Unlocking the Power of Nse India’s Options Market

Options trading has emerged as a powerful tool for investors seeking income generation, risk management, and strategic market positioning. The National Stock Exchange of India (NSE) is India’s leading options trading platform, offering a vast array of options strategies to cater to diverse investment objectives. This comprehensive guide explores the intricacies of options trading strategies in the Indian stock market, empowering you with the knowledge and confidence to navigate the complexities of this dynamic arena.

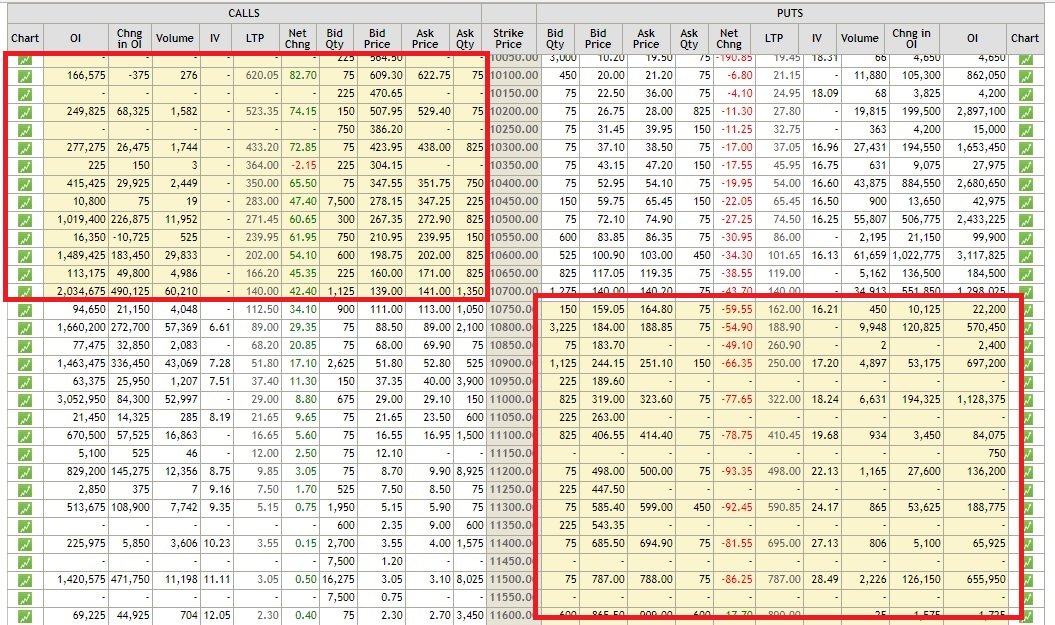

Image: www.1investing.in

What are Options?

Options are financial instruments that confer upon the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price (known as the strike price) on or before a predetermined date (known as the expiration date). Options can be either calls or puts, depending on whether the holder has the right to buy (call) or sell (put) the underlying asset.

Understanding the NSE Options Market

The NSE options market allows investors to trade options on various underlying assets, including stocks, indices, and currencies. The exchange operates a European-style options system, meaning options can only be exercised on their expiration date. NSE options typically have expiry periods of one month, three months, six months, or one year.

Options Trading Strategies for the Indian Stock Market

The Indian stock market offers a diverse range of options trading strategies, each tailored to specific investment goals and risk appetites. Some of the most popular strategies include:

- Covered Call: A strategy where the investor owns the underlying asset and sells a call option with a higher strike price to generate income.

- Cash-Secured Put: Similar to a covered call, but instead of owning the underlying asset, the investor has cash in their account to fulfill their obligation to buy the asset if the put option is exercised.

- Protective Put: A strategy used to hedge against downside risk. The investor buys a put option with a strike price below the current market price of the underlying asset.

- Long Straddle: A strategy involving the simultaneous purchase of both a call and a put option with the same strike price and expiration date.

- Short Strangle: Similar to a long straddle, but instead of purchasing, the investor sells both a call and a put option.

Expert Insights

“Options trading can significantly enhance an investor’s portfolio by providing them with the flexibility to tailor strategies to their unique needs,” says renowned financial expert Rajeev Ranka. “However, it’s crucial to understand the risks involved and trade cautiously.”

Actionable Tips

- Begin with basics: Master the concepts, terminology, and mechanics of options trading.

- Select the right strategy: Choose a strategy that aligns with your investment objectives and risk tolerance.

- Manage risk: Employ risk management techniques to limit potential losses.

- Seek professional guidance: Consider consulting with a financial advisor to guide your options trading endeavors.

Conclusion

Options trading in the Indian stock market presents a rewarding opportunity for investors seeking to enhance their portfolios. By leveraging the strategies outlined in this guide, you can unlock the full potential of this dynamic market. However, it’s imperative to remember that options trading carries inherent risks, so approach it with a prudent mindset and a commitment to continuous learning.

Image: websitereports451.web.fc2.com

Options Trading Strategies Nse India

Image: tradebrains.in