Introduction

Welcome to the world of forex option trading! As an initiated trader, I’m excited to share with you the strategies that have helped me achieve success in this dynamic market. Before we delve into the specifics, let’s take a step back and understand the fundamentals.

Image: www.youtube.com

Forex option trading involves the buying and selling of options contracts, which grant the holder the right, but not the obligation, to buy or sell a specified currency pair at a predetermined price (strike price) on or before a specified date (expiration date). This flexibility provides traders with the potential to capitalize on market movements while limiting their risk.

Strategy 1: Covered Call

A covered call strategy involves selling a call option while simultaneously holding an equivalent position in the underlying asset. By doing so, you are granting another trader the right to buy your asset at a higher price within a predefined timeframe. This strategy generates income from the premium received while providing some protection against potential losses.

Strategy 2: Bull Call Spread

A bull call spread is a bullish strategy that involves buying a call option with a lower strike price and selling a call option with a higher strike price. Both options have the same expiration date. By doing so, you create a limited profit potential but a higher probability of profit compared to a single call option purchase.

Strategy 3: Put Options for Bearish Trades

Put options are used to profit from a decline in the value of an underlying asset. By purchasing a put option, you gain the right to sell the asset at a specified price before expiration. This strategy is ideal when you anticipate a bearish market trend and want to hedge your portfolio or speculate on potential losses.

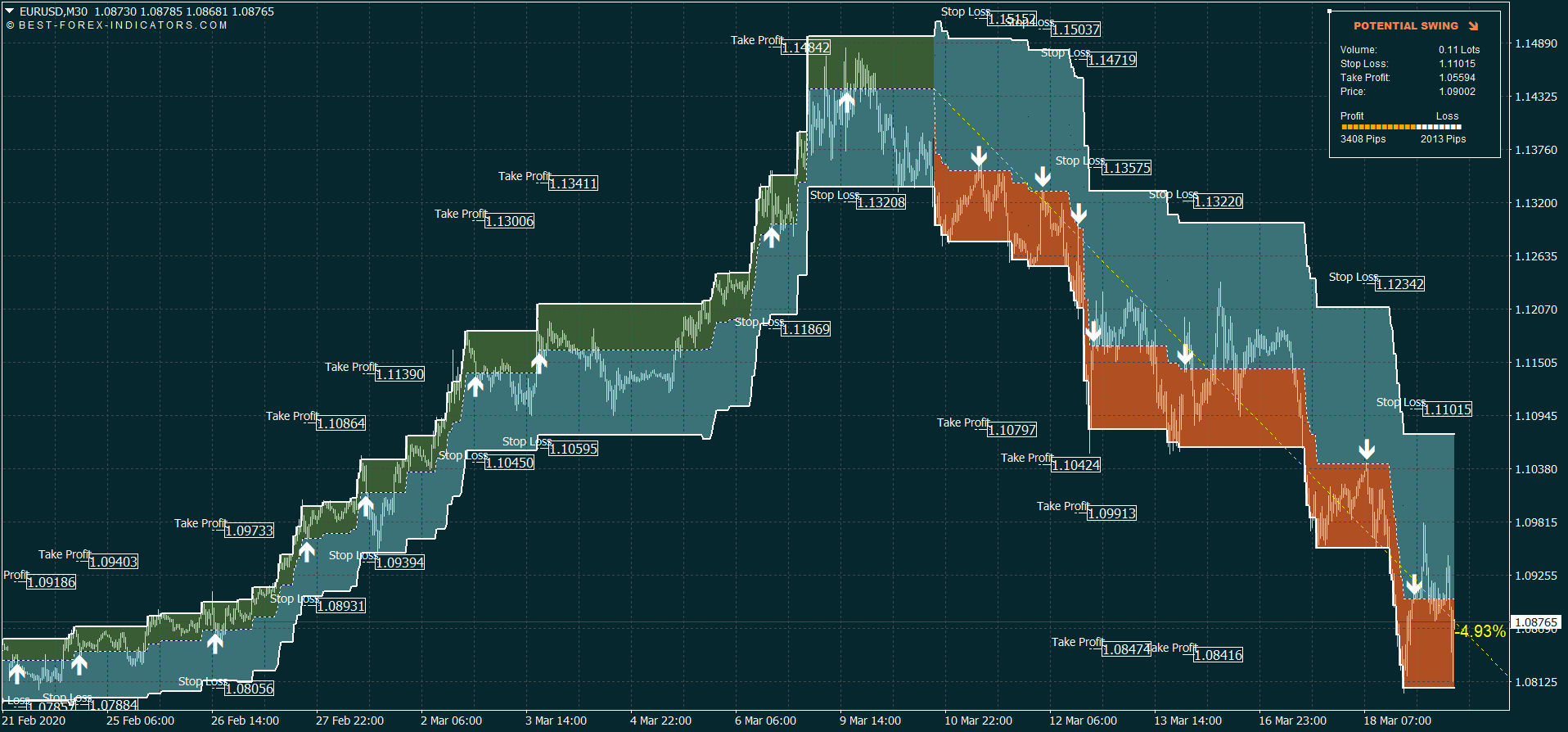

Image: best-forex-indicators.com

Latest Trends in Forex Options Trading

The forex options market is constantly evolving, with new strategies and technologies emerging regularly. One recent trend is the rise of binary options, which offer a simplified and potentially lucrative trading option. Another development is algorithmic trading, which uses computer programs to automate trading decisions based on defined parameters.

Expert Advice for Forex Option Traders

- Choose a reliable and regulated broker: Ensure your trading platform is reputable and complies with industry standards.

- Understand the risks involved: Forex option trading carries inherent risks. Manage your exposure and trade within your risk tolerance.

- Proper Research: Conduct thorough market analysis before entering trades. This includes studying historical charts, economic indicators, and market news.

- Start Small: Begin with small trade sizes and gradually increase your stakes as you gain experience and confidence.

- Utilize Stop-Loss Orders: Protect your profits and limit potential losses by using stop-loss orders to close trades when they reach predetermined levels.

FAQ

- Q: What is the difference between a call and a put option?

A: A call option gives the holder the right to buy an underlying asset, while a put option gives the right to sell an underlying asset.

- Q: What is a strike price?

A: The strike price is the predetermined price at which the holder can exercise the option to buy or sell the underlying asset.

- Q: What is an expiration date?

A: An expiration date is the last day the option contract can be exercised.

Forex Option Trading Strategies

Conclusion

In this article, we have explored the fundamentals of forex option trading strategies. By understanding the different strategies available, staying updated with market trends, and following expert advice, you can increase your chances of success in this exciting and potentially lucrative market. Remember, trading involves risk, so always trade cautiously and within your risk appetite. Is forex trading something you’re interested in learning more about?