In the dynamic world of financial markets, understanding the intricacies of option trading can empower investors with the potential to navigate risk and generate returns. This article delves into the fundamentals of option trading on the National Stock Exchange of India (NSE), providing a comprehensive guide in the form of an Option Trading NSE PDF.

Image: www.1investing.in

Before embarking on this in-depth exploration, let’s set the context with a captivating anecdote that highlights the transformative power of option trading. Imagine a young investor named Anya, who had been making modest returns through traditional equity trading. One day, she stumbled upon the concept of option trading and was intrigued by its potential to generate outsized profits with limited capital. Determined to expand her knowledge, Anya sought guidance from an experienced mentor and immersed herself in the intricacies of the NSE option trading platform.

Understanding Option Trading on the NSE

Option trading involves buying or selling contracts that give the holder the right, but not the obligation, to buy or sell a specific underlying asset at a predetermined price on a specified future date. On the NSE, options are traded on individual stocks, indices, and commodities.

Options are classified into two types: calls and puts. A call option grants the holder the right to buy the underlying asset, while a put option provides the right to sell. Each option contract represents a specific number of shares of the underlying asset, known as the lot size.

Traders on the NSE can choose from two primary strategies:

- Speculation: Taking a directional view on the underlying asset’s price movement and buying or selling options accordingly.

- Hedging: Using options to mitigate risk in existing investments or portfolios.

Comprehensive Overview of Option Trading

An Option Trading NSE PDF provides a structured framework for learning the concepts of option trading. It covers the following aspects:

- Definition and Meaning: A clear definition of option trading, explaining its purpose and the role it plays in financial markets.

- History and Evolution: A historical perspective on the development of option trading, tracing its origins and charting its evolution over time.

- Benefits and Risks: A balanced analysis of the potential benefits and risks associated with option trading, emphasizing the need for informed decision-making.

- Types of Options: A detailed explanation of the different types of options available for trading, including their unique features and characteristics.

- Option Pricing: A discussion of the factors that influence option pricing, including underlying asset price, volatility, time to expiration, and interest rates.

Image: www.amazon.in

Latest Trends and Developments in Option Trading

The Option Trading NSE PDF stays abreast of the latest industry trends and developments. It incorporates insights from regulatory updates, news sources, forums, and social media platforms to provide a comprehensive understanding of market dynamics.

Key trends discussed in the PDF include the increasing popularity of index options, the emergence of algorithmic trading, and the regulatory changes impacting option trading practices.

Expert Tips and Advice

Experienced option traders share their insights and provide invaluable advice for beginners and experienced traders alike:

- Start Small: Begin with small trades to minimize risk and build confidence.

- Understand the Risks: Thoroughly research and understand the risks associated with option trading.

- Manage Positions: Actively manage option positions by monitoring market conditions and adjusting strategies as needed.

- Use Technology: Leverage trading platforms and tools to enhance efficiency and decision-making.

- Seek Professional Guidance: Consult with experienced traders or financial professionals for guidance and support.

These tips empower traders to navigate the option market effectively, foster a better understanding of risk management, and increase the probability of successful trades.

Frequently Asked Questions (FAQs) on Option Trading

The Option Trading NSE PDF addresses commonly asked questions, providing clear and concise answers to enhance comprehension:

- What is the difference between a call and a put option?

- **Answer:** A call option gives the right to buy, while a put option gives the right to sell the underlying asset.

- What factors affect option pricing?

- **Answer:** Option prices are influenced by underlying asset price, volatility, time to expiration, and interest rates.

- What is the best option trading strategy for beginners?

- **Answer:** Beginners should start with simple strategies like covered calls or cash-secured puts.

Option Trading Nse Pdf

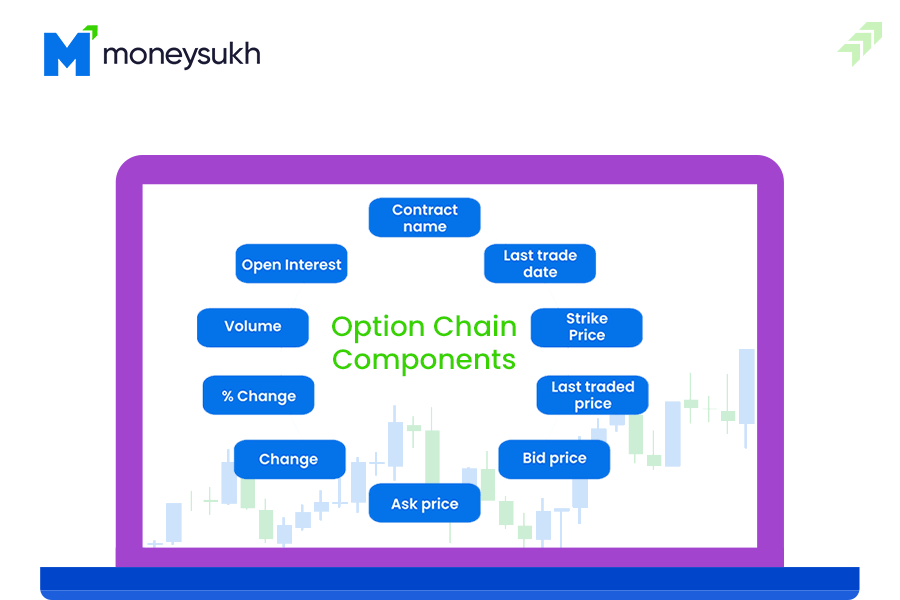

Image: learn.moneysukh.com

Conclusion: Understanding Option Trading for Success in Financial Markets

Option trading is a powerful tool that can enhance an investor’s ability to manage risk, generate returns, and capitalize on market opportunities. The Option Trading NSE PDF provides a comprehensive guide, enabling traders to gain a deep understanding of option trading concepts, strategies, and market trends.

By embracing the principles outlined in this guide, investors can navigate the option market with confidence and harness its potential to amplify their financial success. So, are you ready to unlock the world of option trading? Your journey to maximizing returns begins here!