Introduction

The world of finance can be daunting for beginners, but options trading doesn’t have to be. Options trading provides a unique opportunity to increase potential returns and manage risk, making it an attractive investment strategy for both seasoned traders and those new to the market. This comprehensive guide will delve into the basics of options trading, explaining concepts, strategies, and tools to help you navigate the options market confidently.

Image: www.mapsofindia.com

What is Options Trading?

An option is a contract that gives the buyer the right, but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) an underlying asset, such as a stock or index, at a predetermined price (the strike price) on or before a specified date (the expiration date). Options trading allows investors to speculate on the future price movements of an asset without purchasing it outright.

Types of Options

Call Options: Give the buyer the right to buy the underlying asset at the strike price. Call options are used when investors expect the price of the underlying asset to rise.

Put Options: Give the buyer the right to sell the underlying asset at the strike price. Put options are used when investors expect the price of the underlying asset to fall.

Key Terms

- Premium: The price paid by the buyer of an option contract.

- Expiration Date: The day on which the option contract expires. If the option is not exercised before this date, it expires worthless.

- Strike Price: The predetermined price at which the buyer has the right to buy or sell the underlying asset.

- Exercise Date: The date on which the buyer can exercise the right to buy or sell the underlying asset.

- Option Chain: A list of all available option contracts for a specific underlying asset, including their strike prices, expiration dates, and premiums.

Image: muladharayogawear.com

Benefits of Options Trading

- Leverage: Options offer significant leverage, allowing investors to control a larger position in the underlying asset with a smaller investment.

- Flexibility: Options provide flexibility to tailor investment strategies to suit individual risk appetites and market outlooks.

- Risk Management: Options can be used to hedge against downside risk or to enhance returns in bullish markets.

Risks of Options Trading

- Loss of Premium: If the option expires worthless, the buyer loses the premium paid upon purchase.

- Unlimited Loss Potential: Buyers of call options have unlimited loss potential if the underlying asset price moves significantly below the strike price.

- Time Decay: Options lose value as they approach their expiration date, regardless of the underlying asset’s price movement.

Choosing the Right Options Trading App

Choosing the right options trading app is crucial for a successful options trading journey. Consider the following factors when selecting an app:

- User Interface: The app should be easy to navigate and provide clear and up-to-date information.

- Trading Tools: Look for apps that offer robust trading tools, such as charting, technical indicators, and real-time data.

- Educational Resources: The app should provide ample educational materials to enhance your understanding of options trading.

- Fees and Commissions: Compare the fees and commissions charged by different apps to choose the most cost-effective option.

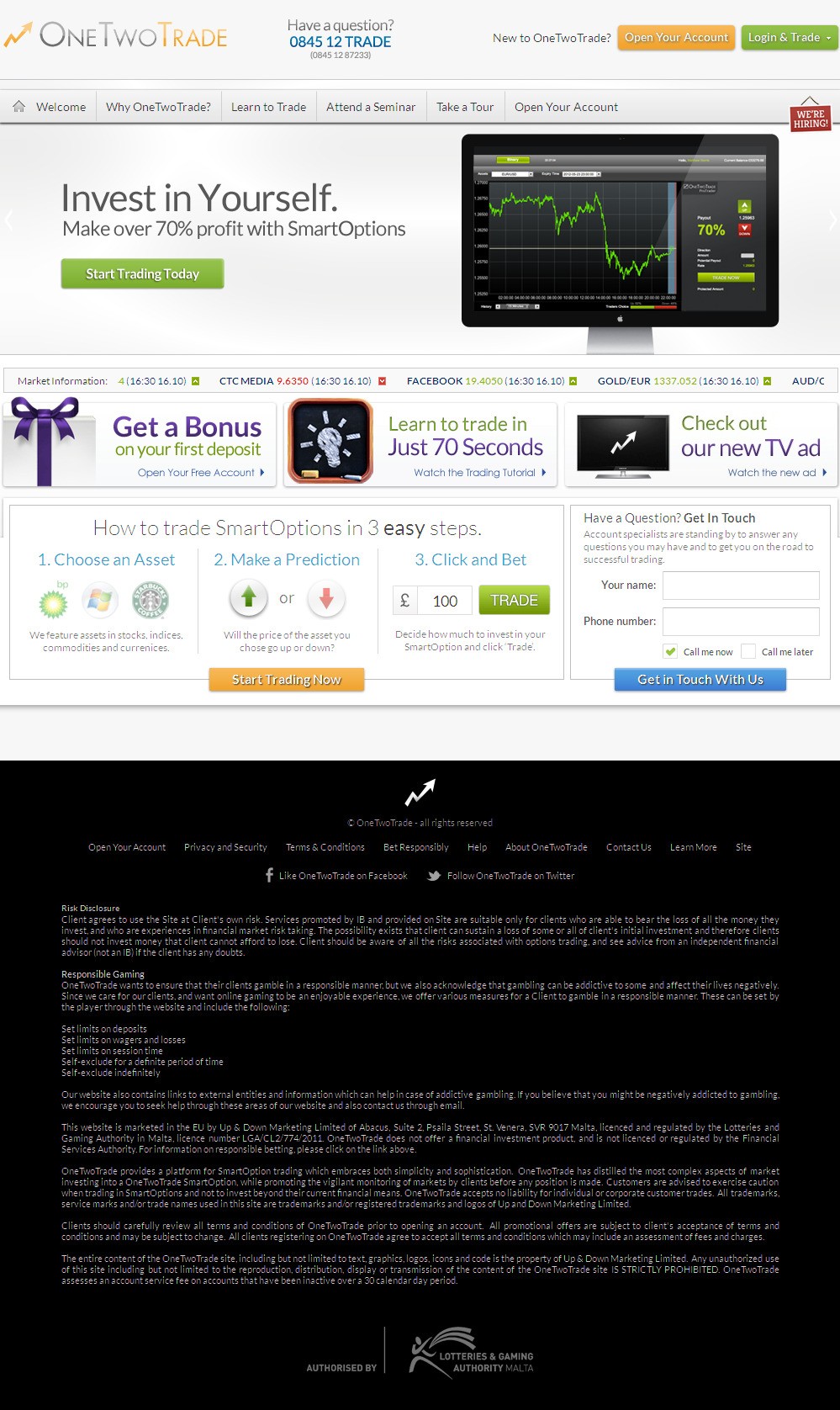

Options Trading App For Beginners

Image: eqogypacuc.web.fc2.com

Getting Started with Options Trading

1. Understand the Concepts: Thoroughly read this guide and explore additional educational resources to grasp the fundamentals of options trading.

2. Practice with Paper Trading: Many options trading apps offer paper trading accounts, which allow you to practice trading without risking actual capital.

3. Choose the Right Strategies: Identify appropriate options strategies based on your risk appetite and market outlook.

4. Open an Account: Once you’re comfortable with paper trading, open a real trading account with a reputable broker.

5. Start Small: Begin with small trades to manage your risk and gain experience.

Conclusion

Options trading provides a powerful tool for investors to maximize potential returns and mitigate risk. By understanding the basics, selecting the right options trading app, and following proven strategies, you can navigate the options market with confidence. Remember to tread cautiously, as options trading carries inherent risks. With careful consideration and a well-informed approach, you can leverage options to enhance your investment portfolio.