In the realm of options trading, understanding the concepts of intrinsic and extrinsic value is crucial for making informed decisions. These two values play a significant role in determining the price and potential profitability of an options contract. Let’s delve into the intricacies of intrinsic and extrinsic value and explore their impact on options trading strategies.

Image: www.slideserve.com

Intrinsic Value: A Measure of Inherent Worth

Intrinsic value, as the name suggests, represents the inherent worth of an option. It’s the value that an option would have if it were exercised immediately. For a call option, intrinsic value is calculated as the difference between the underlying asset’s price and the strike price. Conversely, for a put option, it’s the difference between the strike price and the underlying asset’s price.

For instance, if an underlying stock is trading at $100 and an at-the-money call option (with the strike price of $100) is available, its intrinsic value would be $0. This is because the option holder can immediately exercise the option and purchase the stock at $100, which is its current market price.

Extrinsic Value: The Premium of Time and Volatility

Extrinsic value, on the other hand, represents the premium that an option trader is willing to pay for the right to buy or sell the underlying asset at a future date. It encompasses two key factors: time value and volatility.

Time value refers to the amount of time remaining until an option’s expiration date. The longer the time to expiration, the more likely the underlying asset’s price will fluctuate, potentially increasing the option’s value. Hence, time value is generally higher for longer-term options.

Volatility, which measures the degree of price fluctuations in the underlying asset, also affects extrinsic value. Options on more volatile assets tend to have higher premiums due to the increased probability of significant price movements.

Understanding the Interplay

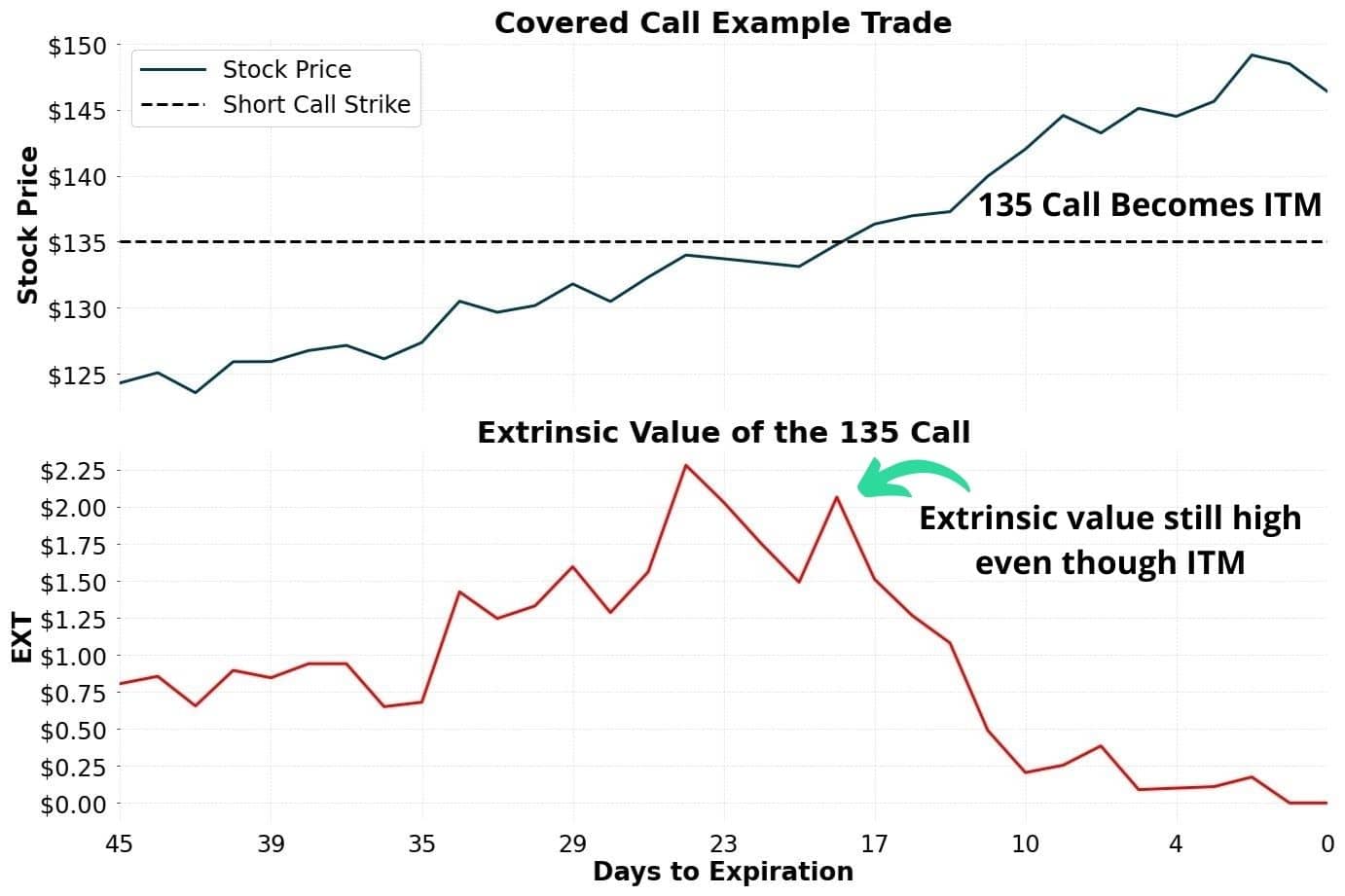

To grasp the complete picture, it’s essential to understand how intrinsic and extrinsic value interact. As an option approaches its expiration date, its time value decays, resulting in a decline in its overall value. Conversely, extrinsic value typically increases during periods of high volatility or when there’s significant time remaining until expiration.

For example, consider an at-the-money option with 30 days to expiration. As the expiration date nears, the option’s time value gradually erodes, and its value steadily decreases towards its intrinsic value. However, if the market experiences a surge in volatility during this period, the extrinsic value of the option may experience a temporary uptick.

Image: www.projectfinance.com

Implications for Options Trading Strategies

Understanding the nuances of extrinsic value options trading empowers traders to develop effective strategies that align with their risk tolerance and investment goals.

Option premiums with significant extrinsic value can be suitable for traders seeking to exploit volatility in the underlying asset’s price. These traders may aim to benefit from the potential increase in the option’s extrinsic value before expiration.

On the other hand, options with lower extrinsic value, closer to their intrinsic value, are often preferred by conservative traders or those looking for protection in the form of hedges or insurance. These traders focus on investing in options with a higher probability of profit, potentially sacrificing some of the potential upside for increased stability.

Extrinsic Value Options Trading

Image: epsilonoptions.com

Conclusion

Extrinsic value plays a pivotal role in options trading, adding a dynamic element that can enhance or diminish an option’s overall value. By understanding the interplay between intrinsic and extrinsic value, traders can make informed decisions, optimize their trading strategies, and navigate the complexities of options markets more effectively.