Imagine a world where you can harness the power of fluctuating currencies or bet on the future trajectory of market prices, all while potentially reaping substantial profits. This dynamic world exists in the realms of financial trading, specifically options trading and forex trading. But which path should you embark on? And which strategy aligns best with your risk appetite and financial goals?

Image: investluck.com

This in-depth exploration delves into the exciting and complex world of options and forex trading. We will unveil the fundamental differences, explore the potential rewards and risks, and equip you with the knowledge to make informed decisions about your investment journey.

Defining the Playing Field: Options vs. Forex

What are Options?

Options trading involves the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (the strike price) on or before a specific date (the expiration date). Think of it as a contract that grants you the flexibility to profit from price fluctuations without the full commitment of purchasing the asset outright.

There are two main types of options:

- Call options grant the buyer the right to buy the underlying asset at the strike price.

- Put options grant the buyer the right to sell the underlying asset at the strike price.

What is Forex?

Forex, short for foreign exchange, is the global marketplace where currencies are traded. It’s the largest and most liquid financial market in the world, operating 24 hours a day, five days a week. Forex traders capitalize on the fluctuations between currency pairs, buying and selling them based on their predictions of future value changes.

Image: brainswithconcepts.com

Navigating the Terrain: Understanding the Key Differences

Underlying Assets: A Tale of Two Markets

One crucial distinction lies in the underlying assets traded. Options contracts can be based on a wide range of assets, including stocks, indices, commodities, and even currencies. Conversely, Forex trading focuses solely on currency pairs, such as EUR/USD (Euro vs. US Dollar) or GBP/JPY (British Pound vs. Japanese Yen).

Leverage and Risk: Balancing Power and Peril

Both options and Forex trading offer leverage, allowing you to control positions larger than your initial investment. This amplification can boost potential profits, but it also magnifies potential losses. Forex trading typically provides higher leverage than options, potentially leading to greater gains but also a higher level of risk.

Contract Expiration: The Time Factor

Options contracts have a defined expiration date, while Forex trades are typically held for shorter periods. You must manage the expiration risk associated with options, making it essential to understand the contract terms and manage your positions effectively. Forex trading, with its shorter timeframes, requires a more active approach to trading and a keen understanding of market trends.

Types of Trading Strategies

Both options and Forex offer a range of trading strategies, each with unique advantages and drawbacks. Options trading encompasses strategies like covered calls, cash-secured puts, bull spreads, and bear spreads. Forex traders utilize scalping, day trading, swing trading, and trend trading, each tailored to specific market conditions and risk tolerances.

The Rewards and Risks: Weighing the Potential

Potential Returns: Chasing Gains

Both options and Forex trading offer the potential for substantial financial gains, but the potential returns are often proportional to the risk involved. Options, with their levered nature, can generate significant profits, especially if correctly identified. Forex trading, with its inherent volatility, also holds the prospect of rapid price fluctuations, potentially leading to sizable gains.

Risk Management: Mitigating Losses

Managing risk is paramount in both options and Forex trading. While leverage amplifies potential returns, it also exacerbates potential losses. Stop-loss orders can be implemented in both markets to limit losses on individual trades, but they may not always be effective in volatile market conditions. Options trading can involve additional risks, including the potential for the entire investment amount to be lost if the option expires worthless.

Volatility and Liquidity: Market Dynamics

Volatility, the degree of price fluctuations, is a key factor in both markets. Options trading tends to thrive in times of high volatility, as it creates more opportunities for price movements. Forex trading, with its highly liquid nature, can also experience rapid price swings, especially during economic releases or geopolitical events. Liquidity, or the ease with which an asset can be bought or sold, is generally high in both markets, but it can fluctuate depending on the specific asset and market conditions.

Exploring the Landscape: Real-World Applications

Options: Beyond the Basics

Options trading has emerged as a versatile tool for various financial goals. Investors can employ options to:

- Hedge existing portfolios: Reduce risk by offsetting potential losses in other investments.

- Generate income: Sell covered calls or cash-secured puts to earn premiums.

- Speculate on price movements: Buy call options for bullish bets and put options for bearish bets.

Forex: A Global Currency Marketplace

Forex trading offers a unique platform to:

- Capitalize on currency appreciation or depreciation: Buy a currency that is expected to rise in value and/or sell a currency that is expected to fall.

- Hedge against foreign exchange risk: Protect against losses on international transactions due to adverse currency movements.

- Profit from economic events: Trade currencies based on anticipated changes in interest rates, inflation, or government policies.

The Learning Curve: Mastering the Art of Trading

Both options and Forex trading require a significant learning curve, as understanding the nuances of the markets and developing effective trading strategies are essential for success. This can include:

- Fundamental analysis: Analyzing macroeconomic factors, company earnings, and industry trends to predict asset movements.

