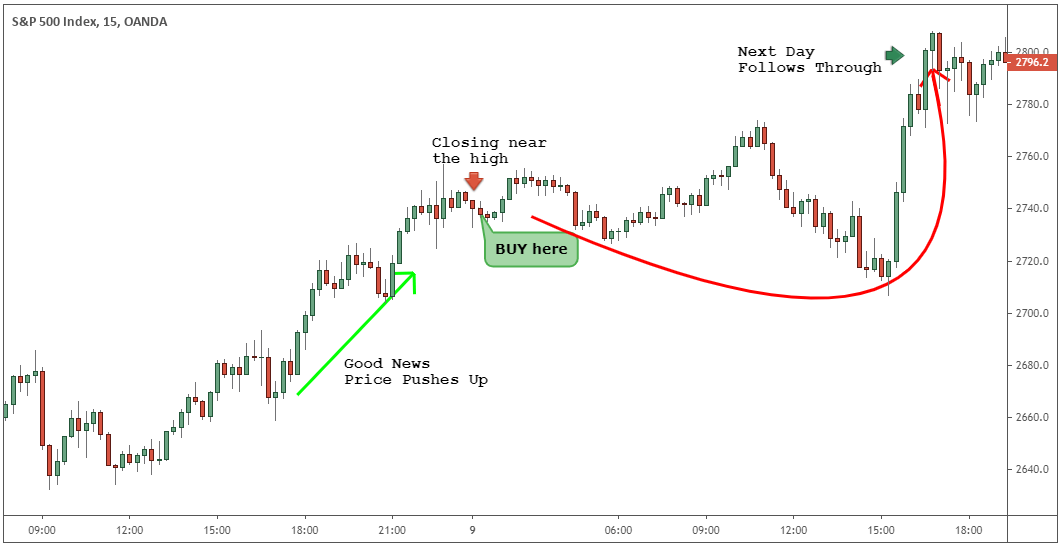

- Monitor Market News: Stay abreast of economic data, company earnings, and geopolitical events that can significantly impact index performance. News-driven market movements can offer lucrative trading opportunities.

- Consider Implied Volatility: Assess the implied volatility (IV) of an option contract to gauge market expectations and potential price swings. High IV implies greater volatility and potentially higher premiums.

- Learn from Experienced Traders: Seek mentorship from seasoned traders, attend webinars, and participate in trading forums to expand your knowledge base and hone your skills.

By integrating these tips into your trading strategy, you can enhance your decision-making and unlock the full potential of index options trading.

Frequently Asked Questions about Index Options Trading

To address common inquiries surrounding index options trading, we present a comprehensive FAQ:

- Q: What are the underlying assets of index options?

- A: Index options derive their value from the performance of market indices, such as the S&P 500, Nasdaq-100, and Dow Jones Industrial Average.

<li><strong>Q: How are index options priced?</strong></li>

<li><strong>A:</strong> The premium of an index option is influenced by factors such as the underlying index price, time to expiration, strike price, interest rates, and implied volatility.</li>

<li><strong>Q: What are some common strategies for index options trading?</strong></li>

<li><strong>A:</strong> Popular strategies include bull call spreads, bear put spreads, and iron condor trades, which involve combining multiple options contracts to create customized risk-reward profiles.</li>

<li><strong>Q: How do I start index options trading?</strong></li>

<li><strong>A:</strong> Open a brokerage account that supports options trading, familiarize yourself with options terminology and strategies, and practice with paper trading before risking real capital.</li>

Image: www.asktraders.com

Index Options Trading Tips

Image: koniukhchaslau.com

Conclusion

Index options trading offers a powerful avenue for skilled traders seeking market leverage, hedging opportunities, and speculative profits. By embracing the principles outlined in this article and continually refining your knowledge, you can embark on a rewarding journey in this dynamic financial arena.

We invite you to explore the world of index options trading further, deepening your understanding of these versatile instruments and unlocking their potential. Are you ready to seize the opportunities that await you in this exciting financial realm?