Introduction

Stock market trading can be a lucrative endeavor, but it also comes with its fair share of risks. To navigate the volatile waters of the market and maximize your chances of success, it is crucial to have a well-defined trading strategy. One such strategy that has gained immense popularity among traders is Bank Nifty options trading. Bank Nifty options provide a wide range of opportunities for both beginners and experienced traders alike. However, it is essential to understand the nuances of this trading strategy before venturing into it. This comprehensive guide will delve into the world of Bank Nifty options trading, providing a detailed overview of the basics, strategies, and tips to help you make informed trading decisions.

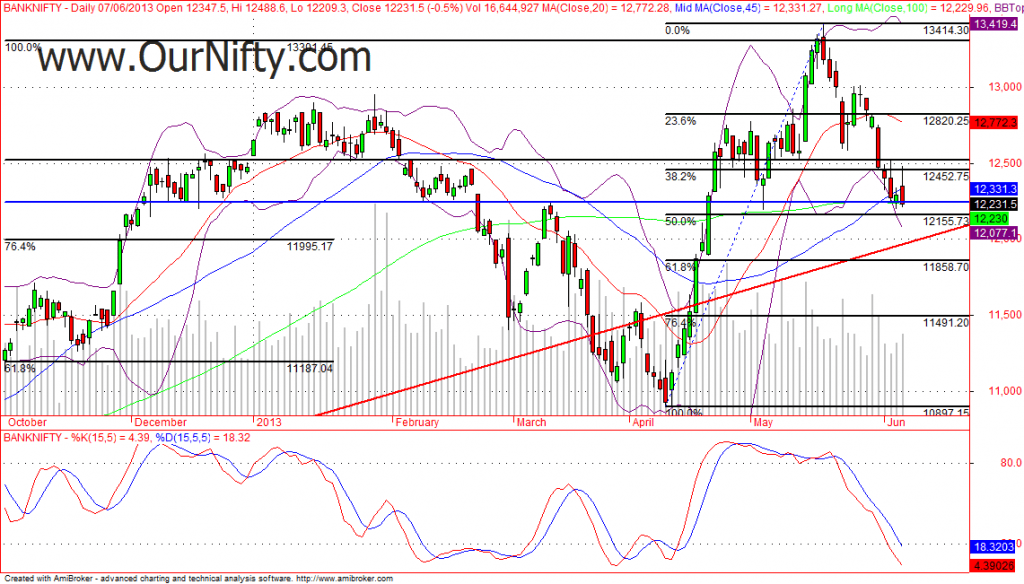

Image: ournifty.com

Understanding Bank Nifty Options

Bank Nifty, also known as NIFTY Bank, is an index composed of the top 12 liquid and high-Beta banking stocks listed on the National Stock Exchange (NSE) in India. Bank Nifty options are financial contracts that derive their value from the underlying index. They provide traders with the flexibility to take both bullish and bearish positions on the index’s future movement without the need to buy or sell the underlying stocks directly. Bank Nifty options contracts have a standardized lot size of 25 shares and come with a fixed expiry period of weekly, monthly, or quarterly.

Strategies for Bank Nifty Options Trading

The Bank Nifty index exhibits significant volatility, making it suitable for a range of trading strategies. Some of the most common strategies include:

-

Buying calls: This strategy is employed when the trader anticipates an upward movement in the Bank Nifty index. By buying a call option, the trader gains the right, but not the obligation, to purchase the index at a specific price (strike price) on or before a specified date. This strategy profits when the index rises above the strike price by an amount greater than the premium paid for the option.

-

Buying puts: This strategy is suitable when the trader expects the Bank Nifty index to fall. By purchasing a put option, the trader gains the right to sell the index at a particular strike price on or before a specific date. This strategy offers profit when the index drops below the strike price by more than the premium paid for the option.

-

Selling calls: Selling call options allows traders to generate income by profiting from a decline or sideways movement in the Bank Nifty index. This strategy involves selling a call option to another trader at a specific strike price and expiry date. The seller receives an upfront premium and benefits if the index remains below the strike price on the expiry date. However, if the index rises above the strike price, the seller may be obligated to deliver the underlying shares at the agreed-upon price.

-

Selling puts: Selling put options offers another way to generate income from the Bank Nifty index. By selling a put option, the trader is giving another trader the right to sell the index at a specific strike price on or before a certain date. This strategy profits if the index remains above the strike price, as the trader retains the premium received when selling the option. If the index falls below the strike price, the seller may be obligated to buy the underlying shares.

Tips for Successful Bank Nifty Options Trading

-

Know your risk appetite: Before venturing into Bank Nifty options trading, it is crucial to have a clear understanding of your risk tolerance. Determine the amount of capital you are comfortable losing and trade accordingly.

-

Choose appropriate strategies: Different trading strategies suit different market conditions and personalities. Select strategies that align with your risk tolerance and trading style.

-

Control emotions: Trading, particularly Options trading, can be an emotional rollercoaster. It is vital to keep emotions in check and maintain discipline while making trading decisions.

-

Start with paper trading: Paper trading provides a risk-free environment to practice and refine your trading strategies. Once you gain confidence, you can transition to live trading with small positions.

-

Manage risk effectively: Risk management is paramount in Options trading. Use stop-loss orders to limit potential losses and position sizing to ensure you do not expose too much capital on any single trade.

Image: priceactionhub.com

Bank Nifty Options Trading Strategy

Conclusion

Bank Nifty options trading can be a powerful tool for both income generation and capital appreciation. However, it is essential to approach this strategy with a thorough understanding of the risks involved and the strategies available. By carefully implementing the tips outlined in this guide, you can enhance your chances of success in the volatile world of Bank Nifty options trading. Remember to always conduct thorough research and stay updated with market trends to make informed trading decisions. With patience and discipline, you can harness the potential of Bank Nifty options trading and achieve your financial goals.