Introduction

In the realm of investing and trading, the Pattern Day Trading Rule for Options stands as a crucial regulation that can significantly impact the decisions and experiences of traders. Comprehending this rule is paramount for options traders to avoid potential consequences and optimize their trading strategies. This guide aims to provide an in-depth exploration of the rule, empowering traders with the knowledge necessary for informed and successful trading practices.

Image: www.pinterest.com.au

Understanding the Pattern Day Trading Rule

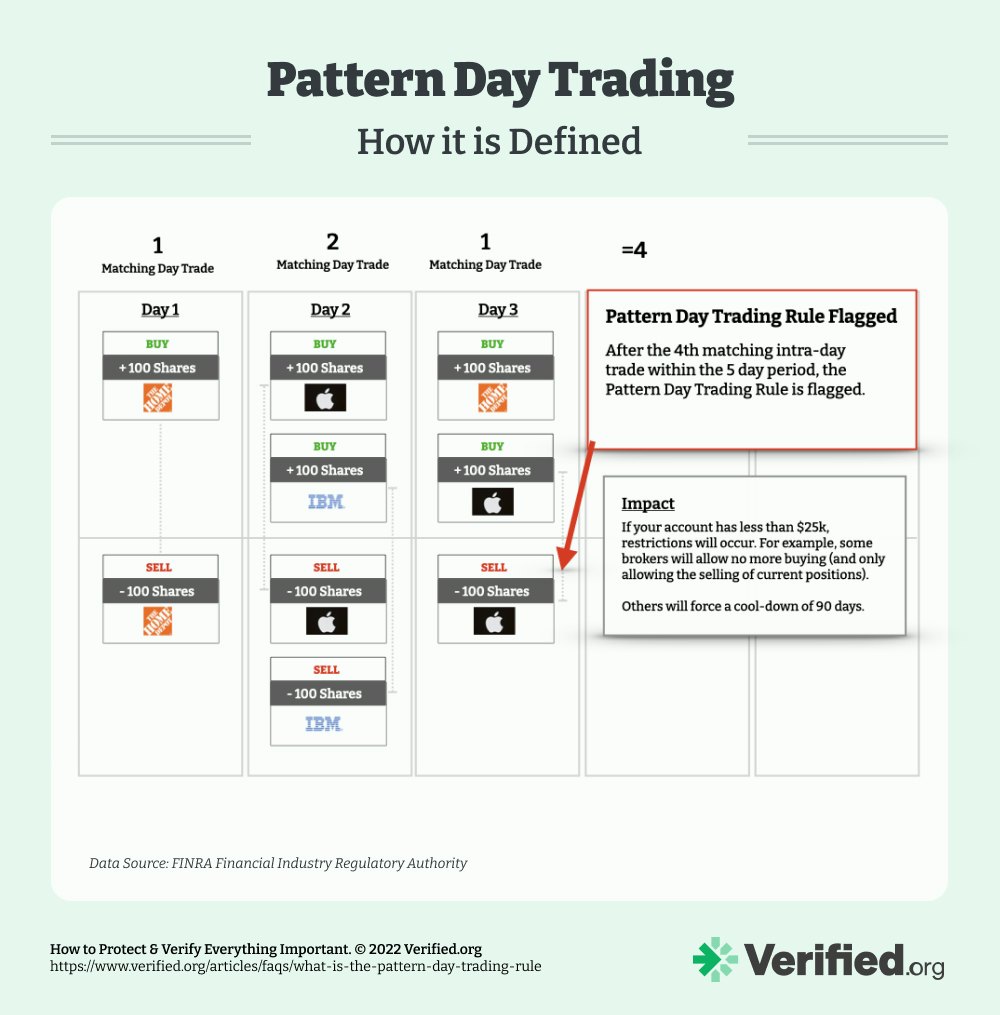

The Pattern Day Trading Rule defines as individuals who buy and sell the same option contract on the same day. The rule limits the number of day trades that a pattern day trader can make to three within a five-business-day period. Failure to comply with this regulation may result in account restrictions or trading suspensions imposed by the brokerage firm.

To qualify as a pattern day trader, a trader must engage in more than three day trades in a rolling five-business-day period. Once tagged as a pattern day trader, this status remains for 90 calendar days, regardless of trading activity during that time. Key factors to consider include:

- Day Trades: Any holding period of less than one business day is considered a day trade.

- Intraday Multiple Transactions: Buying and selling the same contract multiple times within the same business day counts as separate day trades.

- Five-Business-Day Period: This period includes regular business days and excludes weekends and holidays.

Implications of the Pattern Day Trading Rule

Account Restrictions

If a trader engages in more than three day trades without meeting the minimum equity requirement, the brokerage firm may restrict their trading activity. This restriction typically involves limiting the number of trades per day or freezing the account entirely.

![[WEEKLY LESSON] How to Navigate the Pattern Day Trader Rule](https://www.investorsunderground.com/wp-content/uploads/2019/03/Pattern-Day-Trader-Rule.png)

Image: www.investorsunderground.com

Margin Calls and Trading Suspensions

Traders who fail to maintain the minimum equity requirement may face margin calls, which require them to deposit additional funds to cover losses. Noncompliance with margin calls may lead to trading suspensions, preventing further trading activity until the required funds are deposited.

Exemptions to the Pattern Day Trading Rule

Certain categories of traders are exempt from the Pattern Day Trading Rule, including:

- Brokers: Employees of registered broker-dealer firms.

- Trading Firms: Corporations with net capital exceeding $250,000.

- Qualified Individual: Traders with a net worth exceeding $2,000,000.

Expert Insights and Actionable Tips

To minimize the impact of the Pattern Day Trading Rule, consider the following expert insights:

- Understand Your Risk Tolerance: Assess your financial capabilities and determine the level of risk you are willing to accept.

- Maintain Sufficient Account Balance: Ensure you have the required minimum equity to avoid account restrictions.

- Choose Trading Platform Wisely: Select a brokerage that offers customizable features and risk management tools tailored to your needs.

- Practice Responsible Trading: Avoid impulsive trading decisions and employ sound trading strategies to mitigate losses.

- Seek Education and Support: Enhance your knowledge through resources, webinars, and mentorship programs.

Pattern Day Trading Rule For Options

Image: www.verified.org

Conclusion

The Pattern Day Trading Rule for Options serves as an essential safeguard for traders, protecting them from potentially devastating losses. By understanding the rule’s implications and incorporating these expert tips, traders can navigate the complexities of options trading with confidence and minimize potential risks. Remember, responsible trading practices and ongoing education are key to unlocking the opportunities and rewards that options trading offers.

If you are considering becoming a pattern day trader or are currently involved in this type of trading, we strongly encourage you to consult with a financial advisor to discuss your options and ensure compliance with all relevant regulations.