Like a skilled navigator charting a course through turbulent markets, options trading offers investors a powerful tool to navigate financial uncertainties and potentially amplify their returns. eToro, a renowned global investment platform, has extended its reach to the UK, empowering traders with a gateway to this exciting world. This comprehensive guide will delve into the intricacies of eToro options trading in the UK, unearthing its potential and equipping you with the knowledge to make informed decisions.

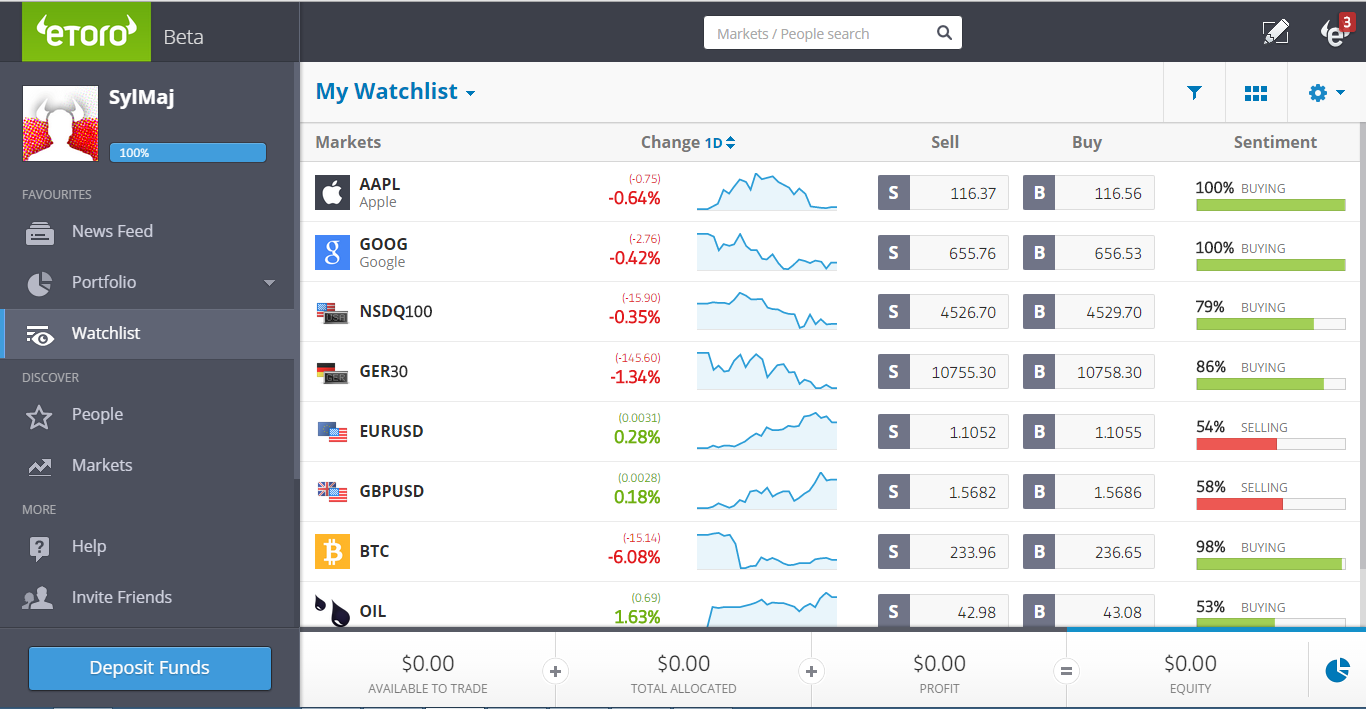

Image: www.binaryoptions.net

Options trading, a sophisticated financial instrument, grants traders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. This flexibility empowers traders to tailor their strategies, hedging against potential losses or speculating on market movements. eToro’s user-friendly platform simplifies this complex concept, making it accessible to both seasoned veterans and those seeking to embark on their options trading journey.

eToro Options Trading: A Gateway to Diversified Investment Strategies

eToro’s options trading platform unlocks a world of strategic possibilities, empowering UK traders to navigate market volatility and pursue their financial goals. Whether you seek to hedge your portfolio against market downturns, amplify your returns by leveraging market movements, or generate additional income through premium selling, eToro provides the tools and flexibility to suit your individual needs.

With eToro, accessing the options market is seamless. The platform’s intuitive interface and user-friendly design guide you through each step of the trading process, from order placement to position monitoring and closure. Transparent pricing and competitive spreads ensure that you know exactly what you’re paying for, empowering you to make informed decisions with confidence.

Unveiling the Nuances of Options Contracts: Calls, Puts, and Options Greeks

Options contracts come in two primary flavors: calls and puts. Call options grant the holder the right to buy an underlying asset at a predetermined price, while put options convey the right to sell. These contracts specify three crucial elements: the underlying asset, the strike price, and the expiration date. Understanding these components is essential for navigating the options market.

Options Greeks, a set of metrics, provide valuable insights into the behavior and risk-return profile of options contracts. Delta measures the sensitivity of an option’s price to changes in the underlying asset’s price. Gamma quantifies the change in delta for each unit change in the underlying asset’s price. Theta gauges the time decay of an option’s premium as it approaches expiration. Understanding these Greeks is crucial for managing risk and optimizing your trading strategies.

Expert Insights and Actionable Tips for Successful Options Trading

To navigate the options market successfully, it’s invaluable to tap into the wisdom of experienced traders. Seasoned experts emphasize the importance of thorough research, understanding your risk tolerance, and developing a robust trading plan. They also advocate for a disciplined approach, managing your emotions and avoiding impulsive decisions that could jeopardize your financial goals.

Here are some actionable tips to enhance your options trading journey:

- Start small: Begin with modest trades to gain experience and build your confidence before venturing into larger positions.

- Manage your risk: Determine your risk tolerance and trade within those limits. Remember, options trading involves inherent risks, and you should only invest what you can afford to lose.

- Monitor your positions: Regularly track the performance of your options contracts and make adjustments as needed. Volatility and market conditions can change rapidly, requiring you to stay vigilant.

- Utilize stop-loss orders: These orders automatically close your positions when they reach a predefined loss threshold, limiting potential losses.

- Seek continuous education: The financial markets are constantly evolving, so it’s essential to stay informed about market trends and strategies. Attend webinars, read books, and connect with fellow traders to expand your knowledge.

Image: www.financemagnates.com

Etoro Options Trading Uk

Image: www.pinterest.com

Conclusion

Options trading with eToro in the UK presents a compelling opportunity for investors to enhance their financial strategies and potentially amplify their returns. By embracing the power of this versatile tool, you can navigate market volatility, hedge against downside risk, and speculate on market movements. Remember, options trading involves risks, so it’s crucial to approach it with thorough research, risk management, and a disciplined trading plan. eToro’s user-friendly platform, transparent pricing, and educational resources empower UK traders to confidently embark on their options trading journey.

As you venture into the world of options trading, embrace the mindset of a skilled navigator. With knowledge as your compass and eToro as your vessel, you have the potential to chart a course towards financial success. Remember, the journey is as important as the destination, so enjoy the process and continuously refine your strategies along the way.