In the realm of investing, options trading stands out as a sophisticated yet potentially lucrative strategy for discerning investors. While it’s often shrouded in complexity, demystifying options trading is essential for anyone seeking to expand their financial acumen. This guide aims to provide you with a thorough understanding of options trading in a language that even a novice can grasp, empowering you with the knowledge to make informed investment decisions.

Image: seekingalpha.com

Decoding the Essence of Options

An option contract, in essence, grants you the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predetermined price (known as the strike price) on a specific date (known as the expiration date). Options trading involves buying and selling these contracts, speculating on the price movements of the underlying asset to potentially profit from favorable price fluctuations.

Types of Options and Their Implications

The world of options trading encompasses two primary categories: call options and put options. Call options provide the right to buy the underlying asset at or before the expiration date, while put options grant the right to sell it.

Understanding the different types of options is paramount. European-style options can only be exercised on their expiration date, while American-style options offer the flexibility of being exercisable at any point before the expiration date.

Benefits and Risks of Options Trading

The allure of options trading lies in its potential for sizable returns, particularly for those with a keen ability to predict market trends. However, it’s equally important to acknowledge the inherent risks associated with this strategy. The value of options contracts can fluctuate dramatically, resulting in potential losses if the underlying asset’s price does not move as anticipated.

Image: www.roadtask.hu

Unveiling Option Pricing

The pricing of options contracts is a complex topic that factors in several variables. The value of an option is primarily influenced by the underlying asset’s price, the strike price, the time remaining until expiration, and implied volatility. Understanding these variables is crucial for making informed decisions.

Strategies for Options Trading

Navigating the world of options trading requires a strategic approach. Investors can adopt different strategies based on their risk tolerance and investment goals. Some common strategies include buying calls for potential upside, buying puts for downside protection, or employing more complex strategies like straddles or strangles for sophisticated investors.

Tips for Options Trading Success

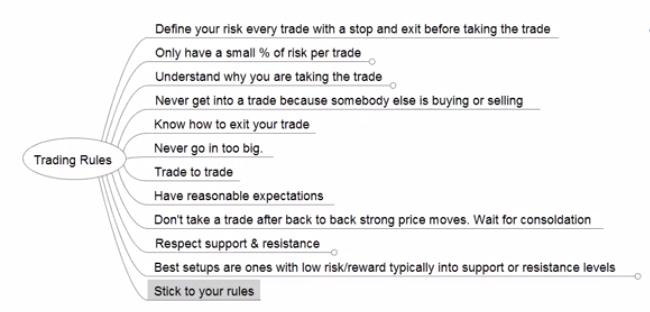

Venturing into options trading requires a combination of knowledge, strategy, and discipline. Start by building a solid understanding of the basics, gradually increasing your knowledge as you gain experience. Develop a clear and well-defined trading plan, encompassing entry and exit points, risk management measures, and profit targets.

Furthermore, stay informed about market conditions and news events that can influence the prices of underlying assets. Practice patience and avoid emotional decision-making, letting thorough analysis and strategic thinking guide your actions. Remember, successful options trading is not a quick-rich scheme but a skill that requires dedication and a long-term mindset.

Option Trading Explained Layman& 39

Image: www.fool.com

Conclusion: Empowering Investors with Options Knowledge

Delving into the intricacies of options trading can unlock a world of opportunities for investors seeking to enhance their financial acumen. By embracing a comprehensive understanding of the concepts, strategies, and risks involved, you can make informed decisions and navigate the markets with greater confidence. Remember, knowledge is the key to unlocking the potential of options trading, and this guide has provided you with a solid foundation to embark on this exciting journey.