Introduction

Enter the captivating realm of options trading on the National Stock Exchange of India (NSE), where savvy investors harness the power of derivatives to navigate market volatility and potentially amplify their returns. Options, financial instruments that bestow the right but not the obligation to buy or sell an underlying asset at a specified price on a predetermined date, offer a versatile array of strategies tailored to diverse investment objectives.

Image: www.entrepreneurshipsecret.com

In this comprehensive guide, we delve into the intricacies of option trading strategies, empowering you with the knowledge and insights to navigate the NSE’s vibrant marketplace. From basic concepts to advanced techniques, we’ll explore innovative approaches to maximize profit potential and mitigate risk.

Understanding Options

Options are contracts that grant the buyer the right to buy (call) or sell (put) an underlying asset, which can be stocks, indices, currencies, or commodities. The buyer has the flexibility to exercise this right at any time before the contract’s expiration date, known as the maturity date. Unlike futures contracts, options do not obligate the buyer to buy or sell the underlying asset, offering greater flexibility and potential for profit.

Types of Options

There are two primary types of options: calls and puts.

- Call Options: Grant the buyer the right to buy the underlying asset at a specified price (strike price) on or before the maturity date.

- Put Options: Grant the buyer the right to sell the underlying asset at a specified price (strike price) on or before the maturity date.

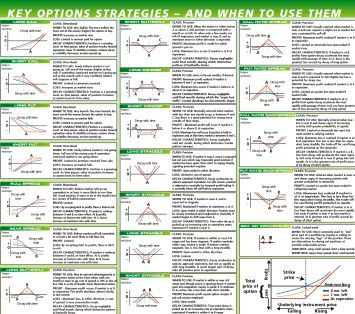

Option Trading Strategies

The NSE offers a plethora of option trading strategies, each with unique characteristics, risk-reward profiles, and suitability for different market conditions.

Image: www.marketsmuse.com

Covered Call Strategy

This strategy involves selling (selling to open) a call option while simultaneously holding an underlying asset equal to the number of contracts sold. It is typically employed in bullish or neutral market conditions, capturing potential upside in the underlying asset while generating income from the option premium.

Cash-Secured Put Strategy

Similar to the covered call strategy, this involves selling a put option while holding an equivalent amount of cash in the trading account. This strategy is suitable for investors anticipating a sideways or slightly bullish market, with the aim of generating income from the option premium.

Bull Call Spread

A bull call spread is a combination strategy involving the purchase (buying to open) of a lower-strike-price call option and the simultaneous sale (selling to open) of a higher-strike-price call option. This spread benefits from limited risk and moderate profit potential in mildly bullish or neutral markets.

Bear Put Spread

In contrast to the bull call spread, a bear put spread consists of the purchase of a higher-strike-price put option and the sale of a lower-strike-price put option. This strategy is appropriate for bear market scenarios where the trader anticipates a decline in the underlying asset’s value.

Iron Condor Strategy

An iron condor is an advanced neutral strategy involving the sale of both a call and a put option at higher strike prices and the purchase of both a call and a put option at lower strike prices. This strategy targets scenarios where the underlying asset’s price is expected to remain within a defined range.

Risk Management in Option Trading

While options trading offers immense potential for profit, prudent risk management is paramount. Here are some strategies to mitigate risks:

- Position Sizing: Calculate the appropriate number of contracts to trade based on your risk tolerance and account size.

- Stop-Loss Orders: Place stop-loss orders to limit potential losses in case the market moves against your position.

- Theta Decay: Understand the dynamic of theta decay, which measures the time decay of an option’s premium, and adjust your strategy accordingly.

- Implied Volatility: Monitor implied volatility levels and trade accordingly, considering the impact of market sentiment on option pricing.

Option Trading Strategies Nse

Image: www.ebay.com

Conclusion

Navigating the complexities of option trading strategies on the NSE requires a comprehensive understanding of the concepts, strategies, and risk management techniques involved. By embracing a knowledge-driven approach and implementing sound risk management practices, investors can harness the power of options to potentially enhance their returns and achieve their financial goals.

Remember, the world of option trading is constantly evolving, demanding continuous learning, adaptability, and the ability to make informed decisions in dynamic market conditions. Stay up-to-date with the latest market trends and trading strategies, and consult with experienced traders or investment professionals when necessary.