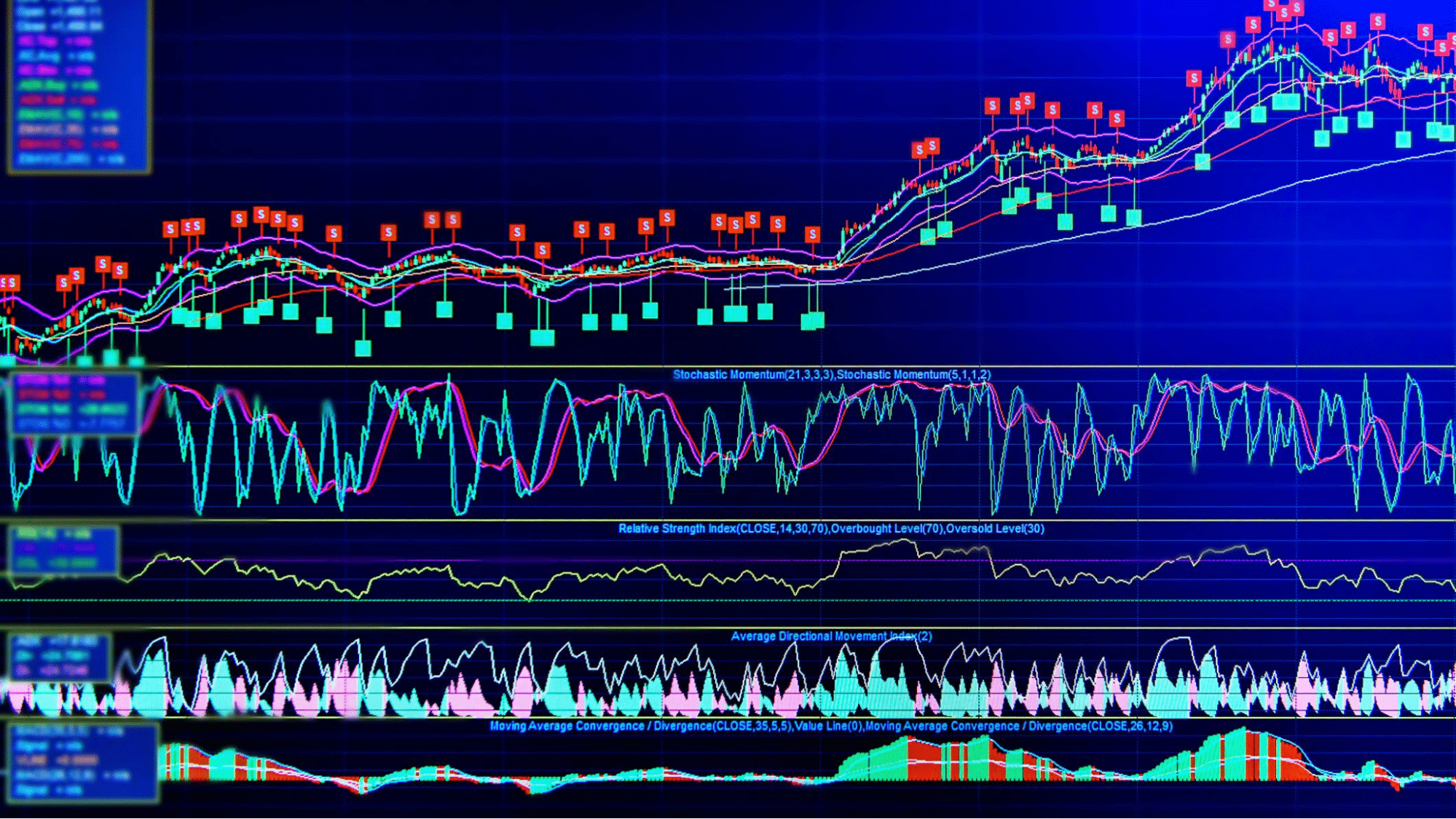

- Technical analysis: Studying price charts and indicators to identify patterns and predict future price action.

- Risk management techniques: Developing strategies to manage potential losses and protect trading capital.

- Understanding trading platforms: Familiarity with trading platforms, order types, and platform features.

The Future Landscape: Emerging Trends and Innovations

Both options and Forex trading are constantly evolving, with new technologies and innovations reshaping the landscape. Emerging trends include:

- Algorithmic trading: Employing automated strategies using computer programs to execute trades based on predefined rules.

- Artificial intelligence (AI) and machine learning: Utilizing AI-powered tools to analyze market data and generate trading signals.

- Cryptocurrency markets: Emerging opportunities for trading digital currencies, including options and futures contracts.

Options Vs Forex Trading

Conclusion: Embarking on Your Trading Journey

The choice between options and Forex trading depends on your individual preferences, risk tolerance, and financial goals. Options offer a versatile tool for hedging, income generation, and speculation, while Forex trading provides liquidity, accessibility, and potential for profiting from currency appreciation. Whether you’re a seasoned trader or a curious newcomer, conducting thorough research, developing a solid understanding of the markets, and practicing effective risk management are essential steps for navigating the exciting and dynamic world of financial trading.

This journey is not without its challenges, but the potential rewards are significant. Embrace the continuous learning process, explore available resources, and always seek professional guidance when needed. The future of your financial success might just be waiting at the intersection of options and Forex trading.