Delve into the Enigmatic World of Option Trading: Empower Your Financial Acumen

Image: www.youtube.com

If you’re an aspiring finance enthusiast or an experienced trader seeking to expand your knowledge, option trading might be the uncharted territory that unlocks exponential potential. As an alternative to traditional stock trading, option trading offers a wealth of opportunities to maximize returns and minimize risks, provided you possess a comprehensive understanding of its complexities. These meticulously crafted lecture notes will guide you through the labyrinth of option trading, empowering you with the knowledge to navigate this dynamic financial landscape with confidence.

Chapter 1: Embarking on the Option Trading Odyssey

Before venturing into the world of options, it’s imperative to understand its conceptual foundations. Options, in essence, are financial contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specific date. By delving into the history and fundamental principles of option trading, you’ll gain a solid footing to comprehend the intricacies of this captivating market.

Chapter 2: Unraveling the Anatomy of Option Contracts

The next chapter delves into the anatomy of an option contract, dissecting its essential components. You’ll discover the significance of key terms like strike price, expiration date, and premium, while learning how these elements interact to determine the value and potential profitability of an option contract.

Chapter 3: Navigating the Options Market: Types and Strategies

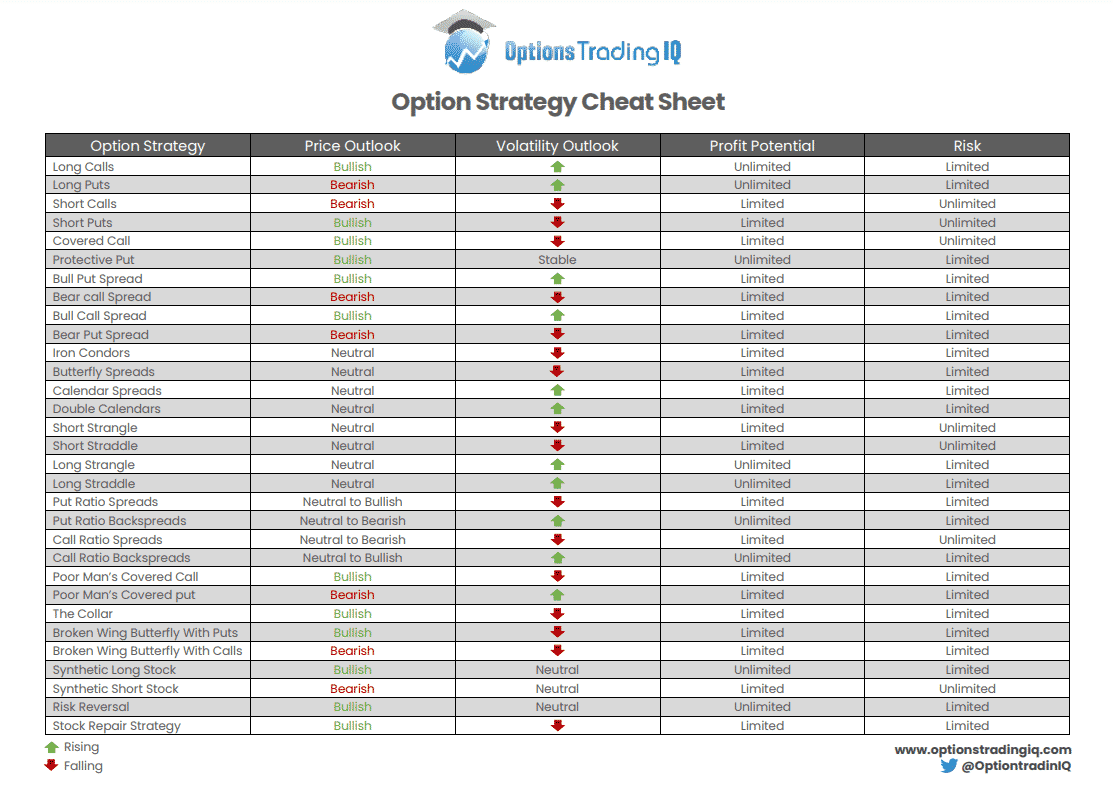

With a firm grasp of the basics, we’ll embark on an exploration of different option types, unraveling the unique characteristics of calls, puts, and other derivatives. We’ll also examine the spectrum of strategies employed by option traders, ranging from conservative hedging to audacious speculation, equipping you with the tools to craft tailored strategies aligned with your risk appetite and investment objectives.

Image: optionstradingiq.com

Chapter 4: Unlocking the Power of Options Analysis

To make informed trading decisions, it’s essential to master the art of options analysis. This chapter will introduce you to fundamental and technical analysis techniques, empowering you to decipher market trends, identify trading opportunities, and assess the potential risks and rewards associated with various option strategies.

Chapter 5: Trading Options in Practice: Execution and Risk Management

Moving beyond theoretical concepts, we’ll delve into the practical aspects of option trading, exploring different execution methods and demystifying the nuances of order types. We’ll also emphasize the critical importance of risk management, outlining strategies to mitigate losses and safeguard your capital amidst market volatility.

Chapter 6: Exploring Advanced Option Trading Strategies

For those seeking to delve deeper into the realm of option trading, this chapter will unveil advanced strategies, including multi-leg options, volatility trading, and exotic options. By mastering these techniques, you’ll expand your repertoire of trading strategies and enhance your ability to capitalize on complex market dynamics.

Chapter 7: Option Trading Psychology: Mastering the Mental Game

Beyond technical proficiency, trading psychology plays a crucial role in the success of option traders. This chapter will provide invaluable insights into the psychology of trading, helping you cultivate a disciplined mindset, manage emotions, and make rational decisions in the face of market fluctuations.

Chapter 8: Case Studies and Success Stories: Learning from the Experts

To solidify the practical application of the concepts covered in previous chapters, this chapter presents case studies and success stories of seasoned option traders. By examining real-world examples, you’ll gain a deeper understanding of how trading principles can be applied to generate consistent returns.

Chapter 9: The Future of Option Trading: Innovations and Trends

In the ever-evolving financial landscape, staying abreast of the latest innovations is crucial. This chapter will explore emerging trends in option trading, including the impact of technology, regulatory changes, and new product developments. By keeping your finger on the pulse of the industry, you’ll be well-positioned to adapt to evolving market conditions and exploit lucrative opportunities.

Option Trading Lecture Notes

Image: www.youtube.com

Conclusion

These lecture notes provide a comprehensive foundation for understanding the intricacies of option trading. By assimilating the knowledge presented herein, you’ll acquire the tools and insights to navigate the complexities of this dynamic market, unlocking the potential for substantial returns. Remember, successful option trading requires not only technical proficiency but also a disciplined mindset and unwavering commitment to continuous learning. Embrace the challenges and opportunities that option trading presents, and embark on a transformative journey of financial empowerment.