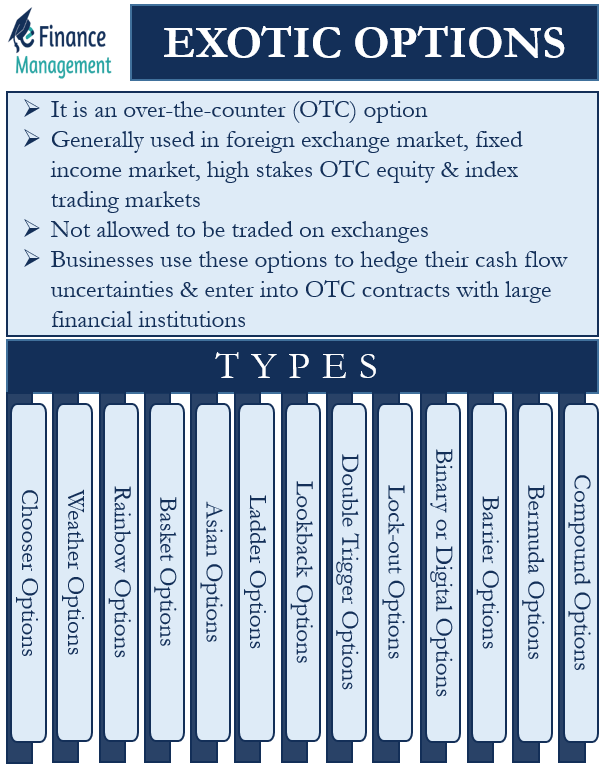

In the ever-evolving world of finance, exotic options have emerged as sophisticated instruments that offer investors a myriad of opportunities beyond traditional vanilla options. Unlike their more conventional counterparts, these multifaceted contracts come with complex features, potentially providing greater flexibility and risk management strategies for seasoned traders. Embarking on a journey into exotic options trading unlocks a universe of possibilities, empowering investors to navigate the complexities of the financial landscape with confidence.

Image: zyfaluyohod.web.fc2.com

Demystifying Exotic Options: The Anatomy of Intricate Contracts

Exotic options, often hailed as the exotic pets of the options world, extend far beyond the familiar boundaries of calls and puts. Their intricate designs allow for customization in terms of underlying assets, payoff profiles, and exercise stipulations, presenting traders with a wide spectrum of risk and reward scenarios. Stripping away the veil of complexity, we delve into the anatomy of exotic options:

-

Barrier Options: These options introduce an additional condition known as a “barrier.” If the underlying asset’s price crosses this predefined threshold during the option’s life, the option takes effect, potentially offering significant returns or protection.

-

Binary Options: Binary options, aptly named due to their “all-or-nothing” payouts, differ from conventional options in that they yield a fixed payout if the underlying asset meets a specified condition at expiration. They offer quick and decisive results, albeit with a heightened risk.

-

Chooses: With chooses, investors gain the flexibility to select an underlying asset from a predefined basket at the time of exercise. This feature allows traders to capitalize on the best-performing asset within the basket, enhancing their chances of profit.

Strategy and Sophistication: Mastering the Art of Exotic Options Trading

Navigating the world of exotic options demands a level of sophistication and an ability to craft tailored strategies that align with individual goals and risk tolerance. Expert insights and actionable tips serve as a roadmap, guiding investors through the labyrinth of these complex instruments:

-

Expert Insights: Seasoned traders emphasize the importance of understanding the risks associated with exotic options and thoroughly researching before venturing into these uncharted waters. They advocate for comprehending the underlying assets, payoff structures, and market conditions that influence option valuations.

-

Actionable Tips: When delving into exotic options trading, experts advise starting with smaller, more manageable positions, gradually increasing exposure as experience builds. Another key tip is to leverage sophisticated trading platforms that provide robust analytics and risk management tools, empowering traders to make informed decisions.

Empowering Investors: The Value Proposition of Exotic Options Trading

Exotic options aren’t mere financial instruments; they empower investors with a wider arsenal for navigating volatile markets. Their flexibility and customizable features enable investors to:

-

Mitigate Risk: Exotic options serve as valuable hedges against potential losses, allowing traders to offset the risks associated with their underlying investments. The ability to create complex option combinations further enhances portfolio protection strategies.

-

Tailored Returns: Exotic options offer the potential for tailored returns, catering to specific risk-reward profiles. Investors can craft options with payoff profiles that align with their investment objectives, optimizing the potential for profit.

-

Enhanced Opportunities: Beyond risk management and targeted returns, exotic options unlock a world of advanced trading opportunities. From speculation on market trends to complex arbitrage strategies, these instruments provide a fertile ground for financial exploration and profit-generating endeavors.

Image: efinancemanagement.com

Exotic Options Trading

Conclusion: A Path Toward Financial Sophistication

Exotic options trading, an art form in the realm of finance, empowers investors to transcend the boundaries of conventional options. While they necessitate a deeper understanding of financial markets and risk management, exotic options offer a gateway to enhanced returns, tailored strategies, and sophisticated trading techniques. With the right guidance and a strategic approach, investors can unlock the full potential of these complex instruments, embarking on a journey toward financial sophistication and empowered decision-making.