Unleashing the Potential of Options on Futures

In the ever-evolving landscape of financial markets, options on futures have emerged as a cutting-edge trading strategy, offering investors and traders a unique blend of flexibility, leverage, and risk management capabilities. This comprehensive guide delves into the world of options on futures, providing a thorough understanding of their history, concepts, and innovative applications.

Image: www.binance.com

Understanding Options on Futures: A Dual Advantage

Options on futures are financial instruments that grant the holder the right, but not the obligation, to buy or sell a specified futures contract at a predetermined price on or before a given date. Unlike traditional futures contracts, options provide a dual advantage: the potential for significant gains while limiting the risk of losses.

Evolution of Options on Futures: A Historical Journey

The concept of options on futures can be traced back to the 1970s, with the introduction of the first exchange-traded options on financial futures in 1982. Since then, options on futures have gained widespread recognition, becoming an essential tool for various market participants, including hedge funds, institutional investors, and individual traders.

Illuminating Key Concepts: Call Options, Put Options, and Premiums

To grasp the intricacies of options on futures, understanding the fundamental concepts is crucial. Call options confer the right to buy an underlying futures contract at the predetermined strike price, whereas put options provide the right to sell. The price paid for this right is known as the premium, which varies based on factors such as the underlying asset’s price, volatility, and time to expiration.

Image: www.happiestpost.com

Risk Management with Options on Futures: A Calculated Approach

One of the compelling attractions of options on futures lies in their risk management capabilities. By strategically employing options, investors can limit their potential losses and protect their portfolios from adverse market movements. This controlled risk environment enables traders to explore higher-return opportunities with enhanced confidence.

Futures versus Options: Distinguishing Features

While both futures and options provide exposure to underlying assets, they exhibit distinct differences in their structure and dynamics. Futures contracts obligate the holder to buy or sell the underlying asset at the specified date, while options grant the right but not the compulsion. This flexibility makes options a preferred choice for risk-averse investors seeking limited exposure.

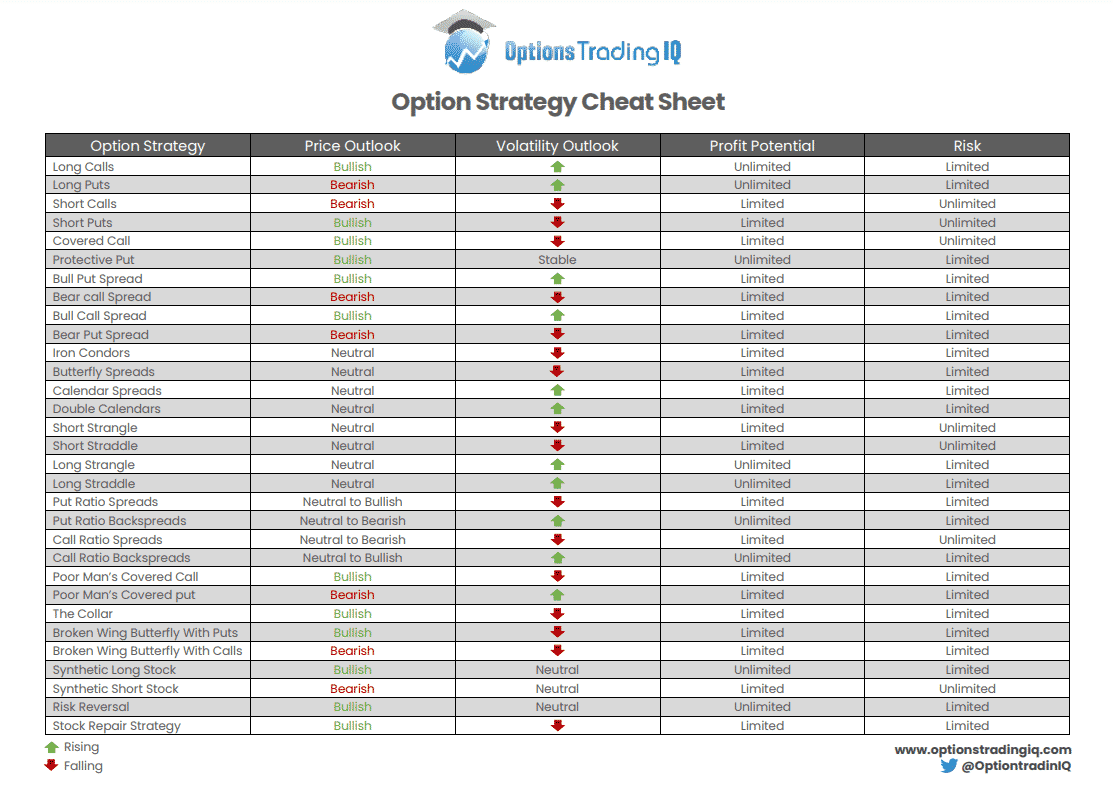

Navigating Volatility and Hedge Markets with Options Strategies

Options on futures present a versatile tool for navigating volatile markets and hedging against potential risks. Combining various option strategies, such as spreads and straddles, allows investors to tailor their risk-reward profiles and adapt to diverse market conditions. This adaptability makes options on futures an effective instrument for both speculative and defensive trading.

Mastering the Mechanics: Trading Options on Futures

Executing trades involving options on futures requires proficiency in specific market mechanics. Investors should familiarize themselves with trading platforms, order types, and margin requirements to participate effectively in this market. Comprehensive knowledge of trading procedures empowers individuals to optimize strategy implementation and manage risk.

Applying Options on Futures: Real-World Applications

Options on futures find widespread application across various market scenarios. They can be employed for hedging portfolio positions, speculating on price movements, generating income through premium collection, and even as an alternative to holding the underlying asset. Understanding these applications empowers investors to leverage options effectively.

Options On Futures New Trading Strategies Pdf

Image: www.newtraderu.com

Conclusion: Embracing the Future of Trading

Options on futures have revolutionized the trading landscape, providing a sophisticated and versatile tool for investors and traders. By offering controlled risk, customizable strategies, and the potential for substantial returns, options on futures empower market participants with a distinct advantage in navigating the intricacies of financial markets. As the future of trading unfolds, options on futures will undoubtedly continue to play a pivotal role in shaping successful investment strategies.