In the bustling world of finance, where fortunes are made and lost in the blink of an eye, options trading has emerged as a potent instrument for risk management and profit generation. As an investor, I have firsthand witnessed the exhilarating triumphs and sobering pitfalls that come with this high-stakes endeavor. In this comprehensive guide, I will unravel the intricacies of options risk trading, sharing insights gleaned from my own experiences and the wisdom of industry experts.

Image: trading-education.com

Options, by their very nature, introduce a unique dimension of risk to the trading landscape. These sophisticated financial instruments bestow the power to control underlying assets, granting traders the option to buy or sell at a predetermined price on a specific date. However, this flexibility comes at a cost—the potential for substantial losses if risk is not carefully considered and managed.

Delving into Options Risk: Understanding the Landscape

A thorough grasp of options risk is paramount for traders seeking to navigate the market with a discerning eye. Intrinsic risk, arising from the difference between the asset price and the option’s exercise price, is ever-present. Time decay, the erosion of option value as expiration approaches, adds another layer of complexity for traders to contend with.

Moreover, volatility, the measure of price fluctuations in the underlying asset, can have a profound impact on option risk. High volatility tends to amplify the potential for both gains and losses, increasing the stakes for traders. Conversely, low volatility can offer some protection against sharp price swings, but it also limits the potential for sizable profits.

Mastering Risk Management Strategies for Options Trading

Navigating the treacherous waters of options risk requires a prudent approach, backed by a robust arsenal of risk management strategies. Diversification, the practice of spreading investments across multiple assets or options, serves as a cornerstone of any sound risk management framework. By mitigating the impact of any single losing trade, diversification enhances the chances of long-term success.

Hedging is another powerful tool employed by traders to neutralize or reduce risk exposure. By employing counterbalancing positions in different options or assets, traders can effectively hedge against adverse price movements, significantly reducing the likelihood of catastrophic losses.

Staying Abreast of Market Trends and Developments

In the ever-evolving realm of options trading, staying abreast of the latest trends and developments is crucial for success. Keeping a watchful eye on market updates, news sources, industry forums, and social media platforms enables traders to stay informed and adapt to changing market conditions.

By analyzing price patterns, monitoring geopolitical events, and interpreting macroeconomic data, traders can gain valuable insights into the forces shaping the market. This knowledge empowers them to anticipate potential risks and make informed decisions that maximize their chances of success.

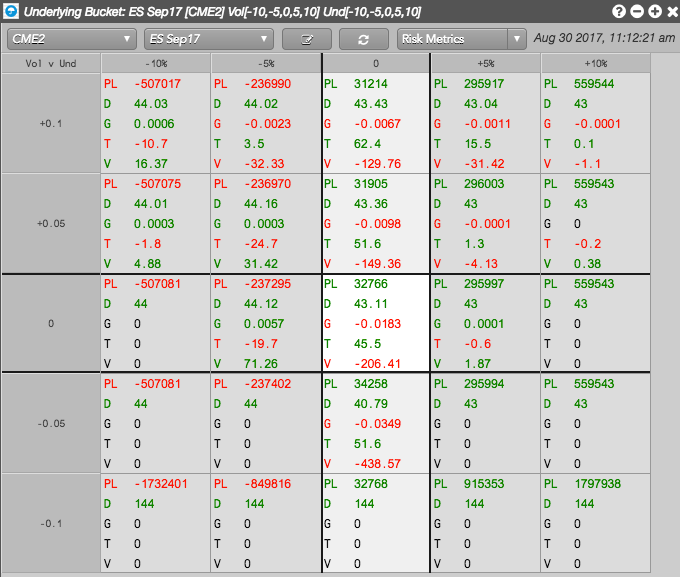

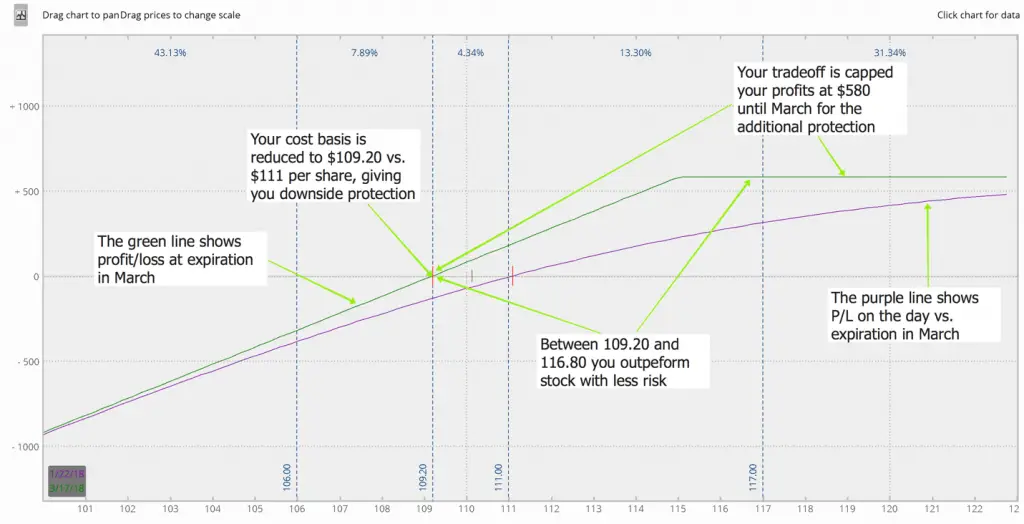

Image: library.tradingtechnologies.com

Expert Advice for Navigating Options Risk: Lessons from the Trenches

Drawing upon the collective wisdom of seasoned options traders, I have distilled invaluable expert advice that can guide aspiring traders on their journey to mastering risk management.

Tip #1: Embracing Proper Position Sizing

Calibrating position sizes to align with one’s risk tolerance and account size is of paramount importance. Avoid over-leveraging, which can lead to catastrophic losses. Starting small and gradually increasing position sizes as confidence and experience grow is a prudent approach.

Tip #2: Focusing on Risk-Reward Ratios

Before initiating any trade, traders must meticulously assess the potential rewards against the inherent risks. Favoring trades with a favorable risk-reward ratio, where the potential profit outweighs the possible loss, is a cornerstone of responsible trading.

Tip #3: Managing Emotions and Avoiding Impulsive Decisions

In the heat of market gyrations, emotions can cloud judgment and lead to rash decisions. Traders should cultivate discipline and emotional control, avoiding impulsive trades and letting logic guide their actions.

Common Questions and Answers About Options Risk: Empowering Knowledge

Q: What are the key types of options risk?

A: Options risk encompasses intrinsic risk, time decay, and volatility risk.

Q: How can I protect myself against options risk?

A: Diversification, hedging, position sizing, and risk-reward analysis are effective strategies for mitigating options risk.

Q: Is options trading suitable for all investors?

A: Options trading involves inherent risks and is best suited for experienced investors with a deep understanding of market dynamics and risk management principles.

Options Risk Trading

Image: www.newtraderu.com

Embracing the Challenge: Are You Ready to Conquer Options Risk?

Options risk trading is an arena where fortunes are made and lost, but with knowledge, skill, and a prudent approach, investors can navigate this challenging landscape with increased confidence. Whether you are an experienced trader seeking to refine your strategies or a novice eager to venture into the world of options, this article has provided a multifaceted perspective on the intricacies of options risk.

Are you ready to embrace the challenge and master the art of risk management in options trading? The path ahead may be arduous, but the rewards can be substantial. Embark on this journey with a commitment to continuous learning, judicious decision-making, and unwavering discipline. The world of options risk trading awaits your arrival—are you ready to conquer it?