Introduction

In the vibrant arena of financial markets, option trading platforms emerge as powerful tools, empowering traders to navigate the ever-changing landscape of risk and reward. Options, intricate financial instruments, grant traders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. Amidst the multitude of platforms available, selecting the right one can make all the difference between profitable trades and costly mistakes.

Image: fity.club

This comprehensive guide delves into the intricacies of option trading platforms, exploring their genesis, fundamental concepts, and practical applications. By deciphering the black and white of these platforms, we illuminate the path to enlightened trading decisions, empowering you to maximize your financial potential.

Evolution and Anatomy of Option Trading Platforms

The roots of option trading can be traced back to the bustling open outcry trading floors, where traders physically gathered to execute orders. Today, technological advancements have revolutionized the trading landscape, giving rise to electronic option trading platforms.

These platforms serve as digital marketplaces, connecting buyers and sellers from around the globe in a virtual realm. They provide traders with access to real-time data, advanced charting tools, and sophisticated order entry systems, empowering them to make informed decisions with lightning speed.

Decoding the Options Trading Arena

At the heart of option trading platforms lies a complex interplay of concepts. Options, as mentioned earlier, bestow traders with the right to buy or sell an underlying asset, such as stocks, indices, or commodities. These contracts are characterized by two key attributes: strike price and expiration date.

The strike price represents the predetermined price at which the trader can exercise their option, while the expiration date marks the deadline by which this right can be exercised. Options can be further categorized into two primary types: calls and puts.

Call options grant the trader the right to buy the underlying asset at the strike price, while put options confer the right to sell. The interplay of these factors creates a dynamic and intricate trading environment, where traders can tailor strategies to align with their risk appetite and market outlook.

Unveiling Option Trading Platforms: A Landscape of Black and White

Navigating the vast array of option trading platforms can be a daunting task. To unravel the complexities, let’s examine the key attributes that differentiate them:

- Trading Interface: The user interface plays a crucial role in determining the overall trading experience. Intuitive interfaces, with clear and concise layouts, empower traders to execute orders efficiently, while cluttered or confusing interfaces can hinder decision-making.

- Order Types: The range of order types supported by a platform is another important consideration. Advanced platforms offer an array of order types, including limit orders, stop orders, and conditional orders, providing traders with greater flexibility and control over their executions.

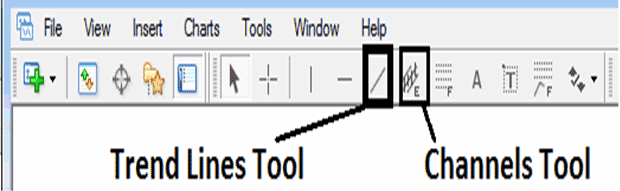

- Real-Time Data and Analytics: Access to real-time market data, including quotes, charts, and news, is essential for effective option trading. Robust platforms provide traders with comprehensive data visualization tools and customizable alerts, enabling them to stay abreast of market movements and make informed decisions.

- Risk Management Tools: Managing risk is paramount in option trading. Effective platforms incorporate robust risk management tools, such as position monitoring, margin calculators, and stop-loss orders, empowering traders to safeguard their capital and minimize potential losses.

- Educational Resources: Educational resources can be invaluable for both novice and experienced traders. Platforms that provide access to tutorials, webinars, and other educational materials empower traders to enhance their knowledge and improve their trading strategies.

Image: www.dolphintrader.com

The Art of Selecting the Perfect Option Trading Platform

The choice of the right option trading platform hinges on several factors, including trading style, risk tolerance, and level of experience. For beginners, user-friendly platforms with simplified interfaces and educational resources may be ideal.

Seasoned traders, on the other hand, may prioritize platforms with advanced order types, comprehensive charting tools, and sophisticated risk management features. Regardless of experience level, it’s prudent to thoroughly research and compare different platforms before making a decision.

Option Trading Platforms Black And White

Image: tradegoldtrading.com

Conclusion

Option trading platforms serve as the gateways to a world of financial opportunities. By understanding the intricacies of these platforms, traders can unlock the potential for profitable trades. Navigating the black and white of option trading platforms empowers traders with informed decision-making, enabling them to capitalize on market opportunities while managing risk.

Remember, the pursuit of financial success is a continuous journey, marked by learning, adaptation, and unwavering determination. Embrace the ever-evolving landscape of option trading with a spirit of exploration, and you will find yourself on the path to financial mastery.