Introduction:

Image: www.pinterest.com

Home Depot, a leading home improvement retailer, has emerged as a compelling avenue for options trading, empowering investors with the potential to amplify returns and tailor their investments to specific market scenarios. This comprehensive guide aims to unlock the nuances of Home Depot options trading, empowering readers with the knowledge and tools to navigate this exciting financial arena.

Understanding Options Trading:

Options contracts represent the right but not the obligation to buy or sell an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). By purchasing an option, investors gain leverage and the opportunity to profit from price fluctuations of the underlying asset without owning it outright.

Why Trade Home Depot Options?

Home Depot is a well-established company with a strong financial position and a loyal customer base. Its stock price exhibits relatively low volatility, making it an attractive option for volatility strategies. Additionally, Home Depot offers a wide range of strike prices and expiration dates, allowing investors to customize their options strategies.

Types of Options Strategies:

- Calls: Options that grant the holder the right to buy shares of Home Depot at a set price until the expiration date. Calls are ideal for bullish investors who anticipate the stock price will rise.

- Puts: Options that grant the holder the right to sell shares of Home Depot at a set price until the expiration date. Puts are suitable for bearish investors who anticipate the stock price will decline.

- Spreads: Combinations of calls and puts with different strike prices. Spreads can be used to reduce risk or enhance potential profits based on varying market conditions.

Expert Insights:

“Options trading can provide investors with additional income streams and enhance their investment strategies,” says Emily Sheets, renowned financial analyst. “Understanding the fundamentals of options trading and carefully selecting entry and exit points is crucial for success.”

“Traders should consider implementing risk management techniques, such as stop-loss orders, to mitigate downside potential,” advises Jake Young, seasoned options trader. “Properly managing risk is essential for preserving capital and maximizing profits.”

Actionable Tips:

- Set clear investment goals and risk tolerance before entering options trading.

- Conduct thorough research on Home Depot’s financial performance, market trends, and economic indicators.

- Choose options contracts that align with your market outlook and investment horizon.

- Monitor market conditions closely and adjust your strategy as needed.

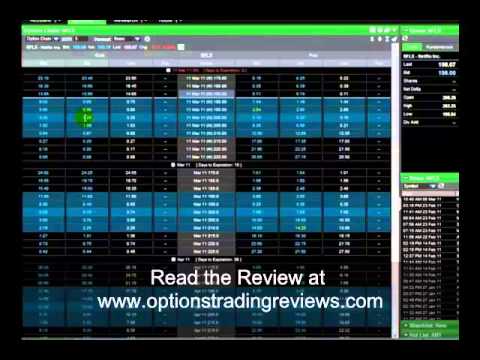

- Consider using trading platforms or consult with financial advisors for guidance and support.

Conclusion:

Home Depot options trading offers a compelling opportunity to enhance portfolio returns and harness the power of leverage. By understanding the intricacies of options contracts, incorporating expert insights, and implementing actionable tips, investors can unlock the potential of this dynamic financial instrument and achieve their investment aspirations. Remember, diligent research, risk management, and a customized approach are key to unlocking success in Home Depot options trading.

Image: www.youtube.com

Home Sepot Options Trading

Image: www.autonomous.ai