Delving into the Realm of Options Contracts

Option trading presents a captivating and multifaceted dimension in the financial realm. It empowers traders with the ability to harness leverage and speculate on market fluctuations, opening up a vast landscape of opportunities—and potential risks. Whether you’re a seasoned trader or embarking on your first foray into options, this comprehensive white paper will illuminate the intricacies of this dynamic market.

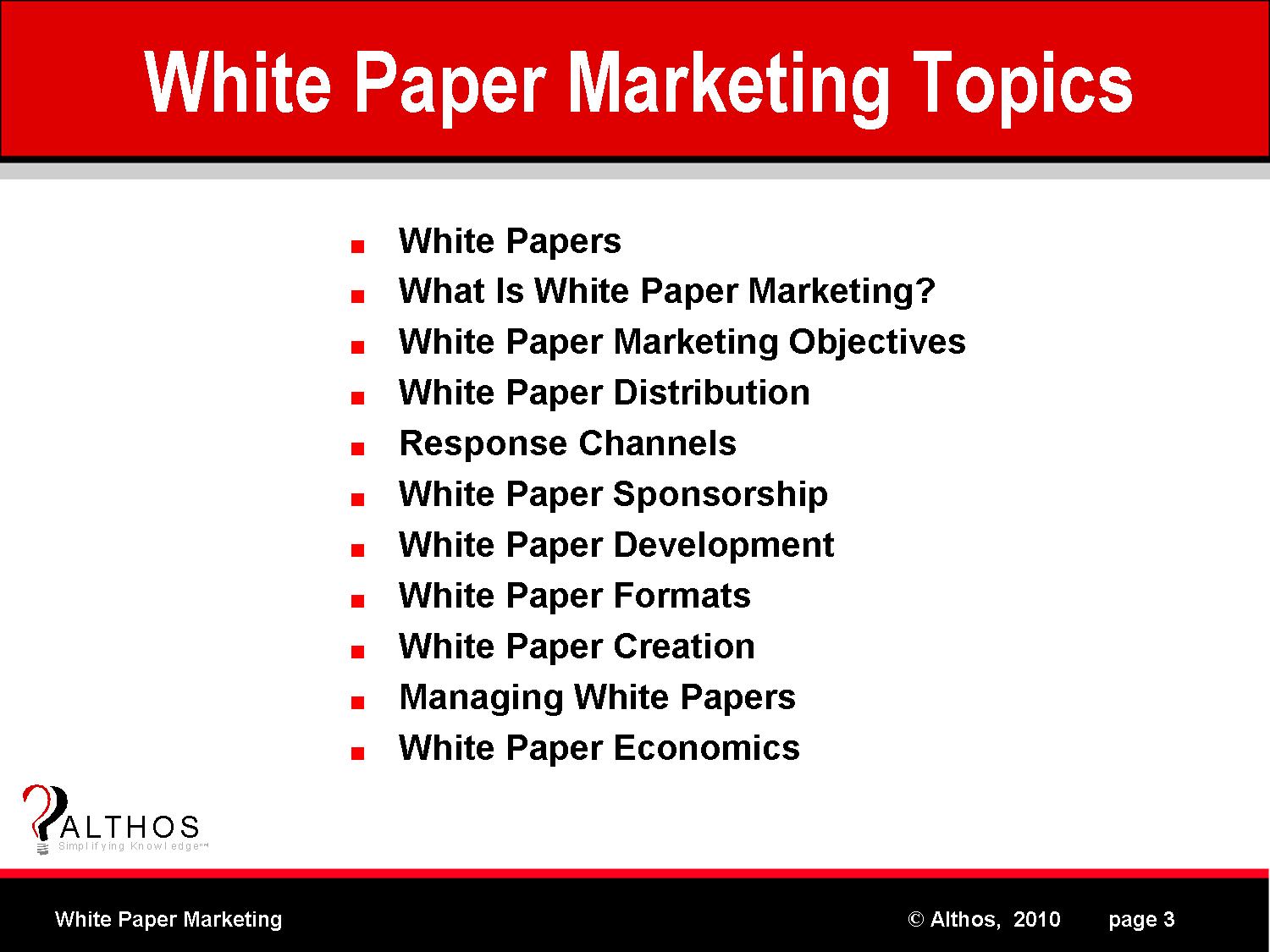

Image: www.tradingview.com

Unveiling the Essence of Options

Option contracts, as the name suggests, endow the holder with the right—not the obligation—to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predetermined price (the strike price) on a specified date (the expiration date). The buyer of an option pays a premium to the seller for this privilege. The value of an option fluctuates based on the underlying asset’s price and a range of other factors, including time to expiration, interest rates, and market volatility.

Navigating the Nuances of Option Trading

The world of option trading is a labyrinth of intricate moving parts, demanding a thorough understanding of the following concepts:

Types of Options

The two fundamental types of options are calls and puts. Call options grant the right to buy, while put options extend the right to sell the underlying asset. Within these categories exist varieties such as American and European options (based on when they can be exercised) and vanilla and exotic options (classifying complexity).

Image: www.imarketingmag.com

Measuring Option Value

The Black-Scholes model provides a bedrock for quantifying option premiums. It combines underlying asset price, strike price, time to expiration, risk-free interest rates, and volatility to generate theoretical option values. However, the real-world market prices often deviate from these theoretical calculations due to factors like supply and demand imbalances.

Strategies for Success

Option traders employ a diverse array of strategies to navigate market dynamics. Some common approaches include covered calls (generating income from selling options on owned assets), protective puts (hedging against potential declines in owned assets), and straddles (combining call and put options at the same strike price).

Tracking Trends and Developments

The option trading landscape undergoes continuous evolution, propelled by market forces and technological advancements. Here are some key trends to watch:

Volatility as a Catalyst

Elevated market volatility can fuel dramatic swings in option prices, creating opportunities for both profit and loss. Understanding volatility dynamics becomes paramount in such scenarios, with traders using tools like implied volatility to gauge market expectations.

Technological Transformations

Advancements in technology, including automated trading platforms and sophisticated data analytics tools, profoundly impact option trading. These platforms facilitate high-speed execution, complex analysis, and risk management capabilities, empowering traders to make faster and more informed decisions.

Unleashing Your Trading Prowess

Navigating the rapids of option trading requires a blend of strategy, skill, and expert guidance. Here are some valuable tips to enhance your trading acumen:

Master Market Dynamics

Immerse yourself in the ebb and flow of the financial markets. Stay attuned to economic indicators, market sentiment, and geopolitical events that may influence asset prices and options premiums.

Manage Risk Wisely

Respect the inherent risks associated with option trading. Implement position sizing strategies and hedging techniques to mitigate losses and preserve capital.

White Paper On Option Trading

Image: www.tradingview.com

Seek Expert Insights

Consult with financial professionals, attend workshops, and engage with fellow traders. Collective knowledge contributes to informed decision-making and helps refine trading methodologies.

Frequen